BlackRock Holds $86 Billion Worth of Bitcoin, What’s the Impact?

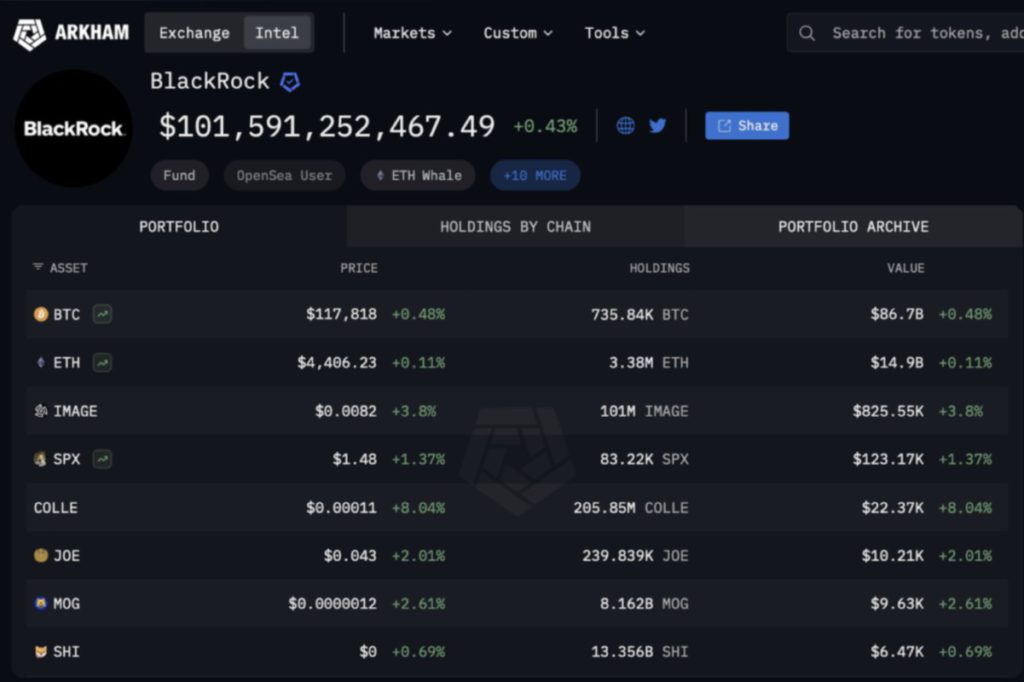

Jakarta, Pintu News – BlackRock, the world’s largest asset manager with more than $11.6 trillion in assets, now controls more than 735,000 Bitcoins (BTC) worth about $86 billion.

According to Crypto Times, this significant increase marks a rapid growth in Bitcoin (BTC) holdings by BlackRock, which previously held just 567,000 Bitcoin (BTC) worth $47.8 billion in March this year.

Check out the full information in this article!

BlackRock Bitcoin ETF: A Big Leap

Data from Arkham Intelligence shows that BlackRock’s iShares Bitcoin ETF (IBIT) wallet has been receiving transfers consistently. In recent days, on-chain transactions of 300 Bitcoin (BTC) worth $37 million each have been recorded through Coinbase Prime.

This shows an aggressive accumulation strategy by BlackRock in expanding their crypto portfolio. The Bitcoin (BTC) ETF managed by BlackRock now controls 749,000 Bitcoin (BTC), making it one of the largest Bitcoin (BTC) holders in the world.

This position not only confirms BlackRock’s dominance in traditional financial markets but also in the cryptocurrency ecosystem, which is increasingly gaining legitimacy from institutional investors.

Also read: These 3 Solana Memecoins Crash Over 12% in a Week, Why?

Comparison with Other Players

With its current holdings, BlackRock surpasses Strategy which owns approximately 628,946 Bitcoin (BTC) worth $54.93 billion. This puts BlackRock among the largest Bitcoin (BTC) holders in the world, competing with government treasuries and crypto whales that have long been in the market.

In addition, the Ethereum (ETH) ETF managed by BlackRock is also showing growth, with several related wallets receiving large deposits. This shows that BlackRock is not only focused on Bitcoin (BTC) but also other cryptocurrencies such as Ethereum (ETH), which is gaining popularity among institutional investors.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (18/8/25)

ETF Market and Liquidity

Since its approval in 2024, the exchange-traded fund (ETF) for Bitcoin (BTC) has managed to attract significant trading volumes. BlackRock has contributed greatly to this liquidity, confirming their role as a key player in the crypto market.

Bitcoin (BTC) price is currently trading at $117,789 after experiencing fluctuations. Despite only seeing a 0.34% increase today, the existence of ETFs has provided a new way for investors to get involved in the crypto market without having to own cryptocurrencies directly, which adds a layer of security and convenience.

Conclusion

BlackRock’s large holdings in Bitcoin (BTC) and other cryptocurrencies mark a new era in institutional investment in the crypto space. With their ever-expanding ETFs and dominant position in the market, BlackRock is setting a new standard in crypto asset management that other asset managers may follow in the future.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. BlackRock Bitcoin ETF Now Holds 735,000 BTC Worth $86B. Accessed on August 18, 2025

- Featured Image: The Block

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.