Tidal Trust II Submits XRP ETF Filing to the SEC as Institutional Demand Surges!

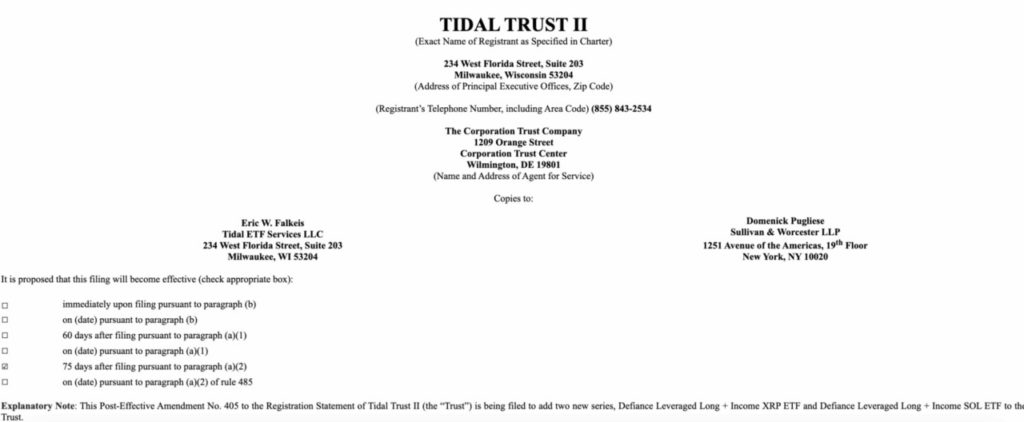

Jakarta, Pintu News – The cryptocurrency market continues to evolve with the latest innovation from Tidal Trust II proposing a highly leveraged XRP ETF.

The product signals Wall Street’s growing interest in digital assets beyond Bitcoin (BTC) and Ethereum (ETH).

XRP ETF: New Steps in the Financial Market

Tidal Trust II recently filed a proposal with the SEC to create the Defiance Leveraged Long + Income XRP ETF. This ETF is designed to provide a leveraged exposure of between 150% to 200% to the daily price movements of Ripple (XRP).

Read also: API3 Crypto Drops After 100% Spike, Is a New Trend in the Making?

Additionally, this ETF utilizes an options-based income strategy that aims to generate steady cash flow while increasing exposure to Ripple. The product not only targets long-term capital growth but also generates current income as a secondary objective.

By using credit call spreads, this ETF seeks to reduce the risks associated with using leverage. This opens up opportunities for pension funds, insurance providers, and retirement portfolios to interact more deeply with Ripple (XRP).

Institutional Demand and its Impact on Liquidity

Institutional interest in Ripple (XRP) derivatives is growing, as seen by the new record high in open interest in Ripple futures on CME. This indicates a huge demand from institutional investors for this altcoin.

Ripple’s global derivatives have reached $7.5 billion, signaling a strong bullish position in the market. The new Teucrium product, which is also a Ripple-leveraged ETF, has attracted over $284 million in assets in the first four months and surpassed $400 million in August.

This suggests that investors are increasingly interested in products that offer leveraged exposure to Ripple.

Read also: Aave Launches in Aptos, Opens New Opportunities in the DeFi World!

Regulatory Changes and Ripple’s Future Prospects

Regulatory changes in the United States have given a positive boost to Ripple’s prospects. Following the settlement of the Ripple lawsuit, the SEC removed Ripple’s five-year fundraising cap, allowing the company to raise unlimited funds from accredited investors.

SEC Chairman, Paul Atkins, recently stated that “very few” tokens should be categorized as securities, signaling a significant change from the traditionally strict approach.

The Project Crypto initiative introduced by Atkins aims to update securities laws to support blockchain technology-based financial markets.

Although decisions on spot Ripple ETFs from various companies have been delayed until October, ETF analyst Nate Geraci predicts that final approval could happen by then, given that this is the final deadline.

Overall, with more and more investment products supporting cryptocurrencies such as Ripple (XRP), the global financial market is witnessing a massive transformation.

A highly leveraged ETF like the one proposed by Tidal Trust II not only expands access to Ripple but also promises capital growth and steady income, attracting more institutional investors into the cryptocurrency ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Tidal Trust II Files Leveraged Long XRP ETF with SEC. Accessed on August 22, 2025

- Coinpedia. XRP ETF News: Tidal Trust Files Leveraged Long XRP ETF, Wall Street Bets Big. Accessed on August 22, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.