Bitcoin Price Crashes to $113,000 on August 22, 2025: 4 Key Signs You Should Know

Jakarta, Pintu News – Bitcoin (BTC) price dropped below $113,844 on the charts, after experiencing a 1.57% decline on August 21. At that time, most of the crypto trading volume was also still dominated by BTC pairs.

Daily chart analysis from Captain Faibik shows that BTC has broken below the rising wedge pattern. In addition, the price movement appears to be below the 50 EMA line, which further confirms the bearish market structure.

Then, how is the current Bitcoin price movement?

Bitcoin Price Drops 0.54% in 24 Hours

On August 22, 2025, Bitcoin was trading at $113,240, equivalent to IDR 1,848,948,587, after slipping 0.54% in the past 24 hours. Within this timeframe, BTC hit a low of IDR 1,826,957,869 and reached a high of IDR 1,858,929,537.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 36,867 trillion, while its 24-hour trading volume has dropped 11% to IDR 520.37 trillion.

Read also: Short-Term Holders Keep Buying Bitcoin Despite Losses — Is a Rebound on the Horizon?

Optimal Levels to Watch Out For

According to Axel Adler’s analysis, Bitcoin is currently in a moderate correction phase, down about 8% from its peak of $124,000. When looking at the realization metrics overlaid on the price, there are three key levels of concern.

- 111-day SMA is around $109,600

- 200-day SMA is around $100,400

- Short-Term Holder Realized Price is around $106,800

These three zones are potentially ideal bounce areas for BTC price. At the time of writing, Bitcoin price has entered a potential accumulation area that is attracting buyers. Historically, this asset often rebounds after a liquidity sweep before breaking to a new high (ATH).

If the pattern repeats itself, then a liquidity sweep below $112,000 – $113,000 could be an attractive entry opportunity for long positions.

However, the question now is: what indicators can confirm a reversal?

4 Potential Triggers for a Bitcoin Reversal

Read also: Kanye West Launches “YZY” Meme Coin on Solana, Market Capitalization Hits $3 Billion

For Bitcoin to truly confirm areversal, there are four important conditions that need to be met:

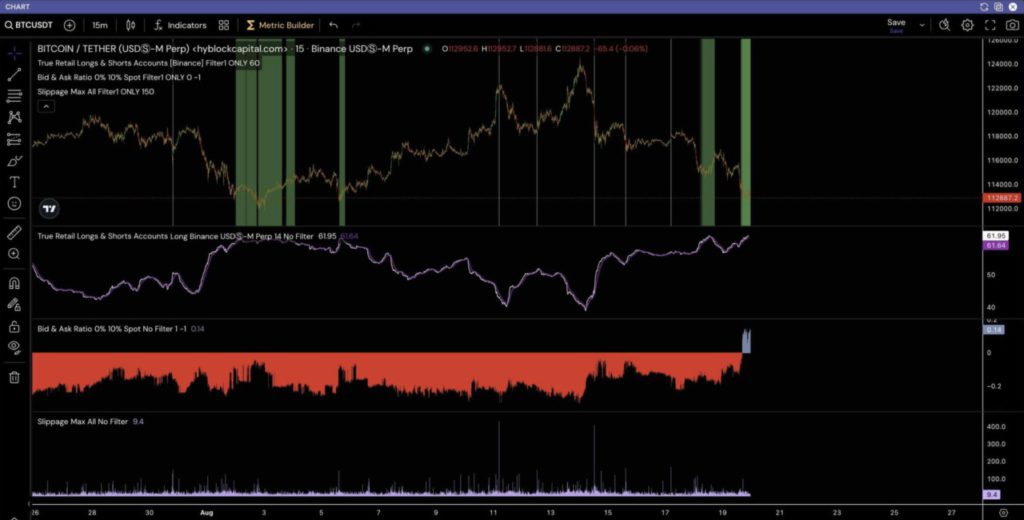

- The Bid-Ask Ratio across the entire order book should turn positive and stay at that level. In the last three instances, this has signaled the formation of a bullish local bottom.

- Every time BTC slippage crosses this mark, the price always responds with an increase. This is a sign of increased market volatility.

- The True Retail Accounts Long % should be fully reversed. It currently stands at 61.95%, and historically readings above 60% often mark bullish pivots – indicative of a local bottom forming.

- The price should be able to reclaim the position above the 50 EMA and stay there.

Whales Start Buying at Correction Level

In the midst of this correction phase, whales and institutions are actively entering the market again. On-chain data recorded a purchase of 200 BTC (approximately $23 million), signaling their confidence to buy at lower levels.

Renowned crypto figure, Adam Back, confirmed this view by saying:

“The price drop is there to move Bitcoin from weak hands to strong hands.”

Meanwhile, Glassnode data shows the supply held by First Buyers is close to 5 million BTC, suggesting that long-term holders and large players are aggressively pursuing a dollar-cost averaging (DCA) strategy amid the price drop.

This combined signal gives an early indication of a potential reversal. However, technical confirmation remains key to ensure the bullish trend continues and avoid the bull trap if BTC fails to defend its local bottom.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Bitcoin’s price drops below $115K – Watch out for THESE 4 reversal signs! Accessed on August 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.