Ethereum Price Hits $4,700 on August 25, 2025 as Network Activity Reaches Record Highs!

Jakarta, Pintu News – Ethereum (ETH) has once again proven itself as the backbone of the altcoin market.

While the price of ETH is near record highs, activity on the network has only gotten heavier, with usage levels reaching all-time peaks and transaction fees remaining low.

In contrast to many other tokens that quickly lose steam when the rally overheats, Ethereum is showing a steadier pace, opening up opportunities for further gains, while other altcoins prepare to challenge Bitcoin’s (BTC) dominance.

Then, how is Ethereum’s current price movement?

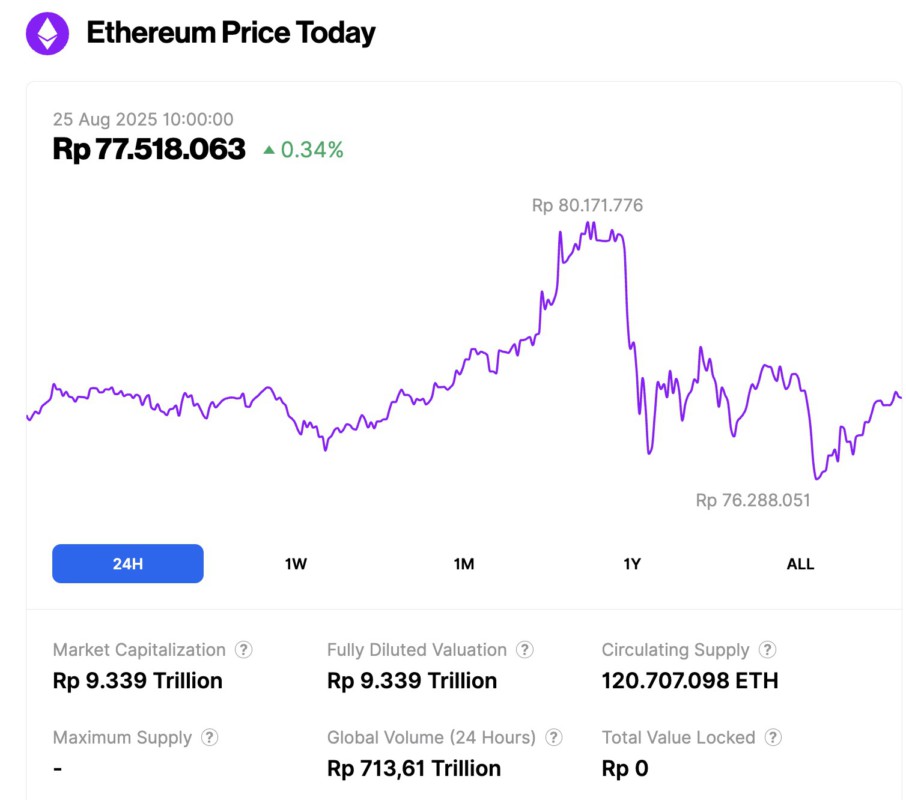

Ethereum Price Up 0.34% in 24 Hours

On August 25, 2025, Ethereum was trading at approximately $4,764 (around IDR 77,518,063), marking a modest 0.34% gain over the past 24 hours. Within the same period, ETH hit a low of IDR 76,288,051 and climbed as high as IDR 80,171,776.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 9,339 trillion, while daily trading volume has surged 71% in the past 24 hours to reach IDR 713.61 trillion.

Read also: 6 Giants of Ethereum: The Biggest Holders You Should Know About

Ethereum is among the Most Resilient Assets in the Market

Reporting from AMB Crypto (5/24), Price Drawdown Heatmap data from CryptoQuant shows that Ethereum ranks among the most resilient assets alongside Binance Coin (BNB), Bitcoin (BTC), and Tron (TRX).

While thousands of other altcoins are still stuck in the red, ETH was able to bounce back from the market pressure and is now trading near record highs again.

Unlike many other cryptocurrencies, Ethereum’s network strength and liquidity have kept it from a prolonged downturn. Because of this, ETH is in a stronger position than most altcoins to absorb waves of new capital as the market moves.

Network Strength Supports Resilience

In line with its resilience in the market, Ethereum network activity also broke records. The number of daily transactions broke through 2.4 million, while active addresses remained above 1.2 million – both reaching historic highs.

Despite the sharp surge in demand, gas costs remain near historic lows, at around $80 million per day, well below the peak of over $300 million in previous cycles.

Read also: According to LookOnChain Data, These Are the 3 Altcoins Crypto Whales Are Buying

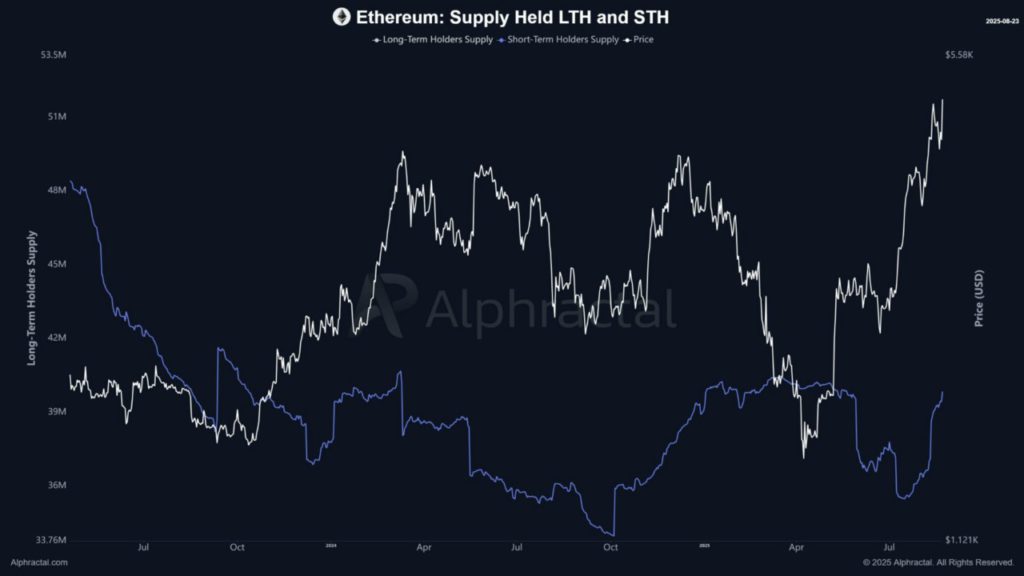

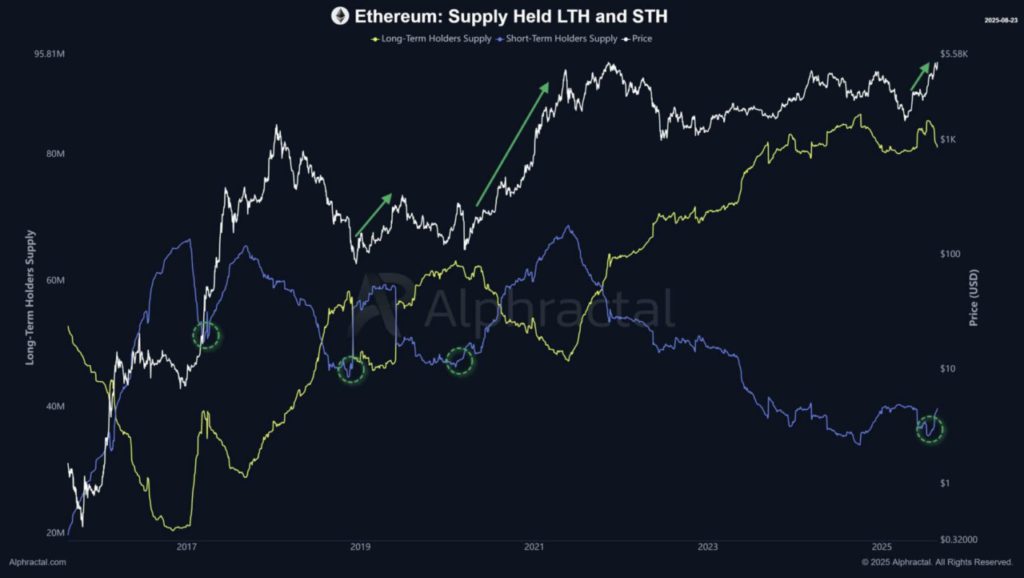

Short-Term Holders Trigger New Wave

Strength on the network side is also reflected in the dynamics of Ethereum holders. Data shows that long-term holders (LTH) with 81 million ETH have started selling, while short-term holders (STH) with 39.4 million ETH are actively accumulating instead of releasing assets.

Historically, when STHs refrain from taking profits, Ethereum often enters a strong rally phase. The current conditions signal confidence from new buyers, which is often the trigger for price spikes.

If this trend continues, Ethereum – alongside the broader altcoin market – could potentially absorb some of Bitcoin’s dominance in the next three months, putting ETH at the center of the next cycle.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum activity hits records while fees stay low – What’s next? Accessed on August 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.