Crypto in Index Fear? 3 Key Indicators that Show Current Market Sentiment

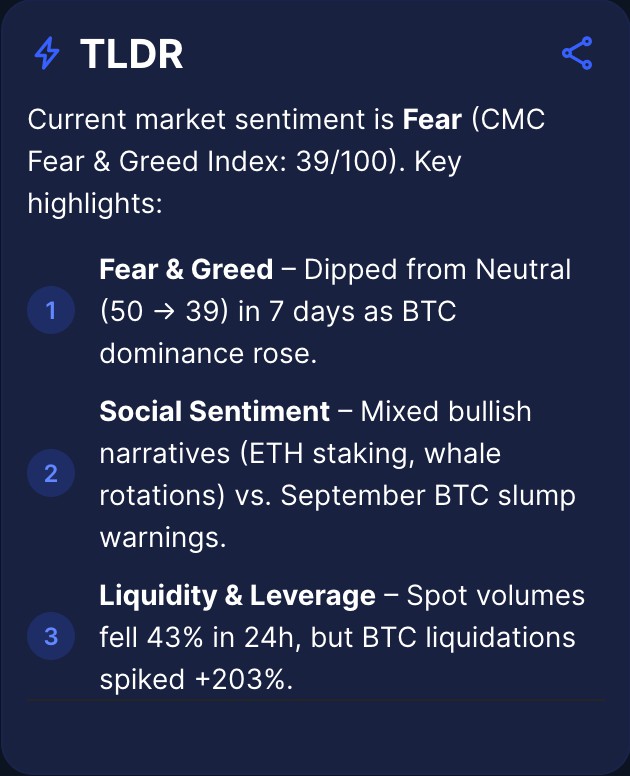

Jakarta, Pintu News – Cryptocurrency market sentiment is currently in the “Fear” zone, based on CoinMarketCap’s Fear & Greed Index which recorded a score of 39/100 as of September 1, 2025.

This is down from last week’s neutral (50/100) position, signaling a change in the mood of investors who are now more cautious. So, what’s driving this change? Let’s explore three key indicators that shed light on the current state of the crypto market.

1. Fear & Greed Index: The Market is in the “Fear” Zone

The Fear & Greed Index, a barometer of investor psychology, dropped to 39-still in the “fear” category. According to CoinMarketCap data, this comes on the heels of a 4.97% drop in crypto’s global market capitalization to IDR 61.9 quadrillion ($3.75 trillion) in the last seven days.

Derivatives trading volumes have also seen a sharp decline of 48.2% in the last 24 hours, signaling a decrease in risk appetite. Typically, a score below 40 indicates widespread fear, but historically it often precedes a price recovery phase – especially if triggered by positive catalysts such as interest rate cuts or ETF approvals.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

2. Mixed Social Sentiment: ETH Strengthens, BTC Still Haunted by Seasonality

Based on CoinMarketCap’s Social Sentiment algorithm, the net sentiment score stands at 5.26 out of 10, aka neutral. Some of the factors driving optimism include Ethereum (ETH) recording a stake value of over Rp2,639 quadrillion ($160 billion), as well as a whale rotation from BTC to ETH worth Rp61 trillion ($3.7 billion), as highlighted by accounts @altcoinvietnam and @hannaXbtc.

But on the other hand, seasonal fears still loom, especially since September is historically the worst month for Bitcoin, with an average decline of 6.2%, according to @Morecryptoonl. These concerns are amplified by the losses of public figures such as Andrew Tate who lost more than IDR 11.5 billion ($699,000) in leveraged positions.

3. Derivative Activities Demonstrate Risk Withdrawal

Although derivatives open interest edged up 1.05% to IDR15.9 quadrillion ($963 billion), daily transaction volume plummeted 34.88%. This indicates that market participants are avoiding opening new positions in volatile conditions. In addition, the liquidation of Bitcoin positions increased dramatically by 111.84% to around IDR400 billion ($24.28 million), the majority of which came from long positions of IDR347 billion ($21 million).

Bitcoin’s funding rate fell 50% on the week to +0.0049%, indicating that market interest in long positions is weakening. This is a bearish signal indicating that traders are risk-averse ahead of important technical levels such as the BTC liquidation zone around IDR1.9 billion ($115,000).

Sentiment Neutral to Bearish, but Opportunities Still Open

The crypto market is currently in a neutral-to-bearish phase, with a combination of macro pressures, seasonality, and decreased derivatives activity. However, institutional rotation into Ethereum and index values below 40 also suggest that the market may be nearing a turning point-if there is a strong enough catalyst.

Keep an eye on Bitcoin’s dominance (currently at 57.3%). A drop below 57% could signal an early influx of interest into altcoins, while if it remains above 57.5%, the market is likely to remain defensive.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinMarketCap. Fear & Greed Index and Market Metrics. Accessed September 1, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.