August 18, 2025 Gold Price Chart: Gold Prices Fall, Time to Buy?

Jakarta, Pintu News – On Monday, August 18, 2025, the BRANKAS gold buying price was recorded to have decreased by Rp2,000 per gram. The purchase price for corporate BRANKAS gold stands at Rp1,834,600/gram, down from Rp1,836,600/gram. As for physical gold, the purchase price also decreased to Rp1,894,000/gram from the previous Rp1,896,000/gram.

Although the decline was relatively mild, this data is still in the spotlight of market participants and investors. Declines in precious metal prices are often used as a moment of accumulation for long-term investors, especially in uncertain economic conditions.

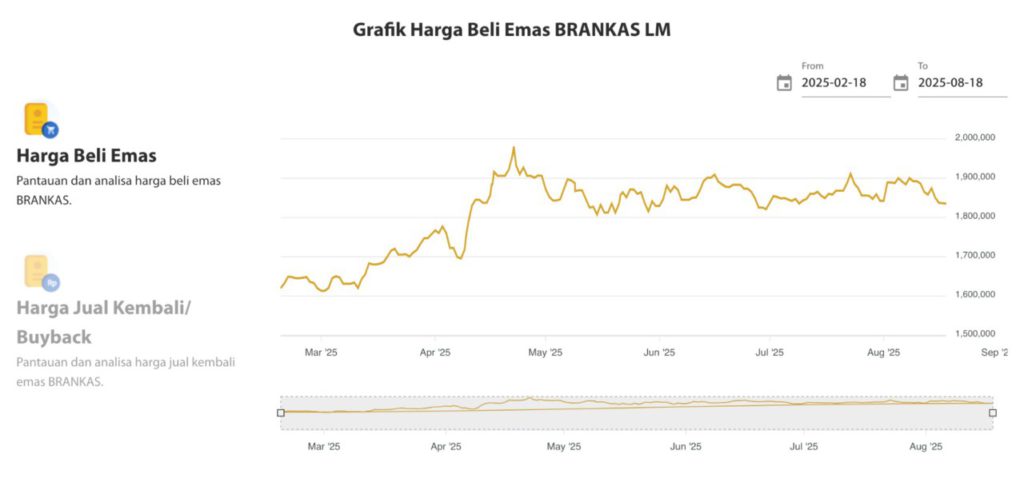

Trends of the Last 6 Months: Sharp Rise, Then Stabilization and Weakening

Based on the price chart from BRANKAS, gold price movements since February 2025 show an interesting pattern. Gold experienced a sharp spike in April and May 2025, breaking the Rp1,950,000 per gram range. This increase was driven by global geopolitical concerns and high inflation in several major countries.

However, after that, prices seemed to consolidate and fluctuate. From June to August, prices tended to stabilize in the range of Rp1,850,000 – Rp1,900,000 per gram, before finally starting to weaken gradually to its current position in mid-August.

Also Read: 5 Native Tokens with the Best Performance According to Birdeye Data

Factors causing the decline in gold prices

There are several factors that may have influenced the decline in gold prices in recent weeks:

- US Dollar Strengthening – When the dollar strengthens, gold prices tend to weaken as investors shift to more attractive dollar-based assets.

- Stock Market Optimism – The recovering performance of global stock markets has led some investors to return to riskier assets, selling their gold.

- Central Bank Policy – Anticipation of interest rate cuts by the Fed or Bank Indonesia can create uncertainty in the gold market.

This shows how sensitive gold prices are to global dynamics. As such, gold investors need to keep abreast of macroeconomic developments to devise a wise investment strategy.

Is it the Right Time to Buy Gold?

For some investors, when gold prices weaken, it becomes an opportunity. With the corporate BRANKAS gold price at around IDR 1,834,600/gram, this position is quite attractive when compared to its highest level which was close to IDR 1,950,000 a few months ago.

However, it is also important to consider investment objectives and the time horizon of ownership. Gold remains an effective hedging instrument over the long term, despite frequent short-term volatility.

Corporate vault gold price difference vs physical gold

It should be noted that the corporate BRANKAS gold price only applies to institutional or corporate customers. Meanwhile, physical gold prices are usually used for individual retail transactions. Currently, the price difference between the two reaches around Rp59,400/gram, which is an additional consideration for retail investors.

Individual investors can access special pricing through the BRANKAS mobile app to get the best deals. These price differences also reflect additional costs such as logistics, storage and sales margins.

Conclusion: Stay tuned, don’t be rash

Gold prices as of August 18, 2025 show a slight but significant decline in the context of the medium-term trend. With the chart trend starting to flatten, investors can start to reconsider gold accumulation, especially for long-term strategies such as wealth preservation.

However, like any other investment, the decision to buy gold should be made with careful consideration and appropriate financial planning. Don’t just be tempted by cheap prices-but also understand the objectives and risks.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. BRANKAS Gold Price – Chart and Price as of August 18, 2025. Accessed August 18, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.