Bitcoin Price Prediction: What’s the Outlook in September 2025

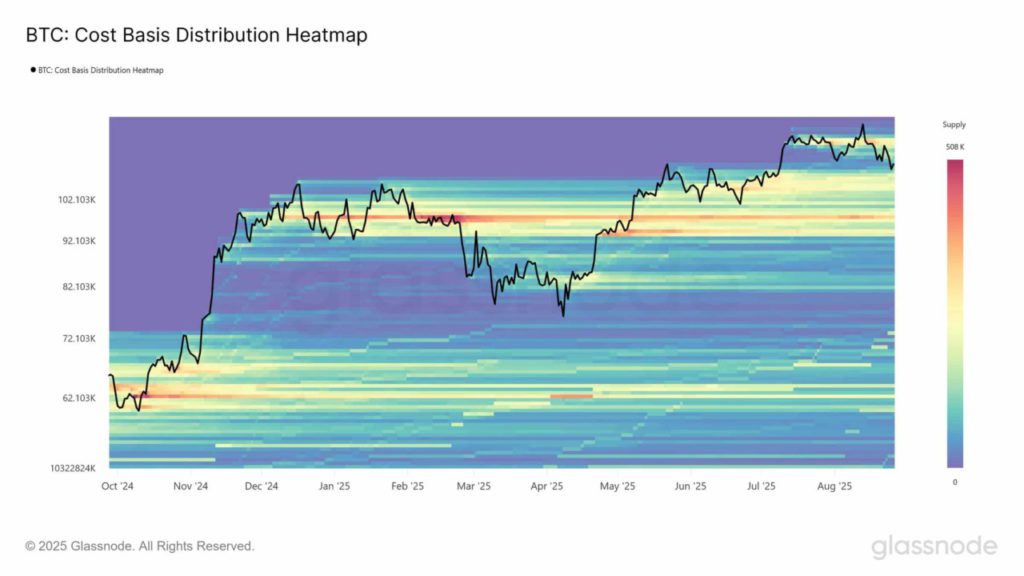

Jakarta, Pintu News – Bitcoin (BTC) is currently showing significant price resilience on top of a dense supply cluster, with long position holders remaining strong.

The golden cross NVT signal approaching oversold levels also indicates a possible rebound if new buying momentum emerges. At the time of writing, Bitcoin (BTC) appears stable in the range of $93,000 to $110,000, a zone where accumulation has been taking place since the end of 2024.

Current Market Conditions

For several months, that price range has been an accumulation pocket among Bitcoin (BTC) investors and traders. If buyers continue to absorb more coins in this area, it could be a strong base for a long time. However, if not, the same zone might be tested by a wave of capitulation.

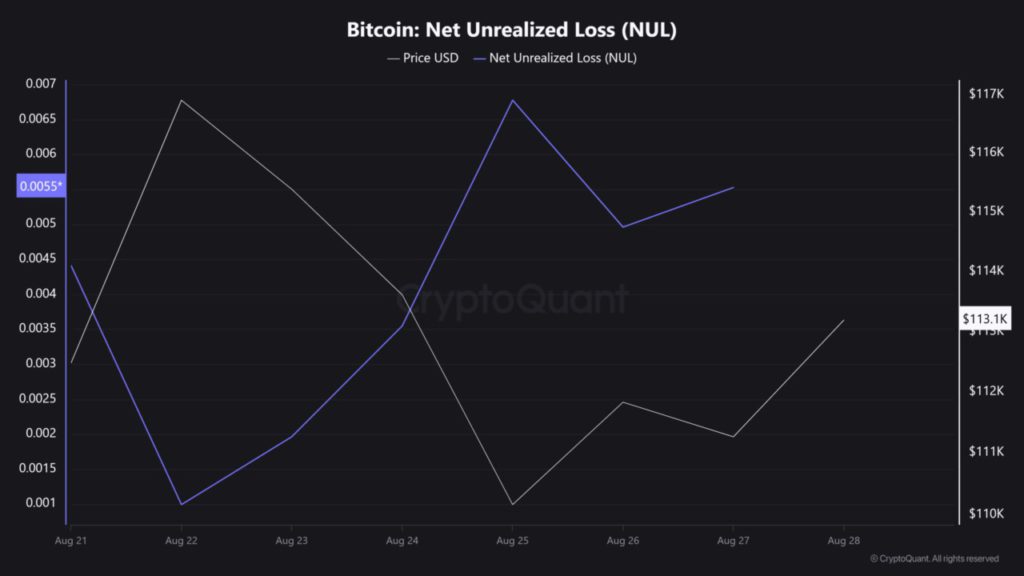

AMBCrypto’s analysis of CryptoQuant’s on-chain data shows that Bitcoin’s (BTC) net unrealized losses have increased in this price range. Normally, this would be considered a warning sign, but the lack of panic selling suggests a different story. Holders seem confident enough to persevere through this downturn.

Also Read: 3 Reasons Why Altcoins Are Predicted By Analysts And Tapiero To Explode And Surpass Bitcoin (BTC)

Seller Fatigue Signal?

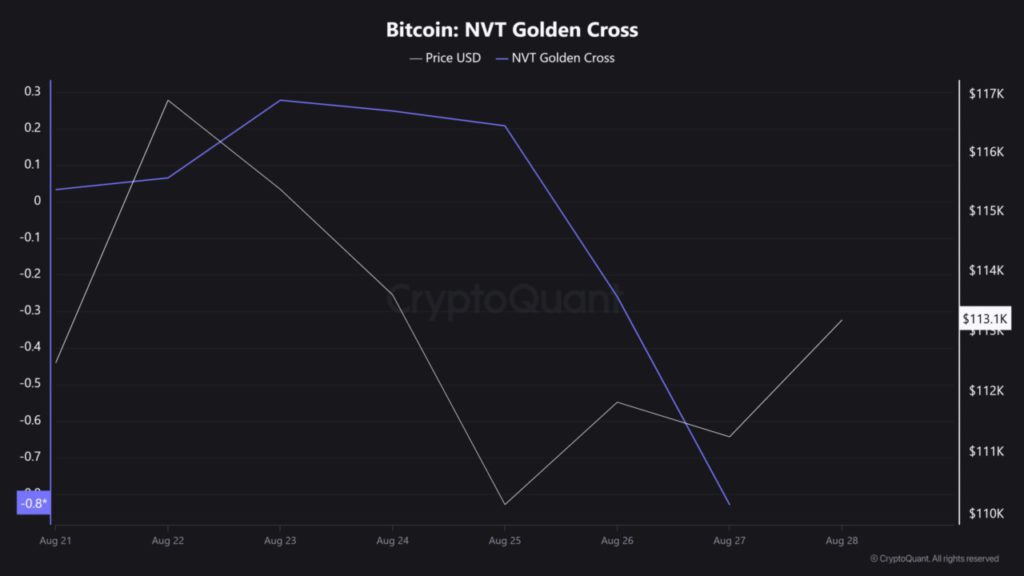

It is important to point out that the NVT golden cross, which compares Bitcoin (BTC) valuation to transaction activity, has slid into oversold territory. This doesn’t guarantee a market bottom, but suggests that prices may be too low relative to network usage.

In previous market cycles, similar moves have often gone hand in hand with relief rallies or marked the early stages of recovery. In the case of Bitcoin (BTC), the same pattern may be repeating itself.

What Do Bitcoin Traders Expect Next?

So, what will happen next in the market? If selling pressure increases, Bitcoin (BTC) could still slip below this cluster before finding stability. Conversely, if BTC demand continues to balance with supply as seen from the positive on-chain sentiment, the zone may be the springboard for the next big rally.

For now, the market is in a wait-and-see phase. Traders and long-term holders alike are waiting to find out if $93,000-$110,000 will be a new foundation, or just another battleground in Bitcoin’s (BTC) volatile journey.

Conclusion

Taking into account the on-chain data and current market behavior, Bitcoin (BTC) traders and investors should prepare themselves for all possibilities. Monitoring indicators such as the NVT golden cross and accumulation activity in the current price zone will be key to predicting the next price movement.

Also Read: 3 Reasons Why Tom Lee Predicts Ethereum (ETH) Could Touch IDR196 Million by the End of 2025

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto markets such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin Price Prediction: A Position Above Supply Clusters Means This for Short-Term Traders. Accessed on August 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.