Egrag Crypto Analyst’s XRP Prediction: Ripple (XRP) Price Has the Potential to Reach $7!

Jakarta, Pintu News – The cryptocurrency market is abuzz again with the latest price prediction for Ripple (XRP), which shows a consolidation phase before surging to the highly anticipated price level of $7.

Ripple (XRP) Price Consolidation in the Spotlight

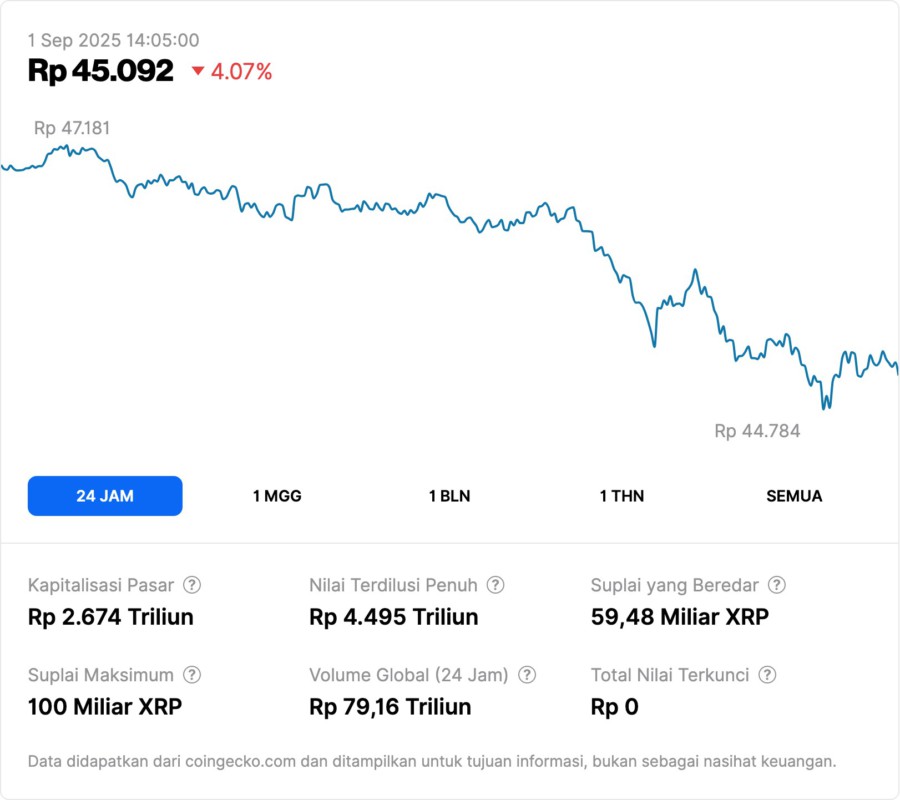

After experiencing significant volatility, the price of Ripple (XRP) is now in a consolidation phase. The token’s price briefly hit a record high of $3.65 in July, but then corrected to around $2.8. This decline raises questions about the short-term momentum of Ripple (XRP).

Analysts estimate that this consolidation period is important to determine the next direction of the Ripple (XRP) price. This consolidation phase is considered a decisive period that will open up opportunities for Ripple (XRP) to again reach and exceed previous highs.

Analysts advise investors and market watchers to pay close attention to price movements during this period, as it can be an important indicator for long-term price predictions.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

Analyst Target: $7 in View

EGRAG, a prominent analyst, remains optimistic about Ripple’s (XRP) ambitious long-term price predictions. His chart shows potential price targets between $7 to $27, signaling that the current consolidation may be the basis for the next significant surge.

A crucial decision point is projected at the end of September 2025, which is believed to determine whether Ripple (XRP) will surge or continue to move sideways. This projection is backed by in-depth technical analysis and an understanding of market dynamics.

If this prediction materializes, then Ripple (XRP) could reach price levels never seen before, changing many people’s views on its long-term potential.

Institutional Interest and ETF Speculation

In addition to technical predictions, some voices in the industry are also highlighting the potential for Ripple (XRP) to grow in institutional finance. Canary Capital’s CEO recently stated that the Ripple (XRP) ETF could attract $5 billion in inflows within its first month.

This, according to analysts like @xrpgovernor, could “fundamentally change Ripple’s (XRP) position in the global financial ecosystem” by opening up access to pension funds, hedge funds, and other large investors.

The development of institutional products such as the Ripple (XRP) ETF is expected to give Ripple (XRP) greater legitimacy and exposure in the eyes of global investors. This could also be the catalyst that drives the price of Ripple (XRP) to reach higher price predictions.

Conclusion

With various factors in its favor, including broader crypto market conditions and the potential approval of institutional products such as ETFs, Ripple’s (XRP) price outlook remains a hot topic among investors and analysts.

Whether Ripple (XRP) will reach the $7 target remains to be seen, but all indications suggest that opportunities for significant growth are within reach.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Brave New Coin. XRP Price Prediction: Analyst Predicts Consolidation Before Ripple Price Hits $7. Accessed on September 1, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.