Top 3 ‘Made in USA’ Cryptos Gaining Attention This September

Jakarta, Pintu News – The crypto market looks set to close August on a positive note, despite still being below the psychological threshold of $4 trillion. Currently, the total market capitalization stands at $3.87 trillion, still not reaching the crucial threshold.

Traders are starting to pay renewed attention to September, driven by expectations of a possible interest rate cut that could boost interest in risky assets. In this context, US-made crypto coins are back in the spotlight.

While large tokens such as XRP (XRP), Solana (SOL), Cardano (ADA), and Chainlink (LINK) still dominate attention, there are three lesser-known yet potentially active US-made coins in September.

Stellar (XLM)

Stellar (XLM) will close August with a fairly weak performance, dropping 8.7% during the month and 12.7% in the past week. Despite this, XLM remains one of the US-made coins worth keeping an eye on in September.

Read also: 3 Biggest Crypto Gainers in a Month, Number 1 Up 113%!

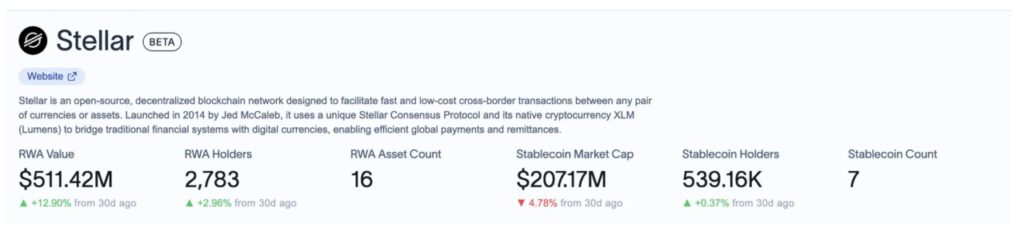

The main driver was the growth of real-world assets (RWA) on the Stellar network, which increased by 12.9% in the last 30 days and is now worth around $511.42 million. This makes Stellar one of the large-cap crypto projects that closed August with positive fundamentals.

To sustain this growth, higher transaction volumes are likely also required – a target that the Stellar Development Foundation is pursuing.

In an exclusive interview with the BeInCrypto website, Matt Kaiser, Stellar analyst at Messari, said:

“By the end of 2025, the Stellar Development Foundation aims for Stellar to have RWAs that generate $3 billion in returns on-chain, and to be one of the top ten DeFi networks based on Total Value Locked (TVL). This could create a sustained effect where the influx of institutional capital drives user engagement, ultimately increasing transaction volumes and ecosystem activity.”

Technically, Stellar is showing a short-term bullish signal. The 4-hour chart displays a hidden bullish divergence, where the price forms a lower low, but the RSI (Relative Strength Index) indicator forms a higher low – a positive momentum signal.

In addition, the Bull-Bear Power (BBP) indicator – which measures buying and selling pressure – is showing increasingly non-negative values, signaling that selling pressure is starting to weaken.

If this bullish pattern continues, XLM prices could potentially rise towards resistance levels at $0.36 and $0.37, with a signal invalidation limit below $0.35. If the price is able to break above $0.38, then this bullish signal will also be clearly visible on the daily chart.

Story (IP)

Story (IP), a layer-1 blockchain designed to placeintellectual property on-chain, has been one of the best performing projects this year.

The token briefly surged more than 30% on August 31, 2025, extending its three-month gain to 91%. On an annualized basis, Story (IP) has skyrocketed by more than 300%.

The token’s growth comes amid ongoing speculation regarding a possiblebuyback program, as well as after the announcement of the launch of the Grayscale Story IP Trust last month, which further strengthened the bullish narrative and pushed the token’s price to an all-time high just a few hours ago.

On the technical front, Story (IP) has successfully broken out of an ascending broadening wedge pattern – a pattern usually associated with a potential bearish reversal.

However, by breaking through the upper trendline, the IP price invalidated the bearish scenario and confirmed that the market forces are still on the buyers’ side (bullish).

This is also reinforced by the Bull Bear Power (BBP) indicator showing a rise, despite the price consolidating – a signal that hidden strength still exists ahead of September.

As of August 31, Story’s price was at $7.86, with immediate resistance at $8.23 and an all-time high (ATH) around $9.09. If the price manages to break through these levels, the token will re-enter the price discovery phase, opening up the opportunity to set a new price record in September. This solidifies Story’s position on the list of noteworthy US-made coins.

Read also: 3 Attention-grabbing Coin Memes in September 2025, Why?

On the other hand, this bullish pattern will be considered a failure if Story’s price drops below $6.84. The risk of a deeper drop could arise if the price falls below $5.45.

Pi Coin (PI)

Pi Coin (PI) has been one of the underperforming crypto assets in 2025. Over the past month, the token fell by 4.7%, although it had risen by 8% in the past week. But on an annualized basis, PI is still down more than 55%.

Currently trading at $0.38, the overall price structure still shows a bearish trend. Nonetheless, September could remain interesting for traders hunting for short-term price spikes.

There have been two developments that have brought PI back onto investors’ radars as one of the noteworthy US-made coins: the latest protocol update that added support for Linux nodes, as well as the launch of the Valour Pi Network ETP product as part of eight new products. Both of these have provided a slight momentum boost.

On the technical and on-chain front, several indicators support a potential short-term move. The Chaikin Money Flow (CMF) rose above zero for the first time in a while, indicating an inflow of funds into the asset.

If the CMF is able to break above 0.05, this will be a confirmation of stronger buying pressure. In addition, the Bull Bear Power (BBP) indicator has also turned positive, indicating growing bullish momentum.

If this momentum continues, PI prices could potentially rise towards $0.46 – a jump of more than 20% from current levels. However, if the price drops below $0.33, then there is a risk of a further drop to below $0.32.

For now, market conditions suggest that traders will likely utilize Pi Network forintraday or swing trading during September, rather than relying on it for a long-term recovery. It should be noted that Pi Coin’s overall price structure is still skewed in a bearish direction.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bullish Made in USA Coins to Watch in September 2025. Accessed on September 1, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.