Pi Network Price Rises 4% as Bears Lose Grip — Will Bulls Seize the Rebound Opportunity?

Jakarta, Pintu News – As of August 20, 2025, the price of Pi Network had fallen by more than 10% in the past week and was hovering around $0.35 – a level very close to its historic low.

Although the downtrend is still ongoing, there are some short-term signals that indicate the possibility of Pi Network being ready to experience a slight price bounce.

Early signs of buying interest are starting to show behind the market moves, and if that interest continues, the Pi Network bearishers may lose control, at least for a while.

Then, how is Pi Network’s current price movement?

Pi Network Price Rises 4% in 24 Hours

On August 21, 2025, the price of Pi Network was recorded at $0.3639, having risen 4.0% in the last 24 hours. If converted into today’s rupiah ($1 = IDR 16,293), then 1 Pi Network is IDR 5,929.

Read also: Pi Coin Price Prediction: Can Pi Network Reach $0.50 Along with Mainnet Migration?

Over the last 24-hour period, PI moved within a price range of $0.3455 – $0.3727, signaling quite active volatility in the market.

The current market capitalization stands at around $2.87 billion, with a fully diluted valuation of $4.41 billion. The 24-hour trading volume was recorded at around $88.67 million, reflecting considerable activity from market participants.

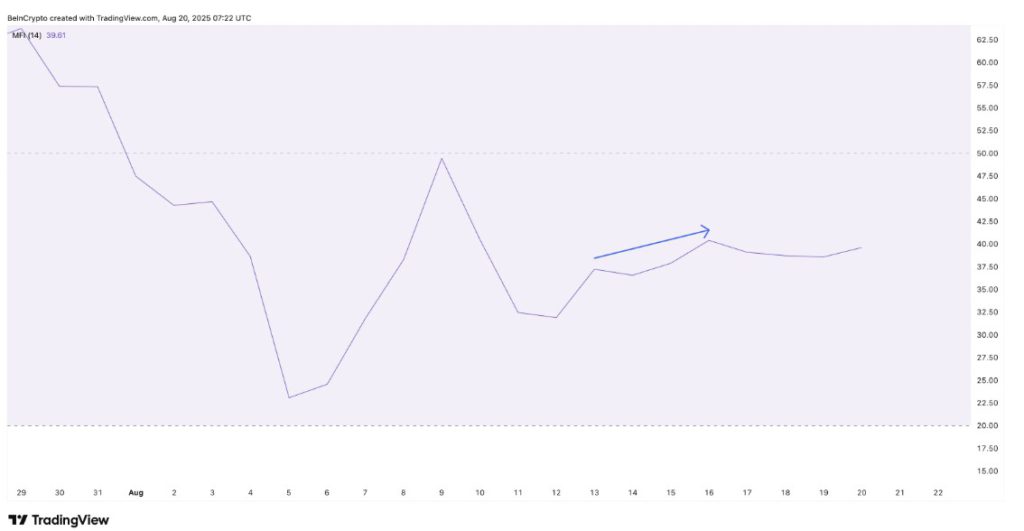

Money Flow Index (MFI) Shows Quiet Bullish Divergence

Reporting from BeInCrypto (20/8), the Money Flow Index (MFI) on the daily chart provides subtle but quite important signals.

While Pi Coin’s price was forming lower peaks, the MFI was recording higher peaks, giving an indication of a mild bullish divergence.

The last time this pattern appeared, between August 3 and August 9, the price of PI bounced from $0.32 to $0.46, a jump of almost 30% in just a few days.

However, if in the next few days it is able to break above the 40 mark, it will form two consecutive higher peaks. If this is confirmed, it could be an early sign that the selling pressure is starting to ease.

MFI itself combines price and volume data to monitor buying and selling pressure. An increase in MFI when prices are declining is often a sign of an accumulation process.

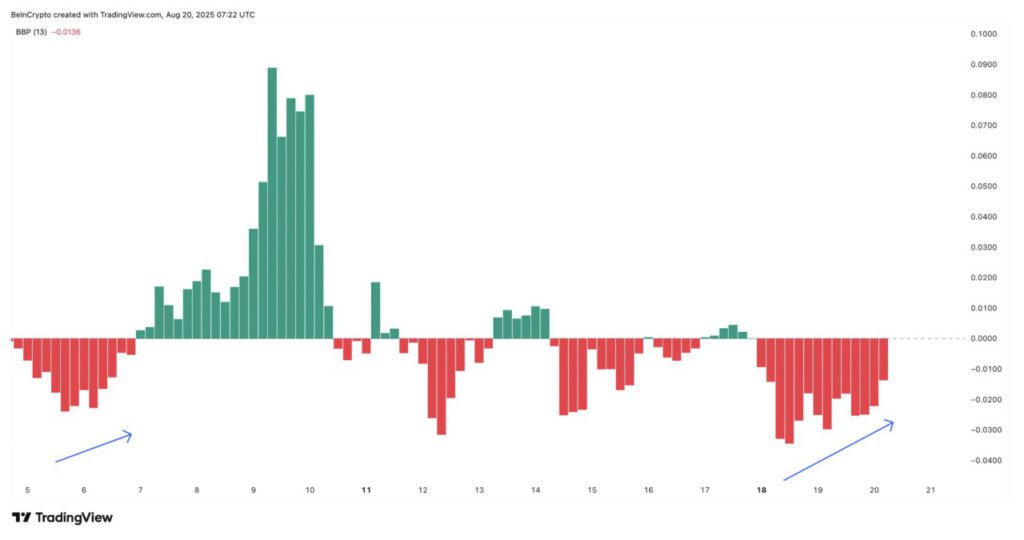

Bear is Still in Control, but Starting to Lose Steam

Although Pi Coin’s bullish side hasn’t really gotten the upper hand yet, the Bull-Bear Power (BBP) indicator on the 4-hour chart (Aug 20) shows signs that the bears are starting to tire. The selling pressure is now weaker compared to the previous cycle, where the bearish forces had formed very aggressively.

This weakening of bearish intensity is not yet a sign of a trend reversal. However, it does indicate that if Pi Coin bulls are able to press at the right levels, there is a chance for a rebound – especially since momentum now looks less strong than before on the sellers’ side.

Similar conditions were seen in early August, when a weakening bearish momentum coincided with a rising MFI, which eventually triggered a price surge of nearly 30%, as mentioned earlier.

The BBP indicator itself measures bull vs. bear strength in real-time. When bearish momentum slows down in the middle of a downtrend, it often triggers a brief rally or relief rally, although it doesn’t always last long.

Read also: Pi Network Launches Hackathon 2025 Soon, Will this be the Turning Point of Pi Coin?

Pi Coin Price Levels to Watch Out For

As of August 20, the price of Pi Coin was hovering around $0.35, holding slightly above the main support area. This support zone has been tested several times.

If the sellers manage to break it, a net move below $0.32 could quickly open up opportunities towards a new low.

However, if the current level is able to hold and buying pressure increases, there are some short-term targets that can be referenced:

- $0.38 – Nearest resistance and first test

- $0.41 – Intermediate level breakout confirmation

- $0.46 – Equal to the peak of the last rebound in early August

The higher high pattern on MFI had also triggered a spike in Pi Coin’s price earlier, and a similar situation is now starting to form.

Thus, although Pi Coin’s long-term structure is still relatively weak, the combination of weakening bearish forces and increased buying interest could give bulls a chance to steal the momentum for a rebound – at least while the bears are losing steam.

Even so, special attention needs to be paid to the $0.32 level as the next direction determinant.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Price Rebound Signals Bulls Return. Accessed on August 21, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.