3 Cryptos Whales Are Quietly Accumulating Ahead of September 2025

Jakarta, Pintu News – As reported by BeInCrypto, ahead of the last week of August and the new month, a number of altcoins experienced a sharp decline in exchange reserves. This trend reflects the growing interest in off-exchange accumulation and storage.

This shift has become more prominent, especially as the so-called altcoin season has become more selective. So, which tokens are showing this surge in accumulation, and what factors are driving investor optimism?

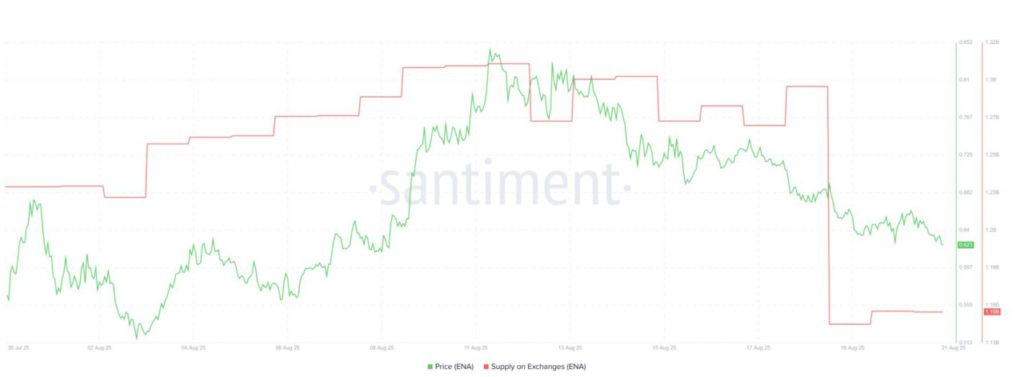

Ethene (ENA)

Data from Santiment shows that Ethena (ENA) reserves on exchanges fell from 1.3 billion to 1.15 billion in the third week of August. This means that about 150 million ENA left the centralized exchange.

Read also: Dogecoin Under the Spotlight, Whale Buys 200 Million DOGE Tokens!

This decline coincides with ENA’s price surge of 30% during August, from $0.51 to $0.65.

The fall in ENA reserves also coincided with the announcement of a $260 million buyback program by the Ethena Foundation. The program allocates around $5 million per day to buy back ENA from the market.

According to Tokenomist estimates, these buybacks could potentially absorb around 3.48% of the total outstanding supply. The absorption of selling pressure is a boost to long-term investor confidence.

In addition, Ethena recorded important milestones in August: revenues surpassed $500 million, while USDe supply reached a record high of $11.7 billion. It was these factors combined that drove the accumulation of ENA and the decline of reserves on the exchange.

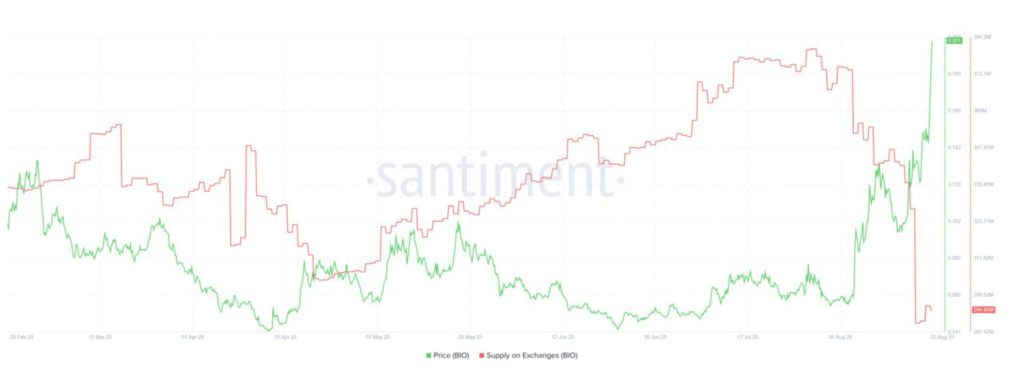

BIO Protocol (BIO)

BIO Protocol, one of the leading projects in the DeSci sector, recorded an outstanding performance in August with a price increase of over 265%.

Along with the price surge, reserves on the exchange also fell sharply. From the beginning of August until now, reserves have decreased from 380 million to 294 million BIO – a drop of more than 22%.

The third week of August was the period with the most significant movements. In one week alone, investors withdrew 42 million BIO, bringing the exchange’s reserves to their lowest level this year.

Several catalysts explain this wave of accumulation. Early August, BIO launched a staking program that attracted more than 25 million tokens. In addition, Arthur Hayes co-invested $1 million into BIO this week, which again increased market attention.

BIO Protocol also introduced a new strategy to reach out to investors. Users are invited to talk about the project on social media to earn BioXP, which gives access to the first sale of BioAgent.

Read also: LABUBU Memecoin Jumps 12,000%

The combination of these factors increases visibility, attracts new investors, and accelerates the pace of accumulation.

API3 (API3)

API3 (API3), an oracle-focused project, again attracted investor interest in August with a price increase of more than 130%. At the same time, reserves on the exchange fell to their lowest point so far this year.

The third week of August was a watershed moment. More than 9 million API3s were withdrawn from the exchange, shrinking the supply to just 17.19 million.

The trigger was the listing of API3 on Upbit. According to BeInCrypto’s report, the token price immediately jumped more than 120% after the listing.

In addition, investor attention to the oracle sector has also increased thanks to the Chainlink (LINK) rally. LINK’s strong performance over the past month has had a positive impact on related projects. Data from Artemis confirms that oracles were the best performing sector in the market during August.

This surge in API3 accumulation has kept the price steady above $1.50.

Taken together, these three altcoins highlight the diverse drivers of August’s selective rally. While the broad altcoin season has yet to truly kick in, projects with unique catalysts – whether through buyback programs, staking incentives, or exchange listings – managed to attract both investor attention and capital.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Made in USA Coins Watch September Rate Cuts. Accessed on August 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.