Ethereum Price Stays Around $4,300: Whale Activity and Chart Indicate Potential Momentum Shift!

Jakarta, Pintu News – Ethereum (ETH) is experiencing mixed momentum as whales continue to accumulate large amounts of assets. This shows the confidence of the whales, but the looming risk of liquidation raises concerns.

The next market movement could determine whether ETH stabilizes or experiences a further decline.

Then, how is Ethereum’s current price movement?

Ethereum Price Drops 1.05% in 24 Hours

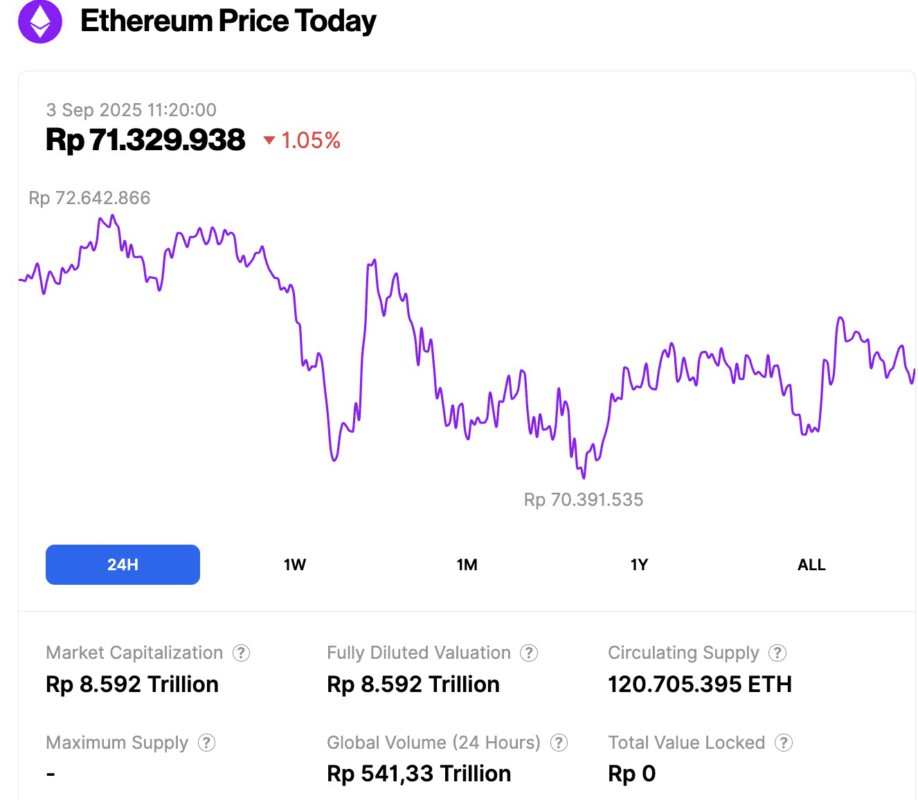

On September 3, 2025, Ethereum’s price was recorded at approximately $4,317, or IDR 71,329,938, marking a 1.05% correction over the past 24 hours. During this period, ETH reached a low of IDR 70,391,535 and a high of IDR 72,642,866.

At the time of writing, Ethereum’s market capitalization is around IDR 8.592 trillion, with a 6% increase in daily trading volume, reaching IDR 541.33 trillion over the last 24 hours..

Read also: Joseph Lubin, Chairman of SharpLink, Shares Bold Prediction: Can Ethereum (ETH) 100x?

Whale Buys $214 Million Worth of Ethereum

A well-known crypto analyst, Ash Crypto, noted that one of the big Bitcoin whales had bought 48,940 ETH for about $214.7 million.

This large accumulation shows that institutional buyers are still adding to their ETH holdings, despite the short-term sell-off. Typically, this kind of buying triggers speculation of a possible price reversal.

Threat of $7.87 Billion Ethereum Liquidation

On the other hand, another analyst named TED highlighted the high-risk status for Ethereum. He revealed that nearly $7.87 billion of ETH short positions could be liquidated if the price drops close to $3,800.

This means that a correction of about 13% from current levels could potentially trigger a massive wave of liquidation and create significant volatility in the market.

Ethereum’s prospects are also highly dependent on Bitcoin’s performance. Analysts predict that if the price of Bitcoin (BTC) falls below $100,000, ETH will struggle to stay above $4,000.

With a large accumulation of buyers and an increased risk of liquidation, ETH is now at a crucial point that could determine the direction of short-term market movements.

Read also: Dogecoin Sees Slight Increase Today: How High Could DOGE Climb?

Ethereum Weekly Chart Hints at Momentum Shift

Quoting the TronWeekly report, Ethereum’s RSI as of September 2 was at 66.11, slightly below the overbought threshold of 70, with the signal line at 61.81. This shows that ETH is still in a positive trend, but the buying impulse is starting to weaken slightly.

If the RSI continues to climb higher, overbought pressure could emerge and trigger a short-term correction. Overall, momentum remains bullish, albeit with signs of caution.

Meanwhile, the MACD indicator shows a blue line at 521.16, well above the signal line at 322.09, with a steady green histogram. This indicates ETH’s bullish trend is still strong.

However, the histogram is starting to narrow, which indicates the momentum is slowing down. If a crossover occurs, it could indicate weakening trend strength.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- TronWeekly. Ethereum Price Approaches $3,800 Risk Target Amid Growing Volatility. Accessed on September 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.