5 Facts Why Pi Network (PI) Prices Remain Sluggish Despite Major Upgrades

Jakarta, Pintu News – Pi Network, one of the cryptocurrency projects that is quite known for its mobile mining approach, recently launched a major upgrade by bringing Linux Node and protocol transition from version 19 to 23. This step is considered an important technical achievement in the Pi network’s journey towards full decentralization.

However, based on a BeInCrypto report published by Abiodun Oladokun on August 28, 2025, the price of the Pi (PI) token remains moving sideways and has not shown any signs of a significant rally. This has raised questions from the crypto community about the effectiveness of the fundamental impact on the market value of PI.

1. Protocol Update Not Followed by Significant Price Increase

According to BeInCrypto data, Pi Network has just completed the launch of Linux Node and the upgrade of the protocol from version 19 to version 23. Technically, this should improve the efficiency of the network and attract investors’ attention to strengthening the infrastructure.

However, despite a slight increase of 2%, the PI price is still moving around USD 0.34 or around IDR 5,599. This increase does not reflect market enthusiasm that is strong enough to boost the price significantly.

Also Read: Tardigrad Trader Predicts Dogecoin Preparing to Surge 3x Compared to Bitcoin!

2. Daily Trading Volume Drops 20%

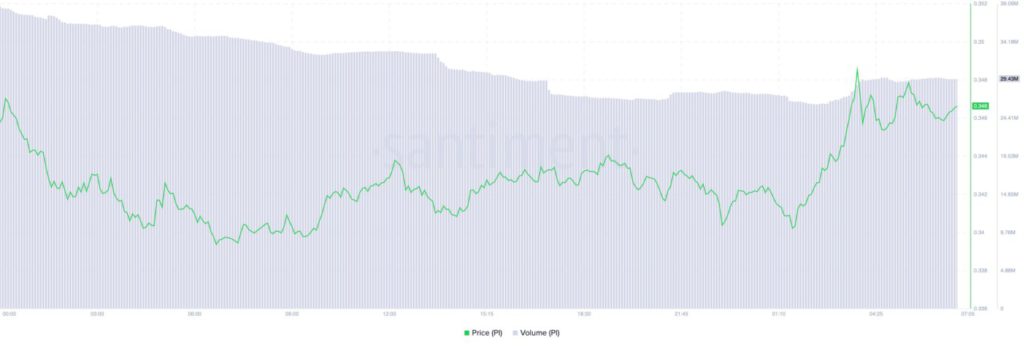

Under normal market conditions, an increase in price is usually followed by a surge in trading volume reflecting buying interest from market participants. But based on data from the Santiment analytics platform cited by BeInCrypto, PI’s daily trading volume actually fell by 20%.

This indicates that despite the price movement, buy-side support is still very weak. This situation makes short-term rallies unsustainable and more prone to reversals.

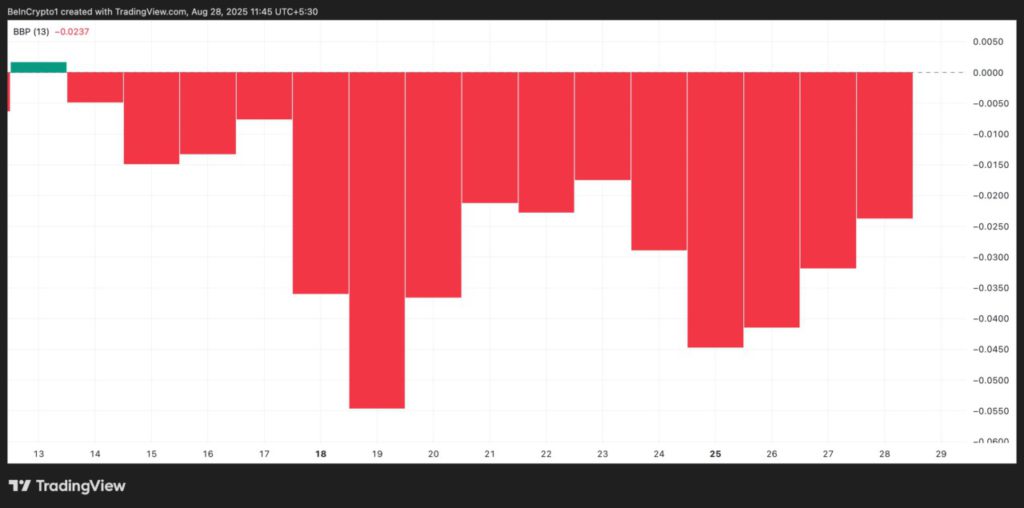

3. Elder-Ray Indicator Remains Negative, a Sign of Bearish Dominance

The Elder-Ray technical indicator is used to measure the strength of buyers and sellers in the crypto market. In the same report, the Elder-Ray PI index was recorded at -0.0237 as of August 28, 2025, indicating that bear power still dominates.

The negative value of this index has occurred consistently since August 14, 2025, indicating continued selling pressure. With this condition, analysts view that the PI is in a vulnerable situation to test the lowest support point again.

4. Risk of Falling to the Lowest Levels Remains Open

Currently, the price of Pi (PI) is still holding slightly above the support level of USD 0.32 or around IDR 5,270. This level is the lowest point in the history of the PI token price.

If the bearish pressure continues, it is very likely that the price of PI will break this support and form a new low. Conversely, if there is an increase in market demand, this token has the opportunity to strengthen to the range of USD 0.37 or around Rp6,093.

5. Market Sentiment Still Weak Despite New Hope

The technical upgrade should be able to trigger an improvement in investor sentiment. But as mentioned by BeInCrypto technical analysts, the crypto market currently tends to be skeptical of fundamental announcements if they are not accompanied by strong evidence in the form of adoption or trading volume.

This indicates that the community and investors are still waiting for more concrete catalysts from Pi Network to move the price. Without broad market participation, technical upgrades are not enough to bring about significant price changes.

Also Read: 3 Things You Need to Know About Linklogis & XRP Ledger Partnership!

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto markets such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Abiodun Oladokun / BeInCrypto. Pi Network Upgrade Fails to Lift PI Price as Bearish Signals Dominate. Accessed August 29, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.