Solana (SOL) Highlights Wall Street with Billion Dollar IPO!

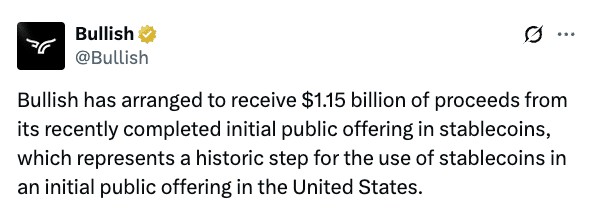

Jakarta, Pintu News – Solana (SOL) recently reached a significant milestone by handling its $1.15 billion Bullish Initial Public Offering (IPO) entirely in stablecoins.

This success marks Solana as the first Layer 1 blockchain to natively manage large-scale market capital flows. With this achievement, Solana is attracting institutional attention and may soon gain wider recognition from Wall Street.

Technical Performance of Solana vs Ethereum

From a technical standpoint, Solana (SOL) still lags behind Ethereum (ETH) in terms of monthly returns. Solana only recorded a 5% increase while Ethereum reached 15%. However, from an operational standpoint, Solana has reached a significant milestone with transaction speed reaching 100,000 transactions per second (TPS), which is the first verified peak.

Despite this, there is a stark contrast between Solana’s on-chain strength and the price action in the market. This begs the question, is Solana undervalued or is capital still likely to flow to Ethereum, so Solana’s potential has not been fully appreciated?

Also Read: 5 Trading Signals Bitcoin (BTC) is Under Pressure-Is This the Start of a Major Correction?

Bullish IPO Impact on Solana

Solana’s processing of Bullish’s $1.15 billion IPO entirely in stablecoins is a major achievement. It not only demonstrates Solana’s technical capacity to manage large transactions, but also the trust placed in it by capital market participants.

This success puts Solana on the radar for Wall Street-scale capital flows, which goes far beyond the usual ETF hype. Moreover, this success shows that Solana is capable of moving serious capital, not just talk. In this capacity, Solana’s credibility in the eyes of Wall Street is starting to look more than just hype around traditional financial products.

Solana On-Chain Analysis

On the on-chain side, Solana is showing some signs of strength. Although Solana’s daily active addresses are down nearly 18% this week, compared to Ethereum’s 4.2% decline, Solana’s active address count has increased from 3.1 million to 3.6 million in the last three days. This adds about 500,000 active addresses, an amount roughly equal to the total activity seen by Ethereum.

This increase shows that the market is not ignoring the strength of the Solana network. With this increase in activity and the success of the Bullish IPO processed on-chain, there is a legitimate bullish signal that Solana is on the move managing serious capital.

Conclusion

With all these achievements, Solana (SOL) has further demonstrated its capacity as a blockchain that is not only fast and efficient, but also capable of handling large-scale transactions relevant to capital markets. Going forward, it will be interesting to see how Wall Street recognition and adoption of Solana will evolve.

Also Read: 5 Secrets to Using Crypto Trading Signals to Increase Investment Profits!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Solana: Here’s why Wall Street should pay attention to SOL now. Accessed on August 21, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.