Bitcoin Treasury Popularity Surges in Asia — Here’s Why

Jakarta, Pintu News – The growth of companies investing their funds in Bitcoin (BTC) in Asia indicates a significant shift in the global financial map.

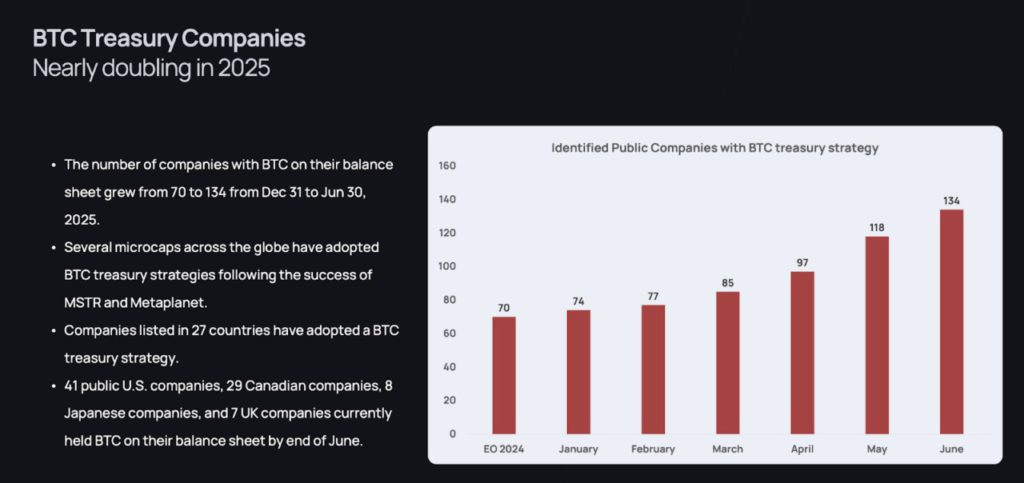

According to the latest data from K33 Research, from December 2024 to June 2025, the number of public companies that have Bitcoin (BTC) as part of their cash increased from 70 to 134.

This phenomenon not only signals wider acceptance of Bitcoin (BTC) but also raises questions about financial stability and supervision.

Check out the full information in this article!

The Role and Impact of a Bitcoin Treasury Company

Bitcoin treasury companies serve to give investors exposure to Bitcoin (BTC) without the need to directly manage custody or trading. They raise capital in the public markets and allocate it into Bitcoin (BTC).

This approach appeals to both institutional and retail investors, but carries risks due to varying standards of leverage, accounting treatment, and governance. These companies have become popular for promising access to capital markets through cryptocurrencies.

However, without adequate supervision, there is a high risk of volatility and instability. These activities may also trigger excessive risk-taking, especially among companies with smaller market capitalizations that may use the “treasury” label to attract speculative investors.

Read also: BitChat: Jack Dorsey’s Decentralized Communication Innovation

Recent Developments and Influences in Asia

Asia is now taking center stage with companies like American Bitcoin planning to establish operations similar to MicroStrategy in Japan and Hong Kong.

This move shows how US political influence can interact with financial centers in Asia that are enthusiastic about new products.

However, without a clear regulatory framework, initiatives like this could increase the risk of market volatility and instability.

Regulators in Japan and Singapore are expected to clarify accounting standards and investor protection soon, while Hong Kong is likely to expand disclosure requirements for new listings.

Read also: Bitcoin Whale Swaps $45 Million in Assets to Ethereum, What’s the Reason?

Risk and Future Perspective

Bitcoin treasury companies can accelerate volatility by acting as forced sellers in bear market conditions, amplifying the price cycle. This has been demonstrated in several cases where such firms triggered massive selling in the market, shaking investor confidence and deepening the bear market.

Going forward, the APEC ministerial meeting may further discuss treasury companies. With crypto market growth reaching nearly $4 trillion by July 2025, it is important for regulators to take steps that will ensure that this growth does not repeat a retail-driven bubble like in 2021, where price momentum trumped fundamentals.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Why Is Bitcoin Treasury Gaining Popularity in Asia?. Accessed on August 23, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.