Ethereum Predicted to Surpass Bitcoin in 1-2 Crypto Market Cycles? Here’s the Analysis!

Jakarta, Pintu News – The second-largest crypto, Ethereum (ETH), is currently in the spotlight in the global cryptocurrency market.

Based on recent research from Trend Research, Ethereum’s market capitalization is currently only a quarter of Bitcoin (BTC), but massive institutional flows are predicted to see ETH overtake BTC in the next one to two market cycles.

Growing demand from treasury firms and Exchange-Traded Funds (ETFs) is the main factor driving this potential upside. This trend indicates a significant change in the crypto landscape, with ETH starting to be considered a major asset alongside Bitcoin.

Check out the full information in this article!

Institutions Drive ETH Demand Past Bitcoin

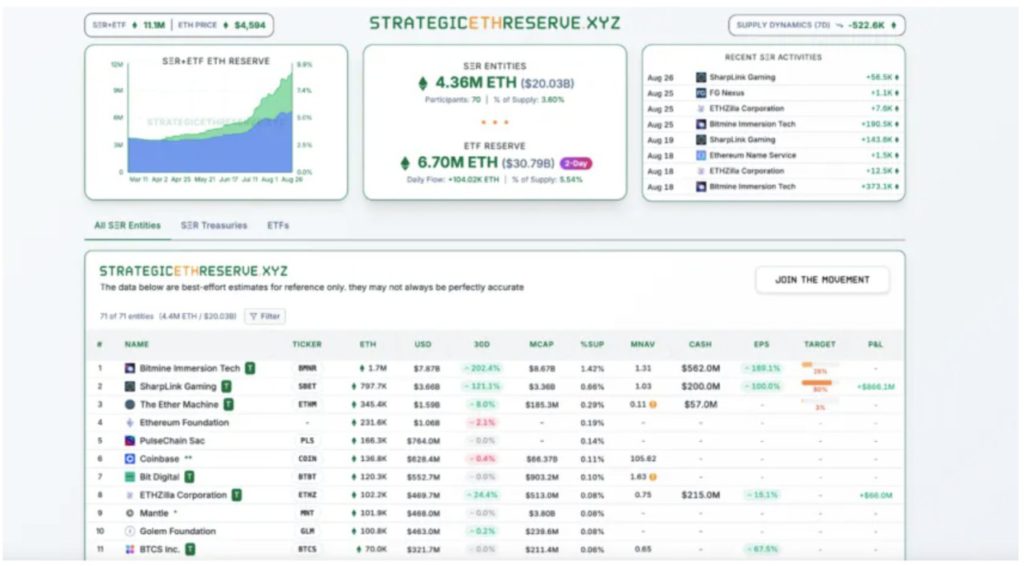

Trend Research, a subsidiary of LD Capital, notes that treasury firms and ETFs already hold nearly US$20 billion of Ethereum, or about 3.39% of the total supply. This value is equivalent to IDR 327.0 trillion, based on an exchange rate of IDR 16,346 per US dollar.

Unlike Bitcoin, which has a fixed supply model, ETH is used as an asset that can generate returns. This makes treasury firms buy ETH not only as a store of value, but also as a source of revenue from DeFi staking and liquidity.

Since the Pectra upgrade in May 2025, the Ethereum network has limited the daily unstaking amount to 57,600 ETH. However, institutional inflows far exceed this amount, creating steady demand pressure.

Read also: Blockchain Technology Breakthroughs: Chainlink Integration and Aptos Growth!

BitMine, for example, has added more than 1.5 million ETH since July 2025. Meanwhile, SharpLink has added around 740,000 ETH since June, confirming the dominance of institutions in the crypto market.

ETF Staking and Flow Profits Strengthen ETH

Ethereum has structural advantages over Bitcoin. In addition to staking with an average yield of 1.5-2.15% per year, ETH can also be used for liquidity provision in DeFi, which can earn up to 5% per year.

These revenues allow institutions to value ETH higher using a discounted cash flow model. Ethereum ETFs also continued to record net inflows for the 14th consecutive week, adding US$19.2 billion (Rp313.6 trillion) to the market.

BlackRock’s ETHA leads the way with 2.93% ownership of the total supply. While Bitcoin ETFs are under pressure, ETH continues to attract the attention of large investors.

Fundstrat’s Tom Lee estimates that ETH prices could reach US$5,500-US$12,000 by the end of the year, equivalent to IDR89.9 million-IDR196.2 million per ETH. The driving factors are institutional accumulation and a decrease in the amount of ETH on exchanges, which makes the effective supply of ETH increasingly scarce.

Also read: Valour Launches 8 Crypto ETPs in Sweden, What are the Future Prospects?

Shifting Investor Psychology and the On-Chain Trend

On-chain data shows a large rotation from Bitcoin to Ethereum. ETH futures trading volume rose from 35% in May to 68% in August, while BTC fell sharply.

Some whales are even staking hundreds of thousands of ETH, exceeding the Ethereum Foundation’s balance. This change reflects the recognition of ETH as the primary financial infrastructure for stablecoins, asset tokenization, and DeFi.

Macroeconomic policies also favor ETH. The US Federal Reserve is likely to cut interest rates in September, which has historically favored Ethereum over Bitcoin.

Ethereum now occupies a strategic position in the cryptocurrency ecosystem, with more than half of stablecoin and real-world asset activity running on the ETH network. Trend Research estimates that Ethereum’s market capitalization could surpass IDR 49,038 trillion, beating Bitcoin.

Conclusion

Institutional dominance, staking gains, ETF flows, and changing investor psychology suggest that Ethereum (ETH) stands a good chance of overtaking Bitcoin (BTC) within one to two crypto market cycles.

Although short-term volatility remains, fundamental factors and on-chain trends favor ETH’s long-term upside potential. Crypto investors and traders are advised to pay attention to these institutional flows as a key indicator of market movement.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Research Predicts Ethereum To Overtake Bitcoin Within 1-2 Cycles. Accessed August 28, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.