Why do you need to monitor your trading? Here are the benefits for crypto trading!

Jakarta, Pintu News – Trading with multiple monitors allows traders to process information more efficiently, monitor multiple indicators and assets simultaneously and manage risk more effectively.

With the right tools, such as TradingView which supports multi-monitoring, traders can improve their performance, reduce errors and make faster decisions.

1. Maximize Data and Information Processing

Trading in the stock or cryptocurrency markets requires the ability to analyze a lot of data at once. By using more than one monitor, traders can more easily access the various sources of information they need without having to constantly switch between windows.

For example, one monitor can be used to display real-time stock or cryptocurrency price charts, while another can be used to view market news, economic calendars or technical analysis.

By using multiple screens, traders can monitor all the important data at one time without distraction, which helps them make faster and more accurate decisions.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

2. TradingView Supports Multiple Monitors for Easy Analysis

One of the most widely used platforms for price analysis is TradingView. This platform supports the use of multiple monitors, which allows traders to split the screen into different views of a chart or financial instrument. For example, traders can monitor daily, weekly and monthly charts to thoroughly examine price trends.

With 6 monitors recommended by many professional traders, investors can have a very organized view-a chart for each currency pair or stock being monitored. The ability to compare multiple time-frames at the same time also reduces the risk of missing trading opportunities.

3. Improve Work Focus and Efficiency

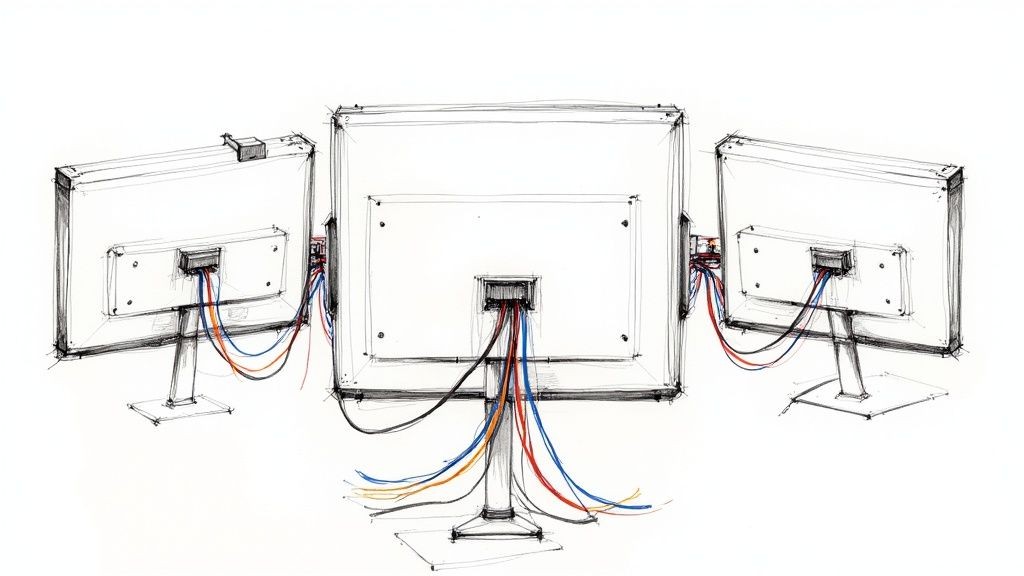

Without the right monitor setup, traders can feel overwhelmed by the amount of information they have to process. With multiple monitors, traders can group different tasks into different screens. One monitor can be used to enter orders, while another can be used to monitor open positions and manage risk.

Careful arrangement of monitors reduces distractions and allows traders to focus more, reduce errors, and improve overall work efficiency.

4. Accelerate Decision Making in Fast Market Conditions

The stock and cryptocurrency markets are very fast-changing. In these situations, timing is everything. With multiple monitors, traders can more quickly analyze real-time data, such as market prices and transaction volumes. This allows them to make decisions faster than if they were using just one monitor.

One monitor may display price charts, another may display transaction volume or market depth, and another may be used to monitor the latest news. By having access to multiple pieces of information at one time, traders can make faster trading decisions.

5. Simplify Risk and Security Management

For many traders, one of the key factors in successful trading is effective risk management. With a dual or multiple monitor setup, traders can separate their position monitoring from risk monitoring. For example, one screen can be dedicated to monitoring price movements, while another screen can be used to view risk and margin positions.

Security also becomes easier to manage as traders can monitor all transaction data and open positions in real-time without having to flip back and forth between different windows.

6. Use of Multi-Monitor to Suit Trading Style

Not all traders need 6 monitors to conduct analysis. Each trading style, such as day trading, swing trading, or scalping, has different needs. For example, a day trader may only need two or three monitors to monitor short-term price charts and market news. While a swing trader may use more monitors to look at long-term trends.

However, with 6 monitors, traders can have greater flexibility in monitoring multiple markets and optimizing their trading strategies by separating the functions for each screen.

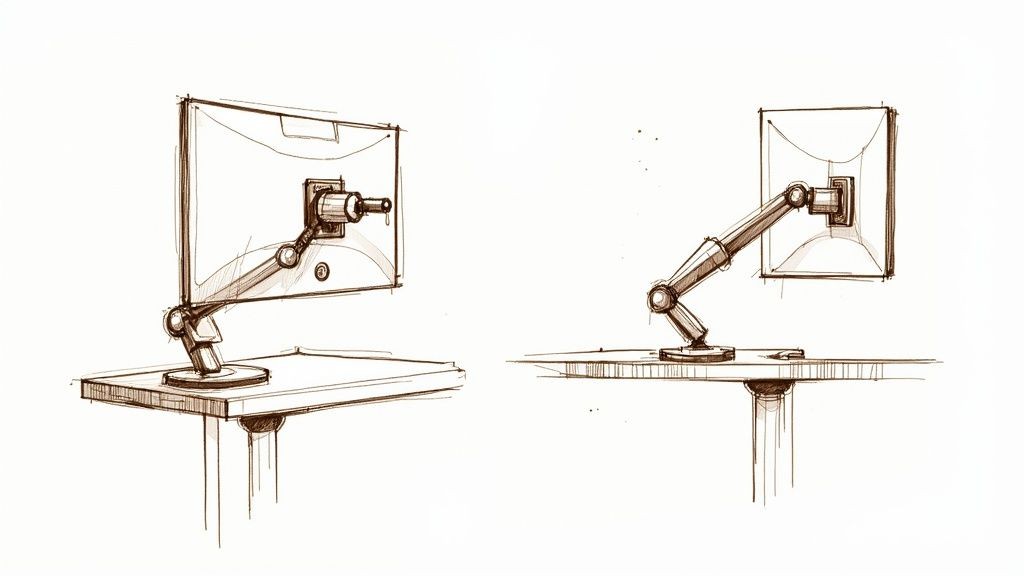

7. Maintain Long-term Quality and Comfort of Work

Trading for long periods of time can be tiring, especially when using only one monitor. In a multi-monitor setup, investors can adjust the position of the screen so as not to put additional strain on the eyes or neck. Ergonomic settings are essential to maintain comfort during long trading sessions.

By strategically arranging monitors and using adjustable chairs and tables, investors can maintain physical comfort during long hours in front of the screen, while staying focused on the markets.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- ChartsWatcher. The Ultimate Guide to Multiple Monitor Trading Setup: Strategies and Best Practices. Accessed August 26, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.