Is Ethereum (ETH) about to experience a price surge? This is what analyst Ted Pillows says!

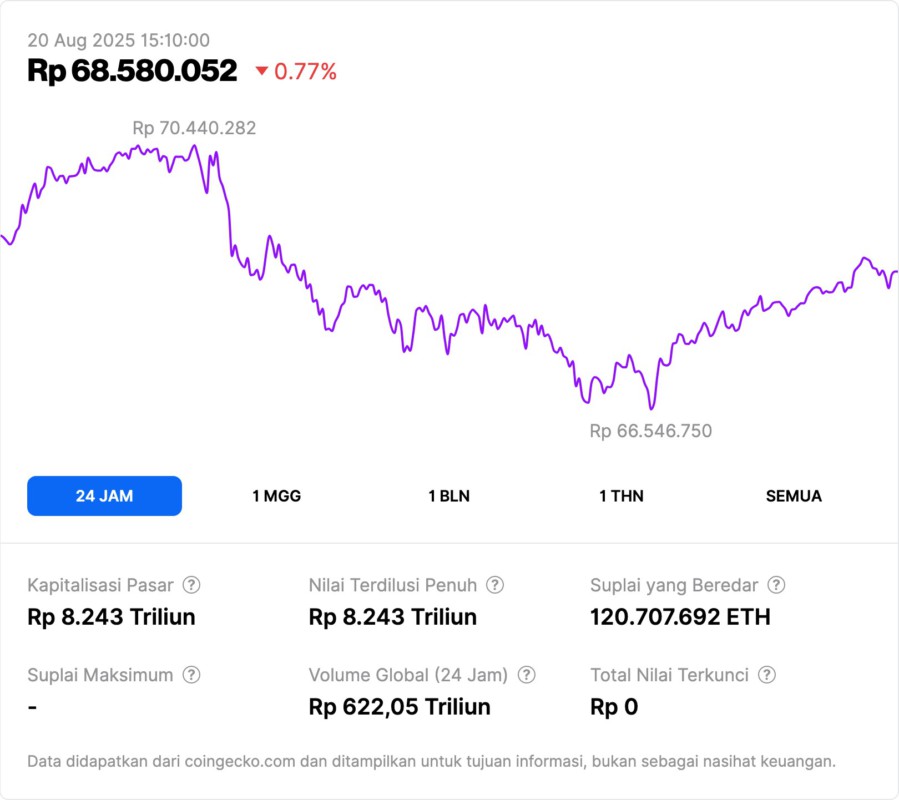

Jakarta, Pintu News – Ethereum (ETH) is currently facing significant market pressure, with volatility increasing and the price recently dropping below $4,300. After several weeks of strong momentum, Ethereum (ETH) is now under pressure to defend the support zone. Losing this level raises concerns about a deeper correction, although fundamentally it remains bullish.

Ethereum (ETH) Short Positions Reach Record Highs

According to leading analyst, Ted Pillows, Ethereum (ETH) is currently facing unprecedented short position pressure. The leveraged short position has reached 18,438 contracts, which is the largest bearish bet in Ethereum (ETH) history.

This increase in positions reflects a market that is bracing for volatility, with traders aggressively betting on the downside after the price drop from the $4,790 level. Pillows emphasized that this could create ideal conditions for a short squeeze to occur.

If Ethereum (ETH) manages to rally from current levels, these bearish positions could quickly unravel, forcing short sellers to close their positions at higher prices, which could accelerate the rally. Historically, imbalances like this have led to significant price spikes in a short period of time, surprising the bears and providing quick gains for the bulls.

Also Read: Ethereum (ETH) Price Predicted to Surge to $15,000, What’s Driving This Increase?

Ethereum (ETH) Technical Details: Testing Demand Levels

Ethereum (ETH) is currently trading at $4,284, showing signs of volatility after its recent drop from the $4,800 region. The 4-hour chart shows that Ethereum (ETH) is struggling to regain momentum, with the price now testing the key support zone around $4,200-$4,250.

This level is important because it is in line with the 100-day moving average (green line), which has acted as dynamic support during previous pullbacks in this rally. The price structure shows that the bulls are still active but under pressure.

After several weeks of consistent gains, Ethereum (ETH) is now experiencing greater selling volume, as seen in the latest red bar on the chart. However, the broader trend remains bullish as long as Ethereum (ETH) holds above its 200-day moving average (red line), which is currently below $3,920.

Strong Fundamentals Support Long-term Outlook

Despite increased short-term volatility, strong fundamentals-including declining supply on exchanges, institutional accumulation, and broader adoption trends-continue to support the long-term bullish thesis. For now, all eyes are on whether this record short position will be the catalyst for Ethereum’s (ETH) next breakout.

A break below $4,200 could open Ethereum (ETH) for further declines towards $4,000 or even $3,900 in the short term. On the other hand, if buyers defend this zone, Ethereum (ETH) could attempt another rally to retest resistance levels around $4,500-$4,600.

Conclusion

With unprecedented short pressure and strong fundamentals, the Ethereum (ETH) market is currently at a tipping point. Traders’ decisions in the coming weeks will largely determine the future direction of the Ethereum (ETH) price. Whether this will be the start of a major rally or a further decline, only time will tell.

Also Read: Dogecoin is the only meme coin in the top 25 – is it the king of meme coins?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Faces Historic Short Interest Rally, Could Trigger Massive Liquidations. Accessed on August 20, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.