5 Big Agendas that Could Shake the Crypto Market by the End of 2025

Jakarta, Pintu News – As the final quarter of 2025 approaches, the cryptocurrency market faces a series of key events that have great potential to trigger volatility or even start new trends.

From the interest rate decision by the Federal Reserve (Fed), to the Solana and Cardano ETF deadlines, market participants are urged to prepare for a variety of possibilities. Here are five key agenda items to keep an eye on.

1. September 16-17: FOMC Meeting – Interest Rates to Catalyze Crypto Liquidity

The Federal Open Market Committee (FOMC) meeting will be held on September 16-17, with strong expectations of a 25 basis point interest rate cut. According to Yahoo Finance, the probability of this cut stands at 92% based on futures market prices, supported by dovish statements from Fed officials regarding the slowing labor market and inflationary pressures.

Interest rate cuts typically weaken the value of the US dollar, thus benefiting riskier assets like Bitcoin (BTC) and altcoins. However, if the cuts are delayed or less aggressive, the market could experience a “risk-off” sentiment that is negative for crypto.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

2. October 10: Solana ETF Deadline – Potential Jumpstart for SOL and Altcoins

The US Securities and Exchange Commission (SEC) is scheduled to give its final decision on the spot ETF filing for Solana (SOL) on October 10. According to Bitcoinist, analysts estimate the probability of approval at 95%, assuming it follows in the footsteps of Bitcoin and Ethereum ETFs.

If approved, this ETF could strengthen Solana’s position as a legitimate digital commodity and trigger large institutional fund flows. However, rejection could pressure SOL and worsen sentiment towards other altcoins.

3. October 23: Cardano ETF Final Decision – Impact Could Be Billions of Rupiahs

After Solana, Cardano (ADA) is also awaiting the SEC’s decision on the ETF filing by Grayscale. The final deadline is scheduled for October 23. Based on Polymarket reported by CoinMarketCap, the chances of approval are at 75%.

If the ETF is approved, Cardano could potentially receive an inflow of funds of more than Rp16.4 trillion ($1 billion), mimicking the impact of previous Bitcoin ETFs. However, rejection could reinforce the negative perception of non-Bitcoin projects in institutional portfolios.

4. December 3-4: Binance Blockchain Week Dubai – A Stage for Innovation and Regulation

The annual Binance Blockchain Week event will be held in Dubai, with over 7,000 attendees and keynote speakers such as CZ (founder of Binance) and Joseph Lubin (Co-founder of Ethereum). Topics to be discussed include DeFi, AI, and global regulatory developments.

According to a report from Coingabbar, these events are often the venue for major partnership announcements and important policies. The potential impact is high, especially if there are announcements related to the integration of new technologies or government support for blockchain infrastructure.

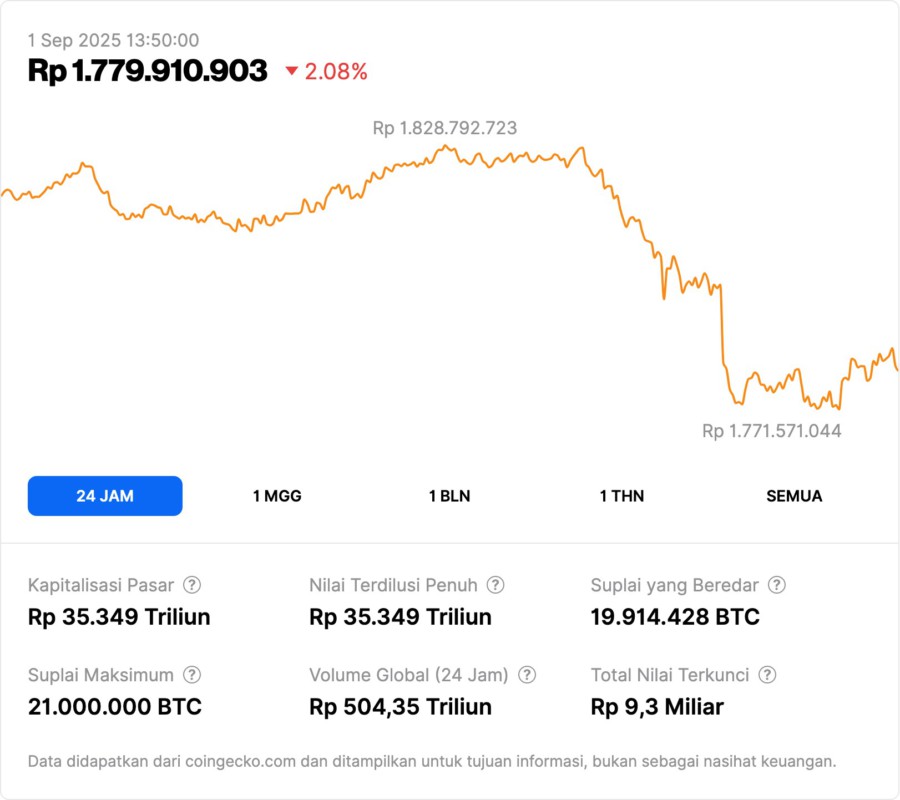

5. December 22: Bitcoin Cycle Peak Prediction – Will BTC Touch IDR3.3 Billion?

Based on Bitcoin’s historical cycle model, the price peak is predicted to occur at the end of December 2025 with a potential price of IDR3.3 billion ($200,000) per BTC. However, veteran analysts like Peter Brandt estimate a 30% chance that the peak has already been reached first.

If these projections are correct, the period leading up to December could be characterized by massive profit-taking and increased volatility. Monitoring ETF inflows and BTC balances on exchanges will be important indicators in verifying these movements.

Market Enters Decisive Phase

From the Fed’s interest rate decision to the possible approval of Solana and Cardano ETFs, the crypto market will face some major triggers in the next few months.

Currently, Bitcoin’s dominance stands at 57.3%, and the Altcoin Season Index indicator is still neutral. Market participants are advised to monitor macroeconomic policy direction, ETF volumes, and key technical signals as a guide to the end of the year.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinMarketCap. ADA ETF Odds and Impact. Accessed September 1, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.