5 Important Things to Watch in the Crypto World in September 2025

Jakarta, Pintu News – Entering September 2025, the cryptocurrency market is again filled with various important agendas that have the potential to affect price direction and investor sentiment.

After an August characterized by a stable Bitcoin (BTC) price around Rp1.93 billion ($117,000) and a surge in institutional interest in Ethereum (ETH) through record ETF fund flows, September promises a new dynamic. Here are five key factors to watch, based on a report from Cointiply (August 28, 2025).

1. Big Crypto Agenda in September

According to Cointiply, there are a number of global events in the spotlight for the blockchain community throughout September. Taipei Blockchain Week (September 4-6, 2025) will focus on the integration between artificial intelligence (AI) and Web3, including major announcements on tokenization, Layer-2 solutions, as well as the adoption of AI in decentralized financial systems.

In addition, Bitcoin Week Bali (September 5-11, 2025) provided a platform for the community to highlight BTC adoption in emerging markets, with real-life case studies of crypto use in daily transactions. Not to forget, ETHTokyo (12-15 September 2025) was held again with the theme of Ethereum’s dominance as the backbone of DeFi and tokenization of digital assets.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

2. Ethereum (ETH) Increasingly Driven by Institutional Support

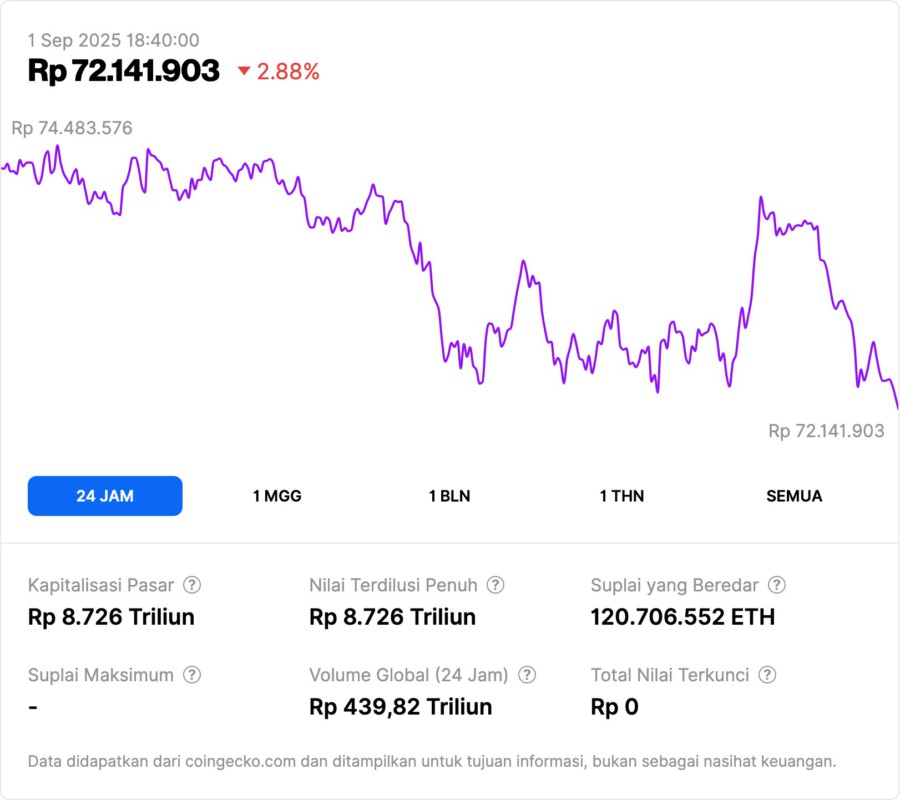

Cointiply notes that Ethereum made history at the end of August with daily ETF fund flows of more than IDR 16.4 trillion ($1 billion). This institutional support reinforces ETH’s position as no longer just an altcoin, but an important part of the global financial infrastructure.

Many analysts expect this momentum to continue into September. If the inflow trend remains high, ETH could potentially challenge new price highs ahead of the fourth quarter, while expanding adoption in the DeFi and real asset tokenization sectors.

3. Watch out for Altcoin ETFs: Solana (SOL), Ripple (XRP), Cardano (ADA), and Dogecoin (DOGE)

In addition to BTC and ETH, US regulators are now reviewing ETF applications for major altcoins such as Solana (SOL), Ripple (XRP), Cardano (ADA), and Dogecoin (DOGE). According to Cointiply, the chances of approval have increased after the GENIUS Act provided regulatory clarity regarding stablecoins.

If one of these altcoin ETFs gets the green light in September, the impact could be significant. The market could potentially witness a surge in the prices of major altcoins, while also reinforcing the narrative that non-BTC/ETH cryptocurrencies also have institutional legitimacy.

4. Stablecoin Expansion Under New Regulatory Umbrella

Cointiply also highlighted the development of stablecoins, which have now been officially legalized in the United States. With this legal certainty, banks and fintech companies are expected to launch new stablecoin products throughout the fall.

Popular stablecoins such as USDC and PYUSD are predicted to see increased adoption, both in the DeFi sector and cross-border transactions. Regulatory clarity is a positive signal that stablecoins will become an important foundation in the global digital payments infrastructure.

5. US Politics and Trump’s Maneuvers in the Crypto World

Not only market factors, political dynamics are also a concern. According to a Cointiply report, the Truth Social platform affiliated with Donald Trump is developing an ETF product titled “Crypto Blue Chip”. This issue is even more interesting because it coincides with the heated campaign for the 2025 US elections.

If Trump does expand his support for cryptocurrency products, it is not impossible that this will make crypto a major political issue. The impact could be felt directly on global market sentiment, especially if a new ETF is announced in September.

Conclusion

September 2025 has the potential to be a dynamic period for the crypto world. From international events in Asia, Ethereum’s momentum post ETF inflow, the possible approval of altcoin ETFs, the expansion of stablecoins with a new legal basis, to the political maneuvering of the United States – all have the potential to shape short and long-term trends.

For investors and observers of the cryptocurrency market, September can be used as a momentum to observe the direction of global policies and institutional adoption that is increasingly evident. While the opportunities are there, it is still important to consider the risks given the highly volatile nature of crypto.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Alyssa, Cointiply. What to Look for in Crypto This September 2025. Accessed September 1, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.