Why is Bitcoin (BTC) Price Plummeting Today? Find out! (1/9/25)

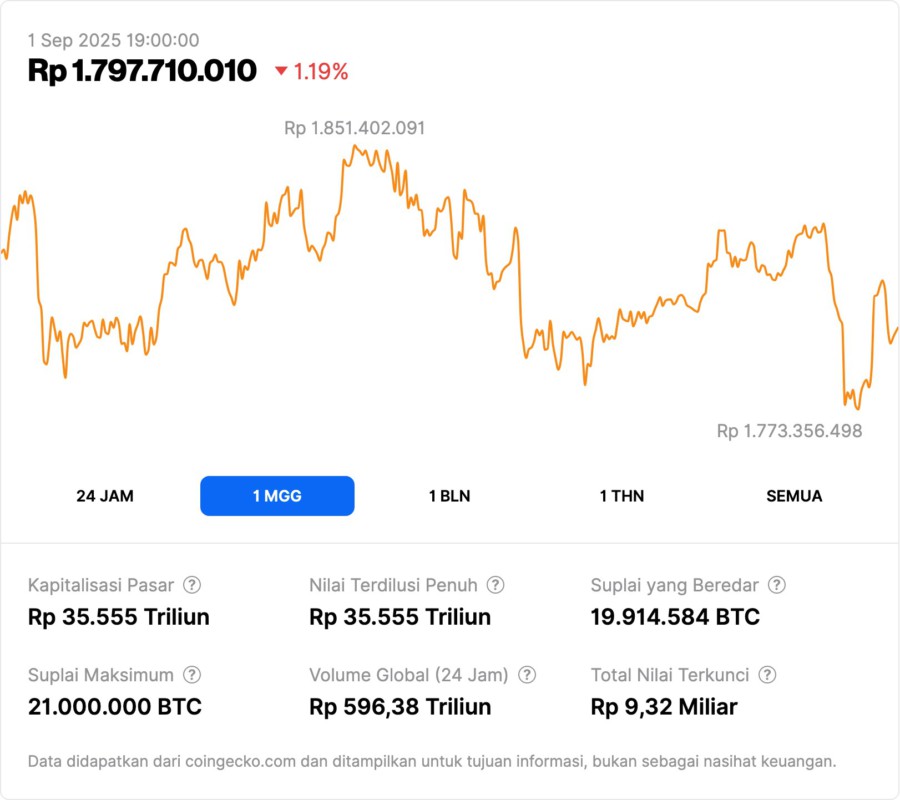

Jakarta, Pintu News – Last week, the price of Bitcoin (BTC) fell by around 4%. While high volatility is the norm for the cryptocurrency, the drop was still worrying for investors who had seen its price soar above $120,000 just two weeks earlier, only to fall back to $100,000.

Effect of Whale Buying and Selling

Last week’s Bitcoin (BTC) price drop was triggered by two main factors. The initial trigger was a sell-off by large Bitcoin (BTC) holders who have held onto their assets for a long time. According to on-chain analytics platform Lookonchain, these holders own more than 100,000 Bitcoin (BTC).

On Monday, they suddenly started selling their holdings on exchanges like Hyperliquid and switched to Ethereum (ETH). This sell-off lasted more than a day, causing the price of Bitcoin (BTC) to drop from around $114,000 to $108,600.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

Impact of AI Stocks on the Broader Market

Just as the market was stabilizing and Bitcoin (BTC) was recovering, a new, unexpected threat emerged. Leading companies in the AI and data center sectors, which have been the driving force behind the US stock market’s rise all year, issued disappointing second-quarter financial reports.

The report highlighted issues of high debt and declining profitability. This decline in AI stocks caused the Nasdaq to drop 1.32%, the biggest decline since the drop triggered by employment data on August 1. As Bitcoin (BTC) has shown a high correlation with the Nasdaq since June, its price fell 3.72%.

Bitcoin (BTC) Outlook Going Forward

With Bitcoin (BTC) still in a volatile state, market predictions are divided. Some analysts remain optimistic, predicting a quick recovery, while others fear a further drop to the $100,000 level.

Many expect the price to find support around $107,000, but some pessimists warn of a deeper correction to $92,000 if the decline continues. This pessimism comes as Bitcoin (BTC) has recently been less mobile compared to Ethereum (ETH), which continues to gain market attention.

Conclusion

With the events of the past week, it is evident that the price of Bitcoin (BTC) is now more tied to global liquidity and the US market at large than its own internal drivers. Investors are advised to remain vigilant during this period of potential high volatility.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. It Was a Tumultuous Week: What Drove the Price Drop. Accessed on September 1, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.