Ethereum Price Rises 3% to $4,500 Today (Aug 27): Are ETH Holders Starting to Sell?

Jakarta, Pintu News – Ethereum (ETH) price failed to reach the $5,000 mark earlier this month and is now struggling to stay above $4,600.

The altcoin king is facing increasing pressure as support levels weaken due to recent market conditions. With increased selling activity, Ethereum is potentially vulnerable to further declines in the near future.

Then, how will Ethereum price move today?

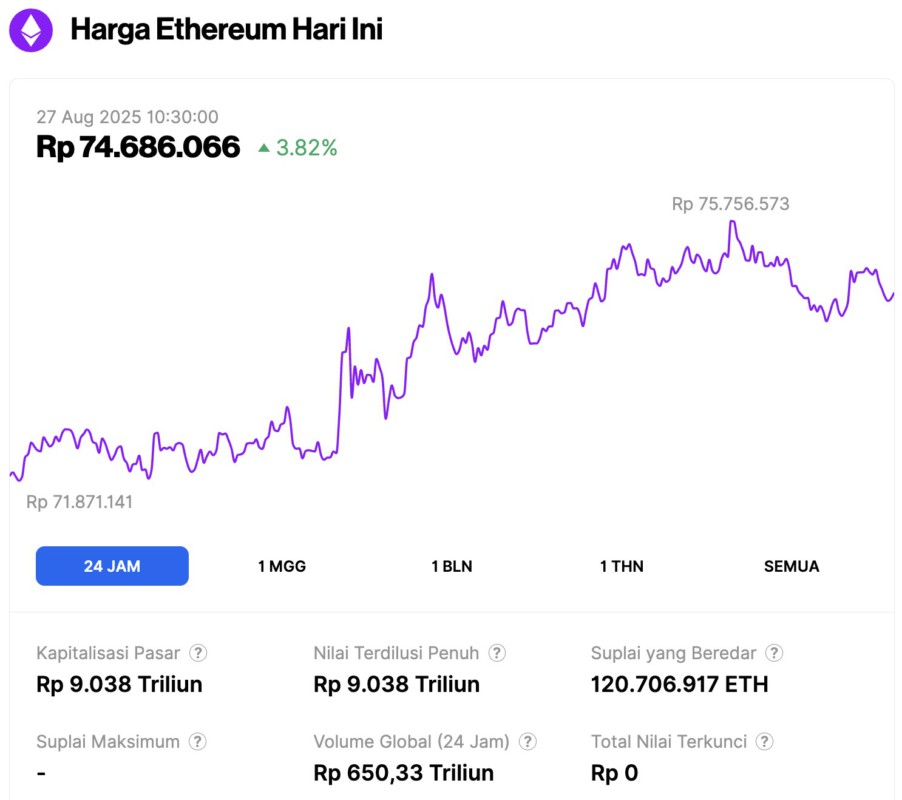

Ethereum Price Up 3.82% in 24 Hours

On August 27, 2025, the price of Ethereum was recorded at approximately $4,571, or IDR 74,686,066, marking a 3.82% increase in the last 24 hours. During this period, ETH reached its lowest point at IDR 71,871,141 and its highest at IDR 75,756,573.

As of now, Ethereum’s market capitalization is around IDR 9.038 trillion, with its daily trading volume dropping by 28% to IDR 650.33 trillion over the past 24 hours.

Read also: Bitcoin Price Hits $111,000 Today (Aug 27): Are Traders Starting to Pull Back and Sell?

Ethereum Holders Are Selling

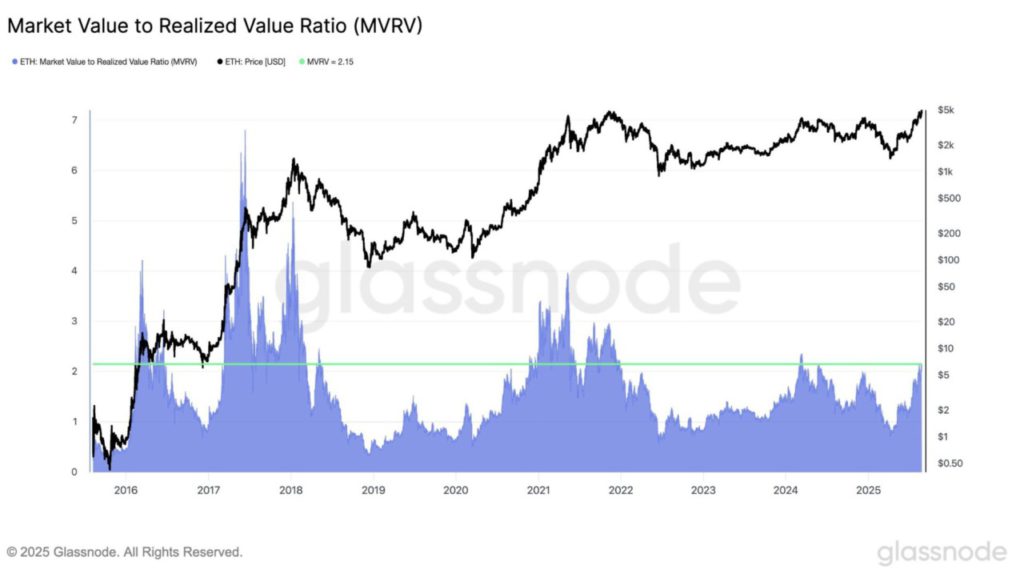

The MVRV ratio for Ethereum has risen to 2.15, indicating that on average, investors currently have an unrealized gain of 2.15 times their initial capital.

These levels have historically often coincided with periods of increased profit-taking. Similar patterns were seen in March 2024 and December 2020, both of which were followed by higher volatility.

On-chain data confirms that profit-taking is already on the rise. Investors are using these levels to lock in profits, leading to higher selling pressure. The correlation between the current MVRV ratio and the previous cycle suggests a possible short-term correction.

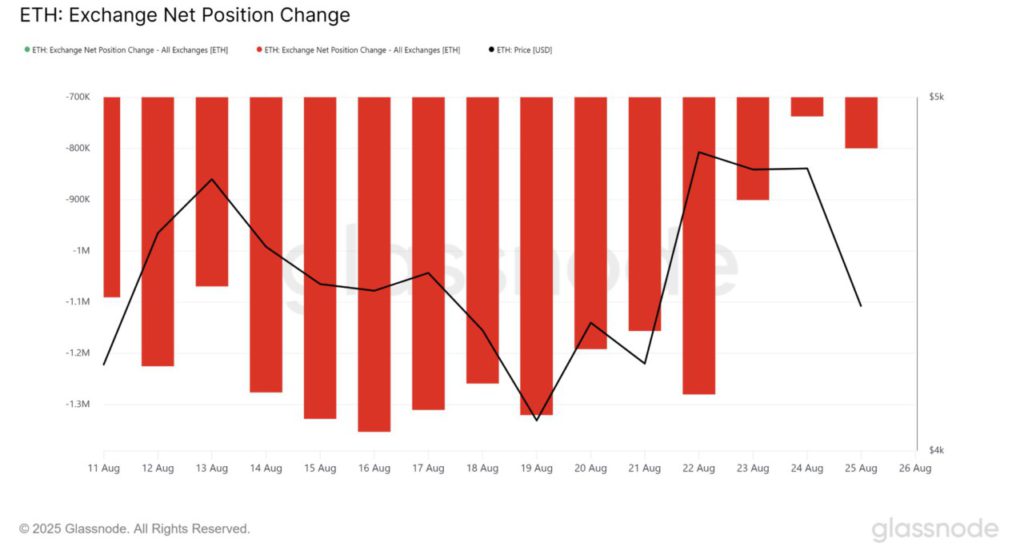

The change in net position on exchanges further highlights the selling activity. Investors switched from accumulation to distribution, with 521,000 ETH worth over $2.3 billion sent to exchanges in the past week.

The scale of this inflow indicates extensive profit-taking across the market. This kind of action usually increases the likelihood of a longer correction.

This timing is in line with the MVRV signal, reinforcing the historical pattern of sharp declines after high unrealized gains. Fear of saturation of bullish momentum seems to be driving capital rotation. The combination of large inflows and high profit-taking weakened the market.

Read also: Ethereum Price Sets New Records, Vitalik Buterin Shares Hedging Insights!

ETH Price Still Vulnerable

On August 26, Ethereum briefly traded at $4,433, below the resistance level of $4,500. The asset failed to reclaim the level as support, indicating weakness in sustaining higher levels.

Without any buying coming back, Ethereum is at risk of dropping further to lower price ranges.

Conditions suggest that Ethereum could break the $4,222 support level. A drop below this level could push the altcoin king to $4,007 or lower. Such a move would confirm a broader selling trend and is in line with on-chain indicators suggesting profit-taking.

If the selling pressure stops, Ethereum might bounce off $4,222 and try to reclaim $4,500. A successful recovery could extend to $4,749, reaffirming short-term positions. This move would invalidate the bearish signals.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Price Faces a Drop to $4,000 Owing to $2 Billion ETH Selling. Accessed on August 27, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.