Grayscale Files to Launch Dogecoin ETF

Jakarta, Pintu News – Grayscale Investments has filed a proposal with the US Securities and Exchange Commission (SEC) to launch a new investment product focused on Dogecoin (DOGE).

This initiative has caused the price of Dogecoin (DOGE) to increase, attracting the attention of investors and market watchers.

Grayscale Filing for Dogecoin ETF

Grayscale Investments recently filed S-1 documents with the SEC to establish the Grayscale Dogecoin Trust ETF. The purpose of the trust is to give investors access to Dogecoin (DOGE) without having to own the crypto directly.

Read also: Dogecoin Slides 4% Today — Analysts Weigh In on Whether DOGE Can Hit $1.40

If approved, the ETF will be listed on the New York Stock Exchange Arca under the stock symbol GDOG. The ETF is planned to hold Dogecoin (DOGE) as its only asset. Coinbase Custody Trust Company will act as trustee.

The trust will issue and redeem shares in large groups called “Baskets,” where each basket represents 10,000 shares. Initial transactions will be made through cash transactions, rather than direct Dogecoin (DOGE) transfers.

Details and Market Expectations for Dogecoin ETF

The value of the Dogecoin ETF will follow the CoinDesk Dogecoin Reference Rate, which reflects the market price of Dogecoin (DOGE) without additional fees and obligations. The trust will not conduct active trading and will not use leverage or derivatives, but will operate passively.

The filing follows the application guidelines issued by the NYSE on January 31, 2025. Grayscale confirmed that it will not proceed with the Dogecoin ETF share offering until it gets approval from the SEC.

If approved, this ETF could become a reference point for Dogecoin (DOGE) investments and possibly influence institutional investor involvement in the meme coin market.

Market Reaction and Future Outlook

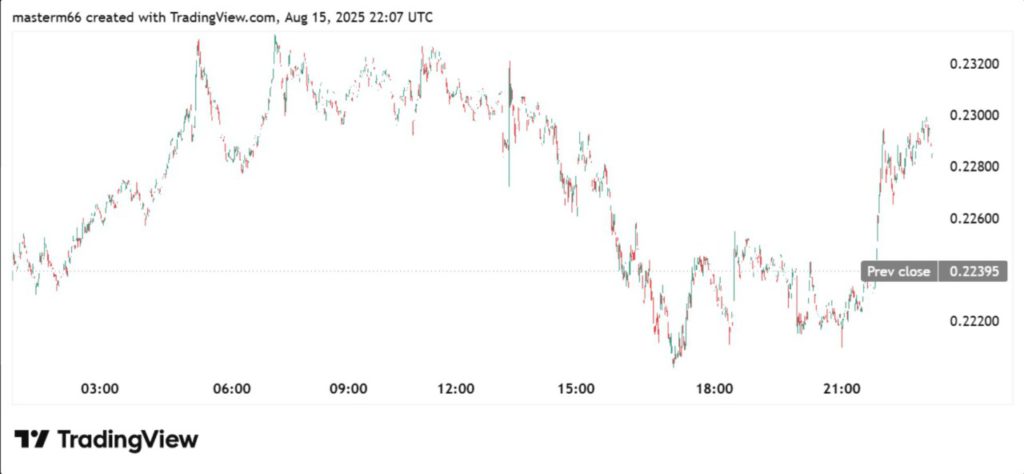

Following the ETF filing, the price of Dogecoin (DOGE) rose nearly 2.5% in a single day on August 15, 2025, reaching $0.22976 from $0.22395. Data from TradingView shows that this price increase occurred towards the end of the trading session, ending the sideways trend that had been ongoing.

Read also: Bitcoin Price Plummets to $115K Today (August 18) as Spot BTC ETFs Take Center Stage

In the last seven days, Dogecoin (DOGE) has increased by 2.67%, and the one-month increase is 14.65%. Risk factors identified in the filing include sharp Dogecoin (DOGE) price swings, uncertainty regarding regulation, and possible competition with other digital assets.

The success of these ETFs depends on various factors, including regulatory approval and market acceptance.

Overall, Grayscale’s initiative to launch a Dogecoin ETF marks an important step in the evolution of crypto assets as legitimate investment options.

With crypto interest and adoption on the rise, products like the Dogecoin ETF offer a way for investors to get involved in the crypto market in a more structured and secure way.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Grayscale Files S-1 for Dogecoin ETF, DOGE Price Spikes. Accessed on August 18, 2025

- Crypto News. Grayscale Moves Forward with Dogecoin ETF Plan Under Ticker GDOG. Accessed on August 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.