Ripple (XRP) is falling, is it the right time? Here’s an analysis of the XRP price drop!

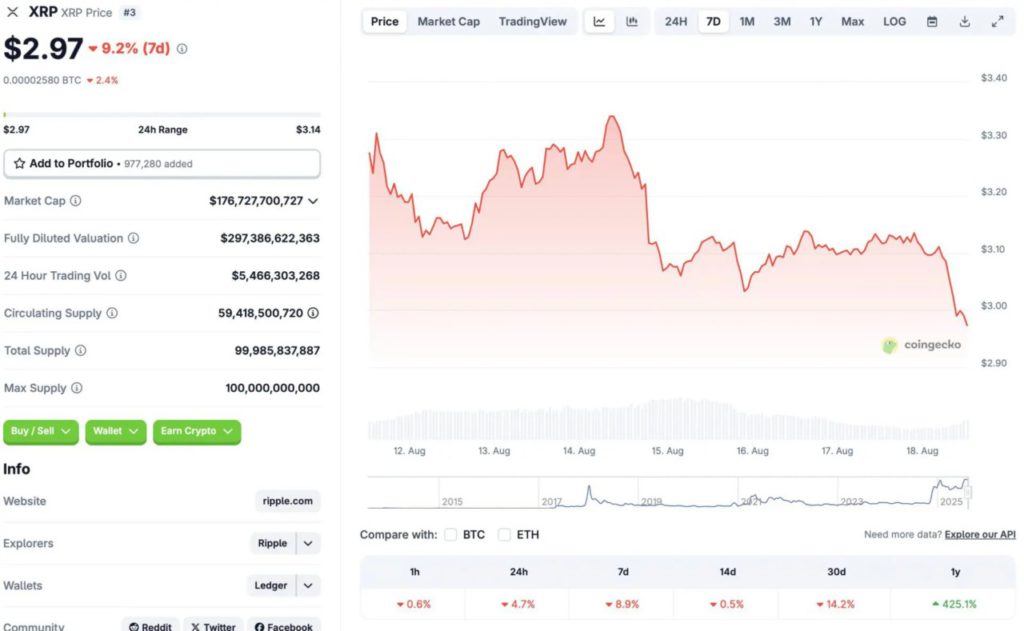

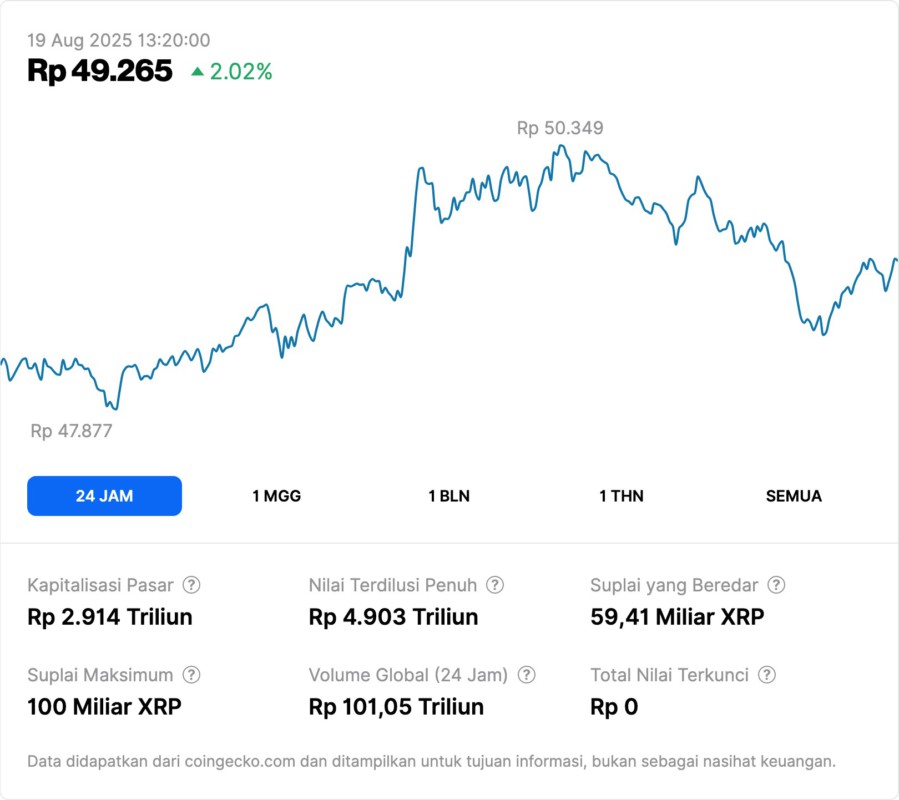

Jakarta, Pintu News – After reaching a new peak high of $3.65 on July 18, Ripple (XRP) has experienced a significant decline. In the past 24 hours, the asset’s price has dropped by 4.7%, and in the past week, it has dropped by 8.9%.

Despite the sharp correction, Ripple (XRP) still recorded a gain of 425.1% since August 2024. This drop may be an opportunity for investors to buy the asset at a lower price.

Ripple (XRP) Price Drop Analysis

This drop in Ripple (XRP) price comes after the crypto asset hit a new record high. This decline could be due to several factors including the results of the higher-than-expected producer price index (PPI), which recorded an increase of 0.9% compared to the forecast of 0.2%.

This casts doubt on the possibility of an interest rate cut by the Federal Reserve next month. In addition, previously bullish market sentiment due to lower-than-anticipated consumer price index (CPI) data also provided a temporary boost. However, this unexpected rise in PPI has triggered a series of liquidations in the market that started on August 14, dampening investors’ optimism towards an upcoming rate cut.

Also Read: CHILLGUY Price Prediction 2025-2030: Meme Coin Viral TikTok, Is it Still Worth Buying?

Buying Opportunities at Current Price Levels

Despite the decline, many analysts are still optimistic about the long-term prospects of Ripple (XRP). The end of the long legal battle with the SEC has opened a new era for Ripple (XRP), with high market expectations of its future performance. This is an important factor that supports the argument to buy Ripple (XRP) while the price is down.

Additionally, there are several Ripple (XRP) ETFs that are awaiting approval from the SEC. If any of these ETFs are approved, it is expected to trigger large institutional inflows into Ripple (XRP), which could push the price to even higher levels. This provides an opportunity for investors to buy at a low price and potentially for significant gains.

Ripple (XRP) Long-term Outlook

With the SEC lawsuit over, Ripple (XRP) is expected to reach new highs in the coming months. This is supported by the generally bullish market sentiment and expectations for interest rate cuts which could strengthen the overall crypto market.

The rise was also triggered by lower-than-anticipated CPI data, which has raised investor expectations. In addition, the potential ETF approval by the SEC will be another important catalyst.

This approval will not only increase liquidity but also the validity of Ripple (XRP) as an investment asset. With these factors, Ripple (XRP) has good potential for long-term growth, making it an attractive investment option at the moment.

Conclusion

Taking into account factors such as the end of the lawsuit with the SEC, potential ETF approval, and current market conditions, Ripple (XRP) offers an attractive opportunity for investors looking for an asset with long-term growth potential. While there are risks, as in every investment, current conditions may be a good time to consider purchasing Ripple (XRP).

Also Read: Worldcoin (WLD) Price Prediction 2025-2031: Bullish Potential or Just Hype?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Watcher Guru. XRP Falls Below $3: Is This Your Chance to Buy Low, Sell High? Accessed on August 19, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.