Ethereum Hits New Price Records, Vitalik Buterin Shares Insights on Hedging!

Jakarta, Pintu News – The crypto market is buzzing again with Ethereum (ETH) reaching new highs, which are now close to $5,000. However, amidst the market euphoria, Vitalik Buterin, co-founder of Ethereum, expressed concerns about the lack of effective hedging tools in the prediction market.

Buterin Highlights Prediction Market

In a post on Farcaster, Vitalik Buterin emphasized that prediction markets are currently not capable of being an effective hedging tool due to several structural flaws.

Read also: Solana Beats Ethereum 10 Months in a Row in DEX Trading Volume!

According to him, this market does not offer interest, which deprives participants of the potential earnings that can be made in traditional financial markets.

Buterin argues that without structural improvements, prediction markets will continue to be less attractive compared to other financial instruments such as futures contracts. In addition, prediction markets are often dominated by speculators betting on a particular outcome, rather than by hedgers who actually want to manage risk.

These shortcomings prevent prediction markets from providing the same liquidity and efficient pricing as more established financial markets.

Ethereum (ETH) Price Rise and Its Impact

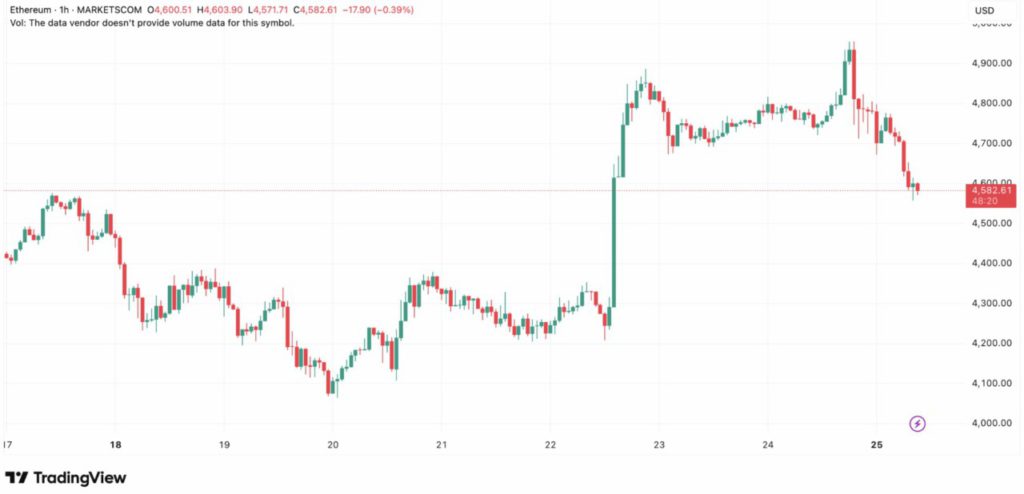

On August 24, Ethereum price reached a new peak of $4,956, marking strong bullish momentum. Despite a brief price drop after reaching the peak, the Ethereum price trend remains strong and bullish.

This price increase has made traders refocus on hedging strategies to protect their profits and minimize potential losses. However, Buterin points out that the current prediction market does not provide reliable hedging options.

This suggests a void in the financial tools available in the crypto world, which may encourage further innovation in derivatives and structured products.

Read also: Is Bitcoin’s Dominance Slowing Down? Experts Weigh in on the Coming Altcoin Season

Market Optimism and Buterin’s Warning

Despite the concerns expressed by Buterin, optimism in the market is still high. Arthur Hayes, co-founder of BitMEX, recently bought back Ethereum and set an ambitious price target of $20,000 for this cycle.

Meanwhile, BitMine ‘s Tom Lee has also invested an additional $45 million into Ethereum following the latest price increase. However, Buterin’s warning should not be ignored.

Lack of robust hedging tools can be a serious problem if the market experiences high volatility. This shows the importance of developing and integrating more mature and effective financial tools in the crypto ecosystem.

All in all, Ethereum’s spectacular price rise brings many opportunities but also risks. Vitalik Buterin’s warning about prediction markets underscores the urgent need for innovation in hedging tools in the crypto world.

As the market continues to evolve, it is important for market participants to heed the advice of experts and develop a more robust and reliable financial infrastructure.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Vitalik Buterin Shares Hedging Insights Following Ethereum Price New ATH. Accessed on August 26, 2025

- Coinpedia. Vitalik Buterin Issues Warning as Ethereum Price Hits All-Time High. Accessed on August 26, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.