What Can We Expect from XRP’s Price in September 2025?

Jakarta, Pintu News – Reporting from BeInCrypto, XRP of Ripple has been trading under persistent selling pressure, moving in a descending parallel channel since August 2.

Although the altcoin has tried several times to break out of this bearish structure, market sentiment remains extremely negative, precluding any significant price movement to the upside. With balances on exchanges continuing to rise and selling activity intensifying, XRP (XRP) could potentially experience further losses this month.

XRP Struggles to Escape Pressure, Price Trapped in Decline

A descending parallel channel is formed when an asset consistently registers lower peaks and lower troughs between two parallel trend lines. This setup reflects a sustained decrease in buying pressure, where sellers continue to dominate bullish attempts to push prices higher.

Read also: XRP Price Prediction: Analyst Forecasts XRP to Surpass ETH as Ripple ETF Odds Hit 87%

Based on the XRP/USD one-day chart (2/9), it can be seen that the altcoin has been moving within this channel since August 2, reflecting the persistent selling that weighed on its price.

In recent weeks, the token has tried several times to break out of this bearish structure. However, each retest attempt has been met with strong selling, preventing a successful breakout and keeping XRP stuck in a downward trend.

XRP Faces Bearish Outlook as Holdings on Exchanges Increase

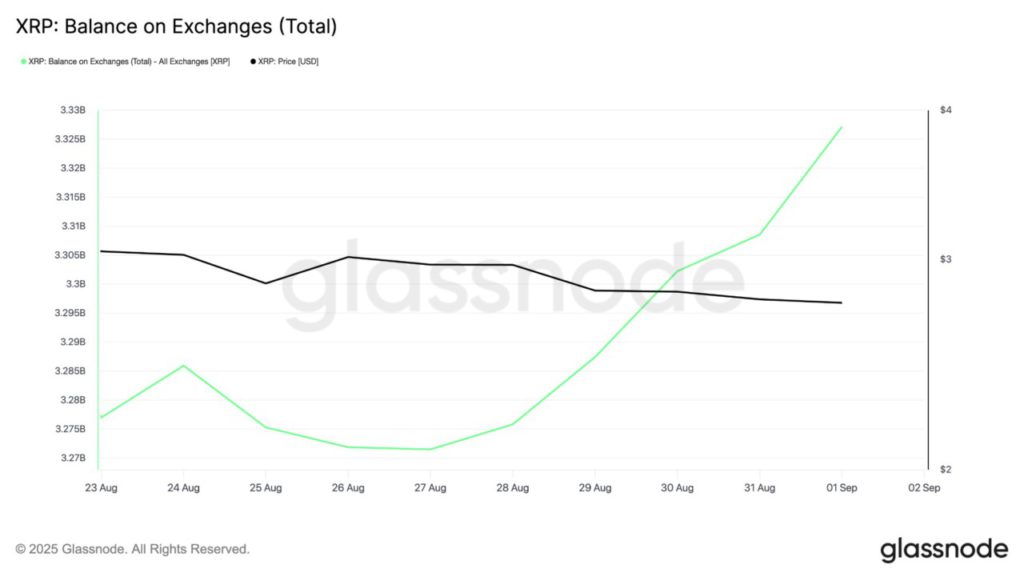

On the network, the increase in XRP balances on exchanges confirms the growing distribution among market participants. According to Glassnode, XRP reserves on exchanges have risen 2% since August 27, indicating increased profit-taking among token holders.

The XRP balance on an exchange measures the total amount of tokens held in the exchange’s wallet at any given time. When this balance rises, it indicates that investors are transferring tokens from their personal wallets to the exchange, often with the intention of selling.

As of September 2, 2025, a total of 3.32 billion XRP worth $9.3 billion was held in exchange wallet addresses. High exchange balances like this mean more liquidity is available for trading, which could push prices lower if demand for XRP cannot keep up.

In addition, the altcoin’s Moving Average Convergence Divergence (MACD) indicator setup supports the bearish outlook. On September 2, 2025, XRP’s MACD line (blue) was below the signal line (orange), and this position has persisted since July 25.

Read also: Analysts Say Shiba Inu is Eyeing 163% Upside, What’s the Reason?

The MACD indicator identifies trends and momentum in price movements. It helps traders to spot potential buy or sell signals through the crossover between the MACD line and the signal line.

When the MACD line of an asset is below the signal line, buying pressure has decreased, further supporting the possibility of a decline in XRP in the short term.

$2.63 Support in Focus as Bears Take Charge

Overall, XRP is at risk of falling to $2.63 if the selling pressure intensifies. If the bulls are unable to hold that support level, the price could plunge deeper towards $2.39.

However, XRP could experience a recovery and rise above $2.87 if buying interest reappears in the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What to expect from XRP Price in September. Accessed on September 4, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.