Pi Network Faces a Slump – Will Pi Coin Revisit Its Bottom?

Jakarta, Pintu News – Reporting from BeInCrypto (21/8), since the beginning of the week, Pi Network’s native token, PI, has moved flat and is facing a new resistance level in the range of $0.37 which was previously the support area.

Traders and investors are still showing limited interest in this altcoin, as its lackluster price performance has not been able to give holders confidence.

Declining Interest Threatens Pi Network

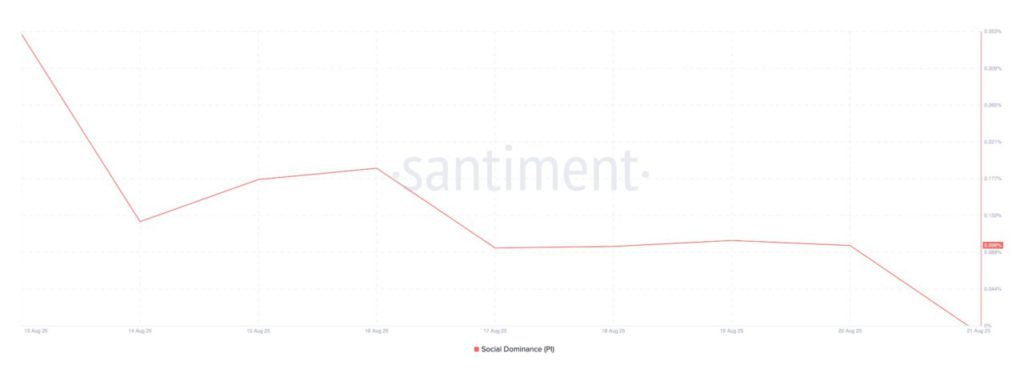

According to data from Santiment, PI’s social dominance dropped dramatically to a weekly low of 0.096%. This shows a sharp decline in the altcoin’s relevance amidst crypto community discussions during the observation period.

Read also: Aave Launches in Aptos, Opens New Opportunities in the DeFi World!

Social dominance itself measures how often an asset is mentioned on various social platforms compared to other assets in the market. If the value decreases, it means that the community’s attention and engagement with the asset has weakened.

The decline in PI’s social dominance is worth keeping an eye on, as the reduced market spotlight also reduces the chances of new buying pressure entering, increasing the risk of further price declines.

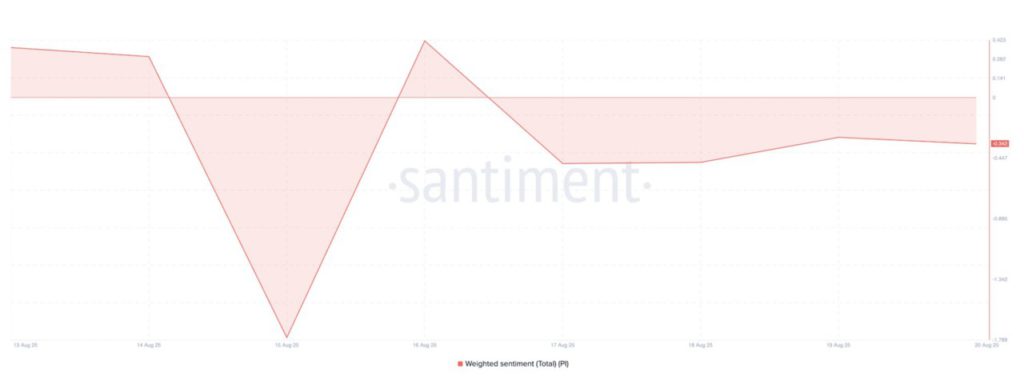

In addition, PI’s weighted sentiment has remained negative since the start of the week, reinforcing this bearish outlook. At the time of this report, the weighted sentiment stands at -0.342.

Weighted sentiment methods analyze data from social media to assess the tone of the conversation (positive or negative) surrounding a crypto asset, taking into account the number of mentions as well as the ratio of positive to negative comments.

If the weighted sentiment of an asset is negative, then the overall market, based on social data, is bearish. This suggests that PI traders and investors are still pessimistic, which could potentially pressure price performance in the short term.

PI Potentially Hits an All-Time Low

The declining presence of PIs in online conversations, coupled with a predominantly negative sentiment, leads to one possibility: continued price drops.

Read also: BNB Price Sets New Record Above $880 as Network Activity Surges!

The combination of factors increases the risk of a further decline towards the all-time low of $0.32.

However, a surge in buying activity and a resurgence in demand could potentially help PI break the resistance at $0.37 and push the price up towards $0.40.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network Fades From Crypto Conversations-Is a Return to All-Time Low Next? Accessed on August 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.