Whales Snap Up 200 Million DOGE as Dogecoin Takes Center Stage!

Jakarta, Pintu News – On August 24, Dogecoin (DOGE) came under bearish pressure, indicating a potential decline in value in line with the overall weakening crypto market.

On Sunday, DOGE prices fell by 1.86%, but the past week has shown signs of stability.

As of August 24, DOGE was trading at $0.2330 with a daily transaction volume of $1.78 billion, a decrease of 66.49%. Its market capitalization was recorded at $35.08 billion, a decrease of 1.87%.

The general market trend has turned bearish as a result of declining investor confidence and Bitcoin’s (BTC) weakening movement. The impact of this has been far-reaching, affecting the entire crypto market, including altcoins like DOGE.

Whale’s Big Buy Triggers DOGE Speculation

A renowned crypto analyst revealed that Dogecoin whales have bought more than 200 million DOGE tokens. This activity has sparked heated conversations amid ongoing market fluctuations.

Read also: Dogecoin Price Falls 2% Today: Could More Volatility Be Ahead?

On-chain data shows a number of large transactions from major holders, which is usually interpreted as a long-term bet on the future price direction.

Such accumulation has often preceded price rises in the past, although analysts caution that it does not guarantee profits in the short term.

This wave of buying comes at a time when Dogecoin, along with the crypto market as a whole, is still facing consistent selling pressure. However, the sudden interest from whales overnight reignited enthusiasm for DOGE and led to speculation of a potential rebound.

Whether this activity will trigger a short-term rally or lay the groundwork for bigger developments later on remains to be seen. However, the market’s attention is now fully focused on the whale action that has shaken up the Dogecoin ecosystem.

DOGE in Consolidation Phase: Breakout Could Target $0.48

Technically, Dogecoin (DOGE) shows a neutral configuration. The RSI was at 53.12 levels reflecting balanced momentum, while the MACD (0.0067 versus 0.0029) signaled an initial bullish divergence.

On August 24, DOGE moved around the middle line of the Bollinger Bands with major support at $0.2008 and resistance at $0.2595, which will most likely determine the direction of the next move.

Price action suggests DOGE is stuck in the $0.20-$0.26 range after being rejected in the $0.40 area earlier this year. If it is able to break above $0.26, the next target could be towards $0.30-$0.35 and even $0.48.

Conversely, if it falls below $0.20, DOGE risks a deeper correction towards the Fibonacci extension level of $0.0499. For now, Dogecoin is still in a consolidation phase.

Read also: Pi Network Price Drops 3% Today: Pi Coin Threatened to Fall Further?

DOGE Derivatives Weaken Amid Market Caution

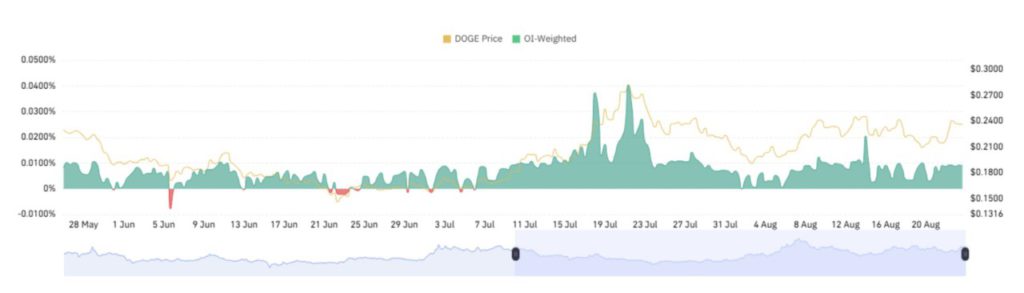

Dogecoin (DOGE) derivatives data is showing signs of cooling. Trading volume plummeted 62.09% to $3.97 billion, while open interest (OI) fell 1.18% to $3.64 billion. This decline reflects reduced market participation, signaling that traders are still cautious.

Additionally, the OI-weighted funding rate was recorded at 0.0076%, indicating a neutral to slightly bullish sentiment. Traders are not aggressively shorting DOGE, but interest in long positions remains limited as well.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Dogecoin (DOGE) Price Forecast: Whale Activity Hints at Potential Rally to $0.48. Accessed on August 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.