Ethereum (ETH) is ready to break record highs, is it time? This is Santiment’s Analysis!

Jakarta, Pintu News – The Ethereum (ETH) market is currently showing less bullish signs on social media, but this condition could actually be a golden opportunity to surge higher. Recent analysis from Santiment suggests that negative sentiment could be a positive indicator for Ethereum (ETH) prices in the near future.

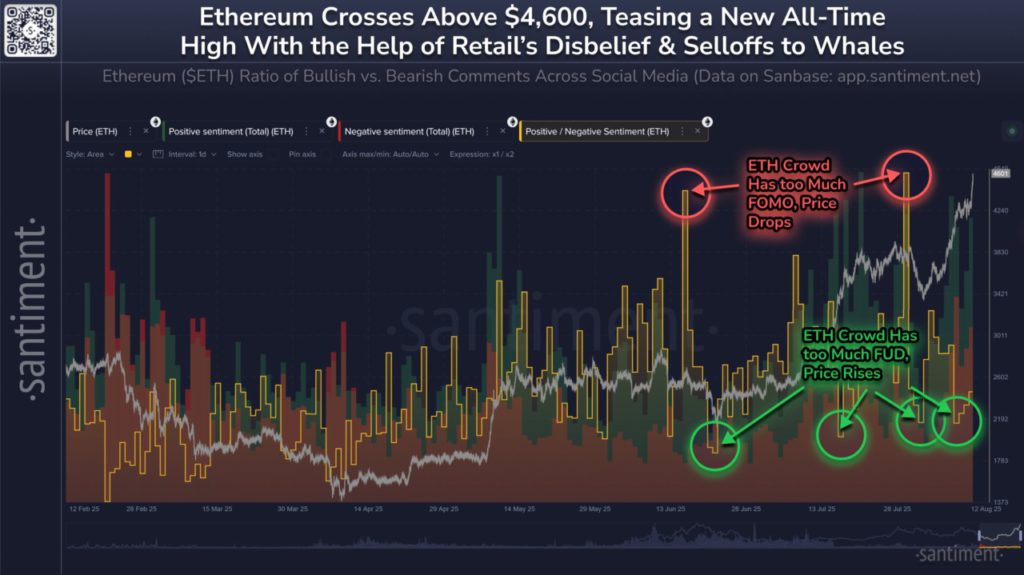

Ethereum’s Positive/Negative Sentiment Still at Low Levels

Santiment, an analytics firm, recently shared data regarding the growing sentiment on social media regarding Ethereum (ETH). The indicator used is “Positive/Negative Sentiment”, which measures the ratio between positive and negative comments on major social media platforms.

A machine learning model was used to separate the two types of comments before counting them. The graph shared by Santiment shows that Ethereum’s (ETH) positive/negative sentiment decreased during the price spike at the beginning of the month.

This suggests that social media users are not too confident about the increase. Although prices continue to rise, sentiment is still well below last month’s peak, signaling distrust of the retail market.

Also Read: 5 Native Tokens with the Best Performance According to Birdeye Data

Sentiment History and Its Impact on Price

According to Santiment, prices tend to move against retailers’ expectations. In the shared chart, there are instances when a surge in FOMO (Fear of Missing Out) leads to a drop in prices, while excessive FUD (Fear, Uncertainty, and Doubt) triggers a rise in prices.

This suggests that the current negative sentiment could be a positive signal for the future of Ethereum (ETH). With major stakeholders accumulating Ethereum (ETH) offloaded by small traders, the price is showing little sentiment resistance to break and set a new record. This signals great potential to surpass the record highs previously achieved.

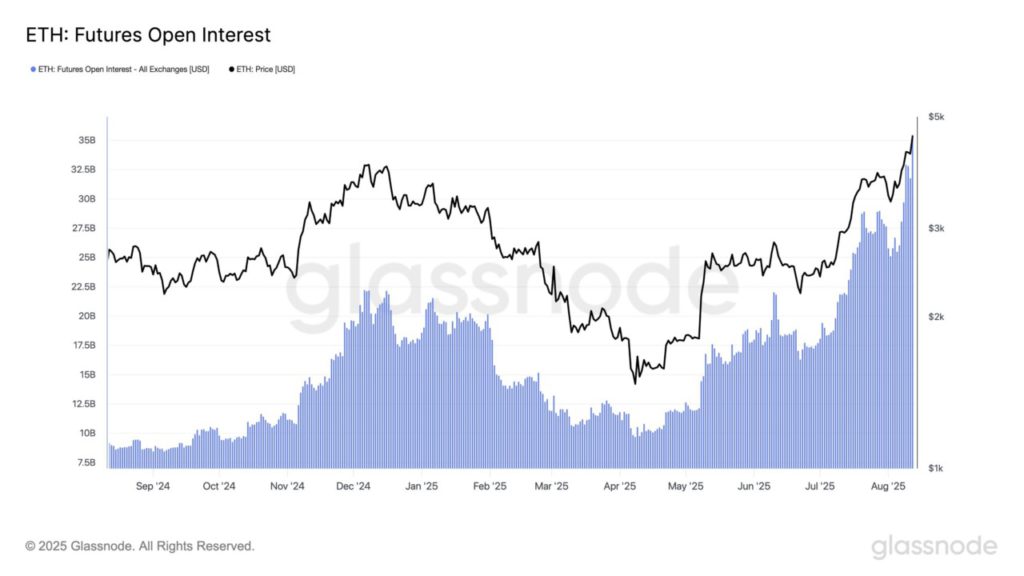

Ethereum Futures Open Interest Increases

In addition to sentiment analysis, open interest for Ethereum (ETH) futures has also shown a significant increase. According to data from Glassnode, futures open interest has surpassed the $35.5 billion mark, setting a new record.

This suggests that there is increased interest and speculation in the Ethereum (ETH) derivatives market. This increase coincides with a surge in the price of Ethereum (ETH) which reached $4,730, close to its previous record high. This increase in open interest could be another indicator of a potential rise in the price of Ethereum (ETH) in the near future.

Conclusion

With sentiment still bearish in retail circles and increased futures open interest, Ethereum (ETH) seems to be preparing to surpass its previous record highs. Current market conditions may be a rare opportunity for investors who understand this unique dynamic.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- CryptoRank. Ethereum Retail Mood Red Perfect ATH Break. Accessed on August 18, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.