Ethereum Price Drops to $4,300 Amid Whale Buying: Is $5,800 the Next Target?

Jakarta, Pintu News – According to TronWeekly, Ethereum (ETH) is in the spotlight after heavy whale activity and crossing important technical levels, indicating that significant price movements may be on the horizon.

As of today, Ethereum was trading at $4,318, having corrected 2.80% in the last 24 hours.

Ethereum Price Drops 2.80% in 24 Hours

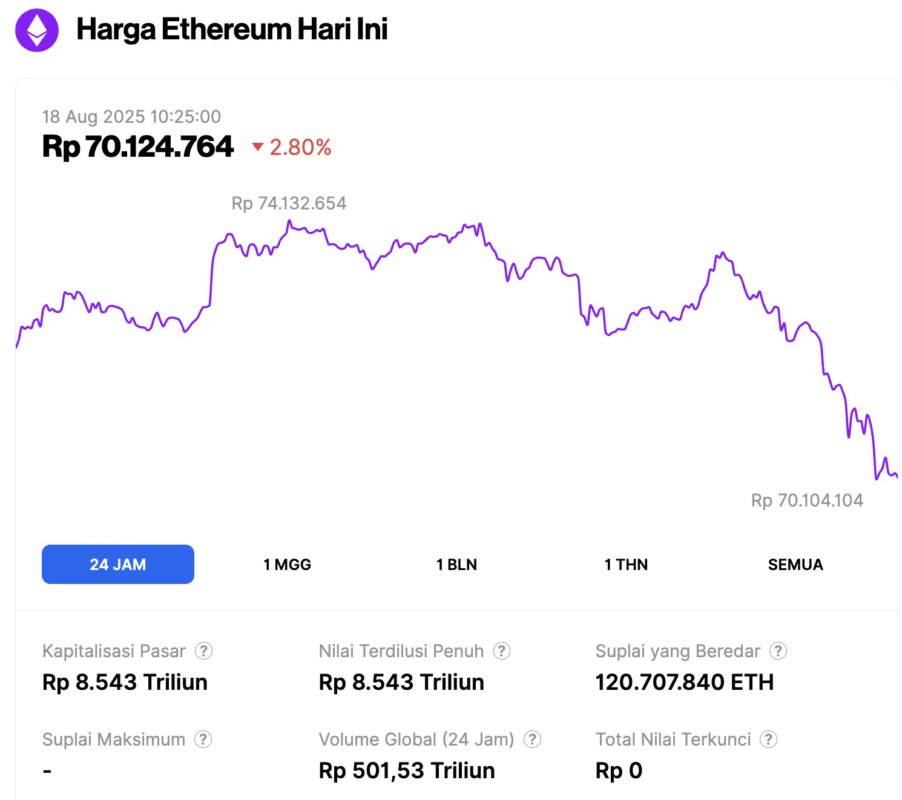

On August 18, 2025, Ethereum traded around $4,318 (approximately IDR 70,124,764), marking a 2.8% decline over the past 24 hours. During this period, ETH reached a low of IDR 70,104,104 and a high of IDR 74,132,654, reflecting notable price fluctuations.

As of writing, Ethereum’s market capitalization now stands at around IDR 8,543 trillion, with daily trading volume rising 60% to IDR 501.53 trillion in the last 24 hours.

Read also: These 3 Cryptocurrencies are Catching Whale Attention This Week!

Whale Accumulates Ethereum

Blockchain data shared on X (formerly Twitter) by the account ‘WHALE EVERYTHING’ shows that an unknown whale made a big move.

Reports suggest that this entity created three new wallets and purchased 92,899 ETH, worth approximately $412 million. This scale of accumulation often attracts attention, as it could be an indication of increased confidence in Ethereum’s future price movements.

Ethereum Maintains Key Support Levels Ahead of Potential Breakout

Meanwhile, analysts from More Crypto Online highlighted an important support level for ETH. According to his observations, $3,370 remains a crucial level that must be maintained for ETH to continue its next rise.

If the price holds above this area, ETH has the potential to reach $5,800. However, a drop below this mark could signal that momentum is starting to weaken.

The combination of whale activity and key technical levels fueled speculation that ETH is preparing for a bigger price move.

With institutional demand on the rise and on-chain activity on the rise, attention is now on whether ETH is able to maintain its position and push the price to new highs.

Ethereum Derivatives Show Diverse Momentum

The Ethereum derivatives market is currently showing mixed signals, with open interest rising slightly while trading volumes have fallen sharply.

Read also: 3 Cryptos to Watch Ahead of Crypto Bull Run, Why?

The latest data noted that open interest increased by 1.92% to $63.71 billion, indicating that investors remain active in the market despite the recent high volatility.

On the other hand, trading volume fell by -50.47% to $71.16 billion. This shows that while most investors continue to hold open positions, fewer are making active trades, signaling a decline in short-term activity in the derivatives market.

For the funding rate, the OI-weighted rate stood at 0.0060%, reflecting a very slight bullish bias. This means that investors holding long positions are willing to pay a premium to maintain their positions, but market sentiment is not significantly skewed to one side.

Overall, ETH derivatives statistics show a cautious yet stable picture. With open interest remaining strong and the OI-weighted rate positive, investors seem poised for a gradual rise, although the sudden drop in trading volume signals lower short-term trading interest.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Ethereum Whale Activity Fuels Hopes for $5,800 Price Target. Accessed on August 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.