Deribit Analysis: When Will Altcoin Season 2025 Happen?

Jakarta, Pintu News – News of the coming altcoin season has been a hot topic of conversation among crypto traders.

Although Ethereum (ETH) is showing impressive performance, and there are signals of interest rate cuts by the US Federal Reserve as well as economic stimulus from China, an expert from Coinbase-acquired crypto exchange Deribit said that the altcoin season still has to wait.

This analysis shows that while there is optimism, there is not yet enough euphoria to kick off the altcoin season.

Check out the full information in this article!

Favorable Macroeconomic Factors

Jean-David Péquignot, Chief Commercial Officer of Deribit, recognizes that supportive macroeconomic policies can be a catalyst for altcoin season. Looser central bank policies could lower yields on safer assets and inject liquidity into the financial system.

This in turn, lowers long-term return expectations and increases speculative flows into high-risk assets like crypto. When liquidity is more abundant, high-risk assets like crypto tend to amplify what happens in the stock market.

This can be seen from the surge in Ethereum (ETH) price that occurred after the announcement by Jerome Powell, Chairman of the US Federal Reserve, indicating a possible interest rate cut.

Read also: Gold Jewelry Price Today, Thursday August 28, 2025, Up or Down?

Ethereum’s Strengthening Gives Hope

The recent rise in the price of Ethereum (ETH) indicates an increased risk appetite among investors. This price action, along with the surge in inflows into spot Ethereum ETFs, is a key development.

According to Péquignot, Ethereum’s (ETH) outperformance over Bitcoin (BTC) is an important signal for the broader market.

The ETH/BTC ratio often acts as a leading indicator when Bitcoin (BTC) starts to underperform and investors show a growing appetite for higher-risk crypto assets. It can also have a spillover effect, where Ethereum’s (ETH) outperformance consolidates investors’ appetite for innovation and triggers FOMO in the wider market.

Also read: Trump Media and Crypto.com Launch $6.42 Billion CRO Treasury!

Bitcoin Still Dominates

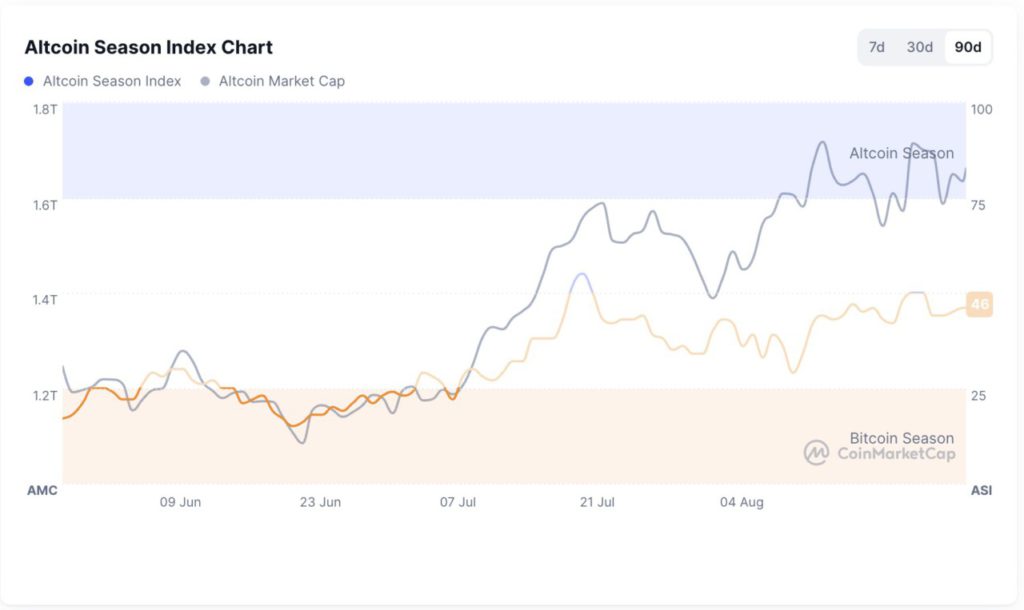

A true altcoin season is characterized by broad market rallies, yet some key metrics suggest that this is not yet the case. CoinMarketCap’s Altcoin Season Index, for example, measures whether 75% of the top 100 altcoins have outperformed Bitcoin (BTC) over 90 days.

Currently, the index stands at 44 out of 100. Bitcoin (BTC)’s dominance is still high on a five-year timeframe at 58%, suggesting that it is still a major catalyst for institutional allocations. For the true altcoin season to take place, this metric will need to change.

Conclusion

Although it hasn’t arrived yet, the conditions for altcoin season are starting to take shape. The powerful combination of macroeconomic winds and the recent spike in Ethereum (ETH) price has provided the strongest signal to date that the market is starting to shift.

However, all the indicators needed to confirm the event have yet to be met. The waiting game continues, but for the first time in a long time, the pieces for the next crypto gold craze seem to be starting to fall into place.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoin Season Timeline Expectation: Deribit Analyst. Accessed on August 28, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.