Bitcoin Covenant: Advanced Innovation or Threat to Decentralization? Here are 7 Facts!

Jakarta, Pintu News – Bitcoin (BTC) as an open network continues to evolve through improvement proposals known as BIPs (Bitcoin Improvement Proposals). One such proposal that has sparked heated debate is Bitcoin Covenants – a feature that allows restrictions on how and for what purpose the coins can be used.

Is this a form of innovation or a threat to the principle of decentralization? Here’s the explanation in 7 key points.

1. What is Bitcoin Covenant?

In the world of property, a “covenant” is a legal contract that restricts the use of an asset. In the context of Bitcoin, the term refers to a mechanism to limit how and where coins can be transferred once owned.

Bitcoin covenants are technically scripts that are attached to transactions and define additional restrictions after the coins change hands. This means that in addition to fulfilling general conditions such as private signatures, users must also fulfill additional conditions specified by the covenant.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

2. How Does Bitcoin Covenant Work?

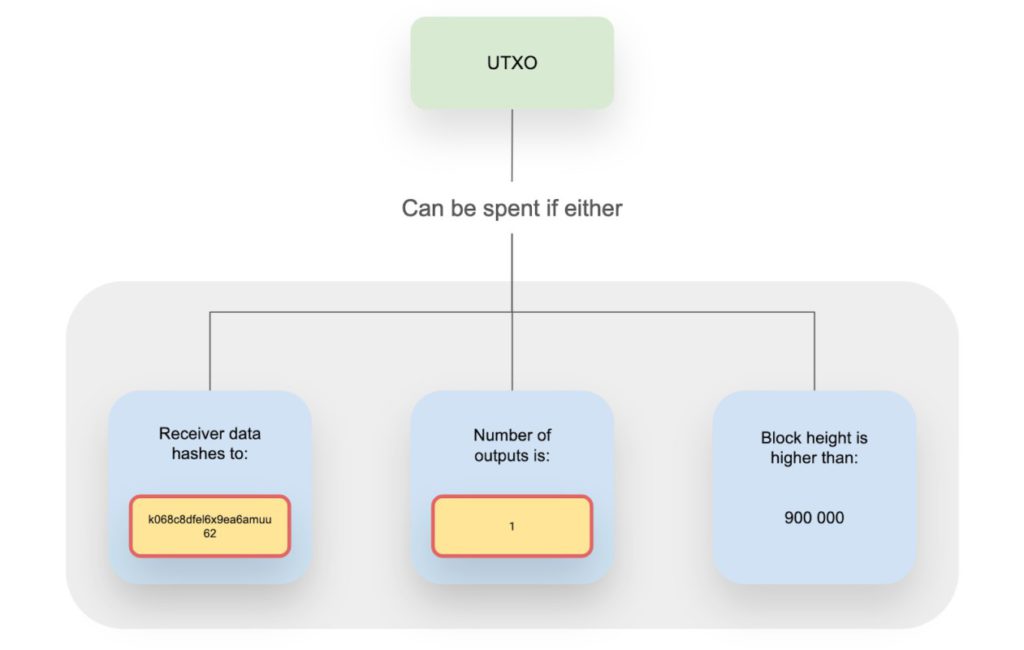

Normally, Bitcoin transactions are locked by a locking script that can be unlocked under certain conditions, such as a digital signature. However, covenants add a new layer: specifying conditions for subsequent transactions, such as limiting the recipient’s wallet.

For example, if you have Bitcoin with a covenant that only allows sending to a specific wallet, then whoever receives that Bitcoin must also send it to the same address. This provides layered control over the UTXO transaction path.

3. This Feature Included in BIP119

One of the main proponents of covenants was Jeremy Rubin, who submitted BIP119. This proposal introduced a new opcode called OP_CHECKTEMPLATEVERIFY (CTV), which allows limited covenant implementation for specific cases.

CTV enables aggregated transactions – a solution to reduce network congestion when transaction volumes are high. With CTV, one large transaction can aggregate multiple payments, saving block space and gas costs.

4. Potential Benefits for Bitcoin Security

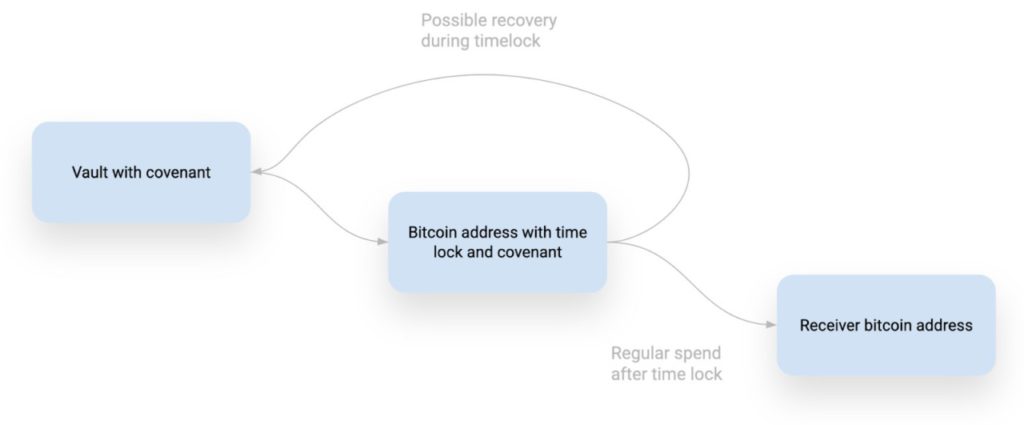

Bitcoin covenants have great potential in terms of the security of user funds, especially to prevent theft or physical attacks such as the “$5 wrench attack”. One application is the use of vaults, which are coin storage systems with layered controls such as time-lock and multisig.

With a vault, users can set it so that coins can only be sent to a multisig address after a certain time, or can only be accessed through signed and locked transactions. This can be very useful for more secure key management.

5. Can be used for Trustless Lending Schemes

Bitcoin covenants can also be used in trust-minimized lending schemes, where assets can be secured and used in transactions without the involvement of third parties. This mechanism promises the development of simple smart contracts on Bitcoin without major consensus changes.

Some researchers also note that covenants can help control network congestion, prevent double spending attacks, and improve Bitcoin’s throughput efficiency through methods like Bitcoin-NG.

6. Risk of Censorship and Loss of Fungibility

However, not all parties agree. Prominent Bitcoin figures such as Andreas Antonopoulos and Adam Back rejected the covenant due to the potential threat to Bitcoin’s fungibility – the ability of one BTC to be exchanged for another without any difference in value or function.

Antonopoulos highlights the risk of recursive covenants, where a single covenant can create an endless chain of transaction restrictions. In addition, covenants can also be used for censorship by governments, for example forcing exchanges to only transfer BTC to whitelisted addresses.

7. The Final Decision is in the Hands of the Community

Since Bitcoin is a leaderless network, the decision to implement features like covenants rests with users and node operators. They will only run software that reflects their preference for the feature.

Open debates and in-depth evaluations like this are an important part of the decentralization process. Despite the controversy, the covenant remains proof that Bitcoin continues to evolve and experiment with new features to adapt to the challenges of the times.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Emi Lacapra / Cointelegraph. What are Bitcoin covenants, and how do they work?

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.