Is Bitcoin (BTC) Momentum Starting to Weaken? Find the Signs!

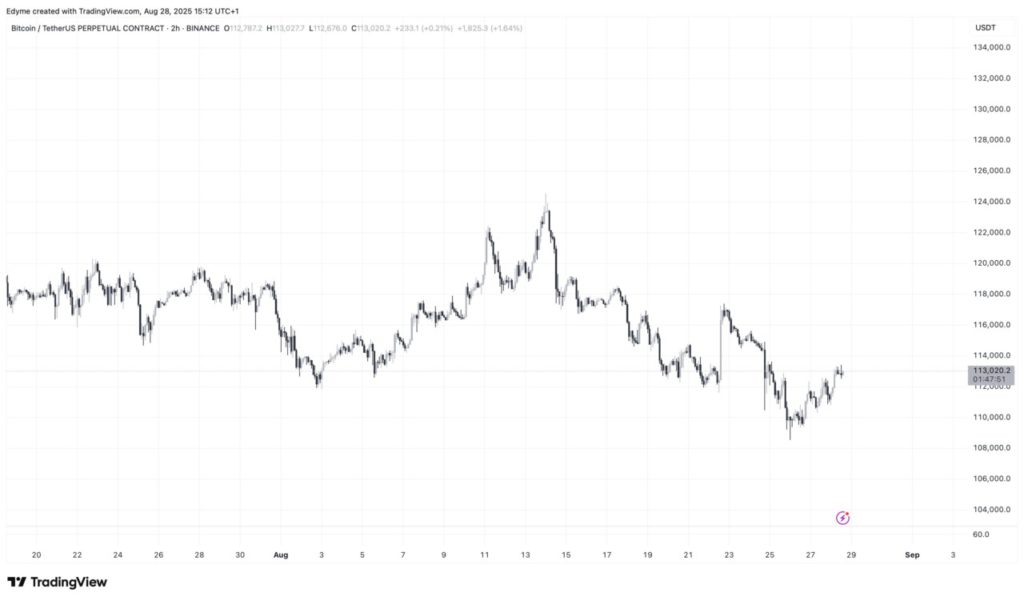

Jakarta, Pintu News – Bitcoin (BTC) is under price pressure after retreating from its record high above $124,000 earlier this month. Currently, Bitcoin (BTC) is trading at $113,146, down 8.7% from its latest peak, despite recording a daily gain of 1.8%.

These fluctuations highlight continued volatility, with investors weighing on-chain metrics and broader market sentiment to determine whether the bull cycle can regain strength.

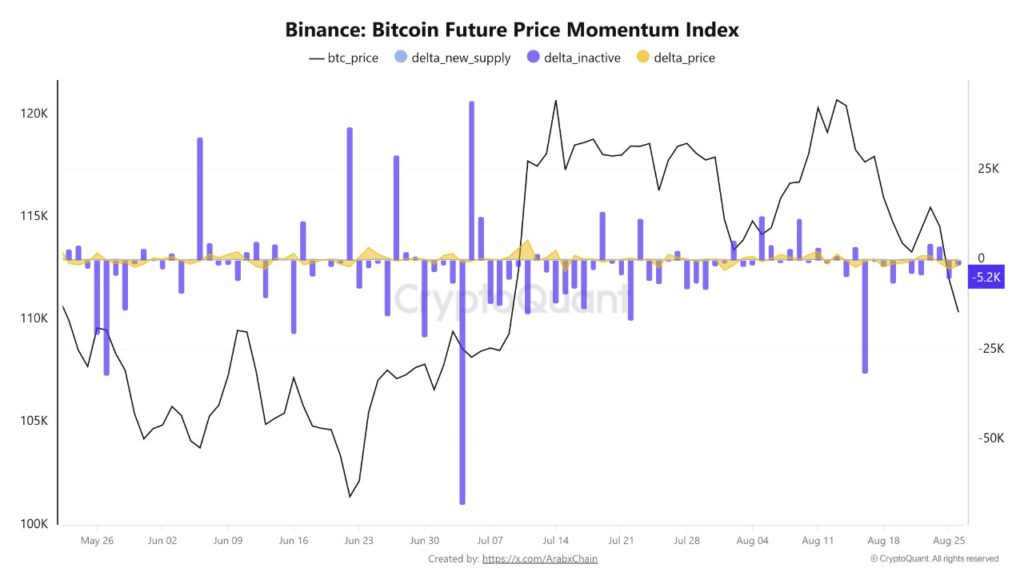

Analysis of Whale Activity on Binance

Arab Chain, a contributor to CryptoQuant’s QuickTake platform, noted that during July, Bitcoin (BTC) fluctuated between $118,000 and $122,000 in a market that had no clear trend, with low volatility and limited directional movement. During this period, the inactive delta, which measures the circulation of old coins, decreased, indicating that whales had stopped selling or temporarily left the market.

However, mid-August marked a change in trend as the inactive delta increased, signaling that long-stored coins were beginning to be moved and possibly sold. This activity coincided with Bitcoin’s (BTC) price drop below $112,000, with the Delta indicator remaining close to zero, indicating a clear absence of buying pressure.

Also Read: 3 Reasons Why Altcoins Are Predicted By Analysts And Tapiero To Explode And Surpass Bitcoin (BTC)

Bitcoin (BTC) Exchange Data Shows Mixed Sentiment

Another analysis by CryptoQuant’s TraderOasis reviewed several metrics to provide further context. It observes that the Coinbase Premium Index, which compares trading activity between US exchanges and global platforms, shows accumulation despite falling prices.

This suggests that some investors, likely institutions, bought during the price drop. However, he cautioned caution given that funding levels remain positive, a sign that traders are still bullish despite the price decline, which raises concerns about the risk of a liquidity reset.

TraderOasis also highlights open interest, or the number of unsettled derivative contracts, as a key factor. Currently, the open interest is above the market price, which could act as resistance unless it can be broken.

Market Dynamics and Future Projections

While long-term adoption metrics and institutional buying remain favorable, short-term dynamics suggest cautious sentiment and potential for volatility.

With whales selling off, stablecoin inflows increasing, and the derivatives market heating up, the next move of Bitcoin (BTC) will likely depend on whether demand can reassert itself strongly enough to offset the recent profit-taking.

Analysts added that future price movements may depend on whether new catalysts, such as macroeconomic developments or institutional inflows, can reignite demand.

Conclusion

With the various dynamics at play in the Bitcoin (BTC) market today, investors and analysts alike must remain vigilant. A deep understanding of on-chain metrics and market behavior can help in anticipating the next price movement. Despite selling pressure from whales and mixed sentiment, opportunities are still wide open for those who understand the nuances of the market.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto markets such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Warning Signs: On-Chain Data Shows Bitcoin Momentum Slipping. Accessed on August 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.