Story Protocol (IP) Price Prediction: TVL Surge and Crypto Market Outlook!

Jakarta, Pintu News – In the last 24 hours, the Story Protocol (IP) token recorded a 10% price increase with its Total Value Locked (TVL) increasing by 12% to $25.5 million. This increase not only indicates price strengthening, but also a significant increase in capital commitments from investors and traders. This phenomenon caught the market’s attention and signals further growth potential.

TVL as an Indicator of Market Confidence

TVL is often considered an indicator of user commitment in the crypto ecosystem. An increase in capital locked in the network usually indicates that investors feel confident enough to not only participate but also maintain their investment in the long run.

In the case of IP, the surge in TVL shows that users are not only trading but also increasingly integrated with the ecosystem. This provides a stronger basis for the continuation of the positive trend of IP prices.

This significant increase in TVL signifies greater market confidence in IP tokens. More capital flowing into the system shows that investors are not only looking for quick profits but also investing for the long term. This is a positive signal for the potential future growth of the IP price.

Also Read: 3 Reasons Why Altcoins Are Predicted By Analysts And Tapiero To Explode And Surpass Bitcoin (BTC)

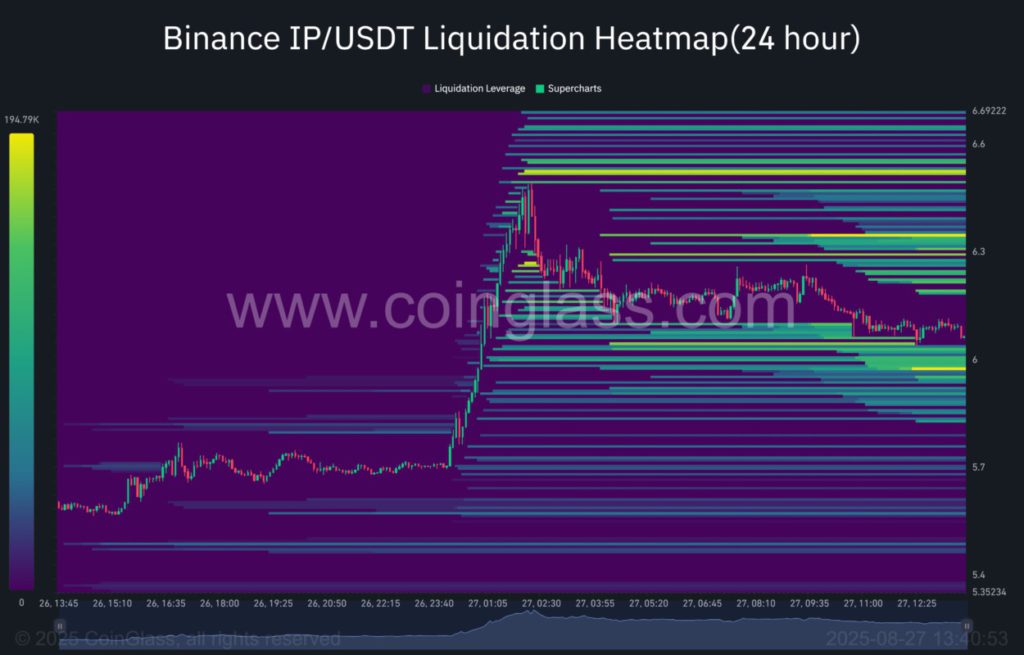

IP Liquidity Map Shows Next Target

Analysis of liquidity data from Coinglass shows a bullish bias with several liquidity clusters located above the current price range. Based on historical observations, the market tends to move towards these zones as large order concentrations often attract price action.

If buyers continue to push, this zone could serve as a magnet that pushes IP prices higher to test higher resistance zones. However, keep in mind that when liquidity builds above the spot price, this could also be an area for profit-taking.

Volatility becomes almost certain if traders decide to take profits immediately. Although current spot volumes remain strong, it is important to consider whether small investors will continue to follow the lead of the ‘whales’ who seem to be leading the market.

A Note of Caution in Rally

While there are bullish indications from the rising TVL and clear liquidity targets, it’s important to remember that market rallies rarely last without a hitch. Momentum from retail investors could subside, and if that happens, the rally could lose steam quickly.

Therefore, despite the upside potential, the market should still be wary of possible downside if the retail momentum does not hold. This rapid and significant rise in IP prices has certainly caught the attention of both traders and institutions. However, as in every investment, risks are always present, and it is important for market participants to remain vigilant and not get too carried away with market euphoria.

Conclusion

With TVL on the rise and a clear liquidity target in place, IP shows potential for further gains. However, volatility and potential profit-taking by traders could affect the continuation of the rally. Investors and traders are advised to monitor closely and act on changing market conditions.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. IP Price Prediction, Liquidity, TVL, and what’s next for altcoins traders. Accessed on August 29, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.