Bitcoin Fees Drop: Is This a Sign of Investors Switching to Altcoins?

Jakarta, Pintu News – The cryptocurrency market is undergoing significant changes with Bitcoin (BTC) transaction fees dropping to their lowest level in more than a decade. This phenomenon indicates a decrease in demand for Bitcoin (BTC) along with increased investor interest in altcoins.

Proof of Portfolio Diversification

Recent data from CryptoQuant reported by AMBCrypto shows a spike in the number of active sender addresses in the last 48 hours. These spikes usually signify coin holders moving their assets from their wallets, often to rebalance or take positions elsewhere.

This coincides with significant gains in most altcoins, which suggests that capital is being shifted from Bitcoin (BTC) to altcoins in search of higher short-term gains.

While Bitcoin (BTC) transaction fees are declining, activity in the market suggests that investors are not only pulling out, but also looking for new opportunities. This combination of declining fees and an increase in active sender addresses paints a picture that the market is in a transitional phase, with altcoins appearing to be an attractive option for investors.

Also Read: Ondo Finance (ONDO): RWA Project Claimed to be 10x in 2026, Is it True? Here’s the Analysis!

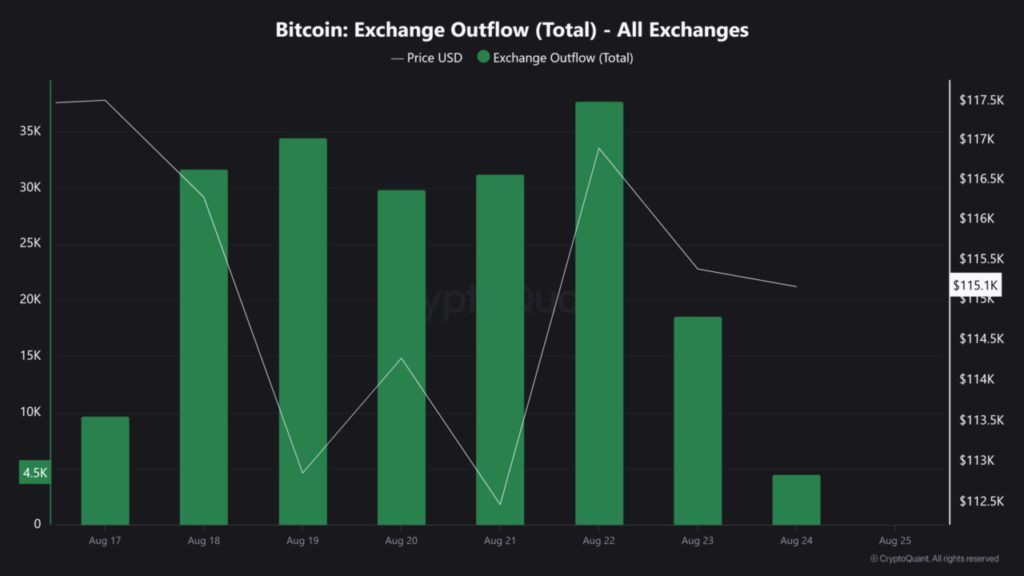

Exchange Outflows Add a New Dimension

Despite an increase in active sender addresses, Bitcoin (BTC) has also recorded a sharp increase in outflows from exchanges in the past week. Analysts interpret this as a bullish sign, suggesting that long-term holders are moving assets into private storage.

However, when combined with increased delivery activity, the picture that emerges becomes less clear. It is likely that some of this outflow is still heading to altcoins rather than cold storage, reflecting a broader repositioning in the market. This suggests that while long-term confidence in Bitcoin (BTC) still exists, there is a shift in investment strategy among holders.

Impact on Bitcoin

All these indicators suggest that the Bitcoin (BTC) market is in transition. Bitcoin (BTC) appears to be losing some of its trading momentum to altcoins, which have performed more strongly in the past 48 hours. However, outflows from exchanges still signal that long-term confidence in Bitcoin (BTC) has not been completely lost.

Despite the shift of capital to altcoins, Bitcoin (BTC) still has a strong place in the cryptocurrency market. This dynamic suggests that the market is adapting to new conditions, and Bitcoin (BTC) might find a new balance in this evolving ecosystem.

Conclusion

Looking at the various dynamics at play, it’s clear that the cryptocurrency market is undergoing significant changes. Bitcoin (BTC) investors and holders need to pay attention to these trends to optimize their investment strategies for the future. Over time, we will see if this is a temporary shift or the beginning of a new trend in asset allocation in the crypto market.

Also Read: Notcoin (NOT): Why 100 Billion Supply Could Be a Strength and Risk in the Crypto World

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin: Assessing the Impact on BTC Fees as Investors Move to Altcoins. Accessed on August 25, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.