3 Big Signals in the Crypto Market: SHIB Ready to Explode, XRP Threatened, Bitcoin Headed for a Downtrend?

Jakarta, Pintu News – The cryptocurrency market is in turmoil again towards the end of the third quarter of 2025. With Shiba Inu (SHIB) forming a technical pattern that could potentially trigger a surprise rally, XRP (XRP) starting to lose ground, and Bitcoin (BTC) dropping below key technical levels, investors are starting to wonder: is the bull market over?

This article summarizes three important signals based on the latest technical analysis, which can help you understand current market conditions.

1. Shiba Inu (SHIB) Ready for a Surprise Rally?

According to analysis from U.Today by Arman Shirinyan, Shiba Inu (SHIB) is forming a symmetrical triangle pattern-atechnical pattern known as a strong signal for price breakouts. SHIB is currently within this formation, showing increasing price pressure but decreasing volatility. This is often followed by sharp price movements.

Although SHIB is still below the 200-day moving average, which indicates a bearish long-term trend, the potential for a rally remains. If the price breaks the upper limit of this triangle pattern with large volume, the price of SHIB could shoot up to $0.0000130 or around Rp213,811 (at an exchange rate of 1 USD = Rp16,447). However, if the lower limit is broken, the price could drop back to the $0.0000115 area or around Rp189,141.

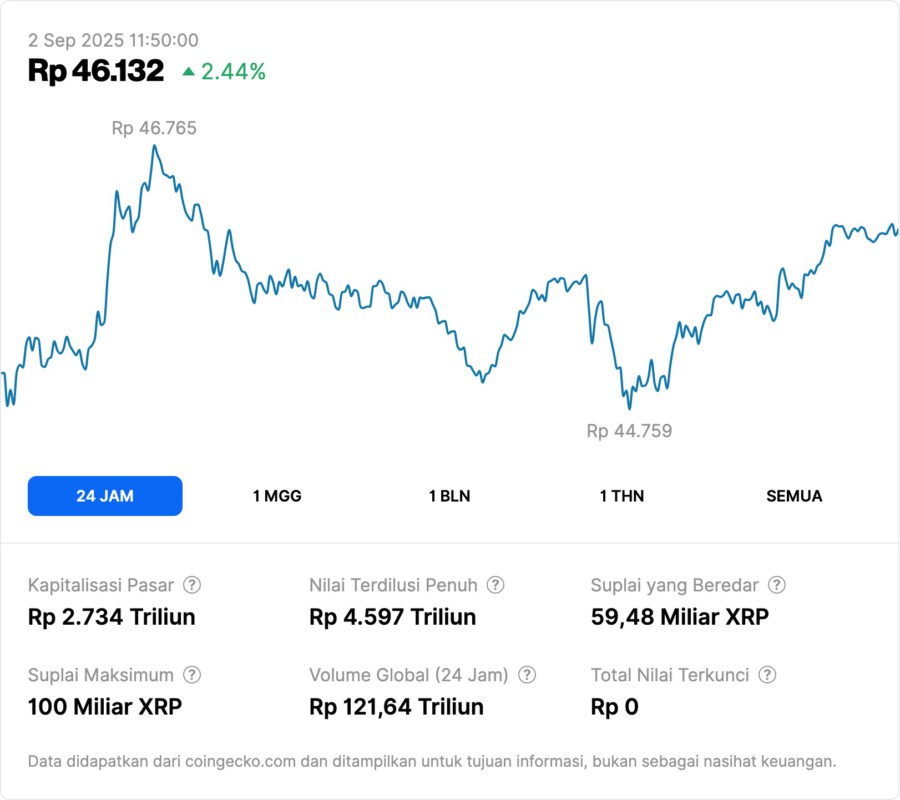

2. XRP Loses Momentum, Next Target Could Be Below IDR32,000

Things are different for XRP, which according to the same report, has broken out of a symmetrical triangle pattern and is now testing important support at the 100-day moving average. At the time of writing, XRP is trading at around $2.81 or around Rp46,226, and is approaching the crucial psychological level of $2.50 or Rp41,117.

If this support fails to hold, XRP risks falling towards $2.00 or €32,894, erasing most of the gains made over the summer. The declining trading volume suggests that not many buyers have stepped in to defend the current price level. This signals that XRP’s uptrend may have ended and could enter a medium-term bearish phase.

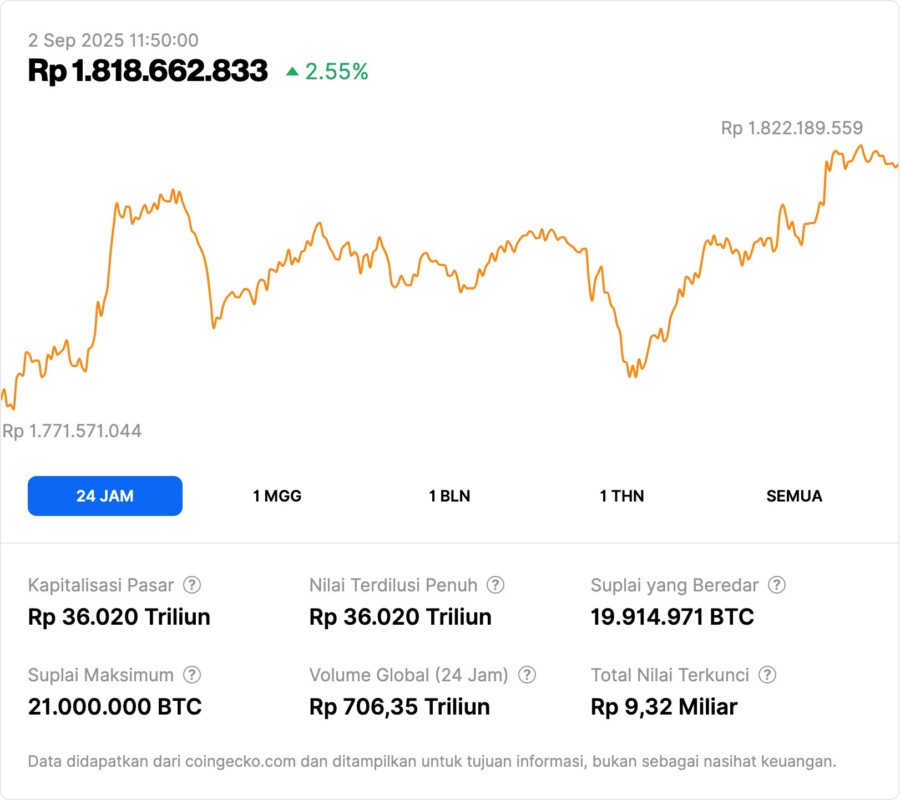

3. Bitcoin (BTC) on the verge of a major correction if it fails to recover

Bitcoin (BTC) is not spared from market pressure. After breaking through resistance above $120,000 or Rp1,973,640,000, BTC has now dropped below its 50-day Exponential Moving Average (EMA)-an important technical indicator to measure the strength of medium-term trends. This drop indicates a potential end to the bull market that has been going on for several months.

The next support level is the 200-day EMA, which is currently in the range of $104,000 or about Rp1,710,488,000. If BTC fails to hold this level, selling pressure is likely to intensify, with a downside target to the $106,000 – $104,000 range. However, there is still a chance of recovery if the price can break the resistance at $113 , 000 or Rp1,857,511,000 in the near future.

Also Read: Bitcoin Price Increase Prediction: Analyst Dave The Wave Reveals Potential Spike in September!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Arman Shirinyan / U.Today. Shiba Inu (SHIB) Surprise Rally Is Possible, XRP Expelled, Risks Losing $2, Bitcoin (BTC): Bull Market Is Over?. Accessed on September 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.