Solana Price Breaks $209 – Will ETF Optimism Push SOL to $233?

Jakarta, Pintu News – The price of Solana (SOL) is now continuing to record a positive trend. As of September 3, the token was trading at $209.77 after rising 3.48% in the last 24 hours.

The rise comes amid optimism regarding the potential approval of Solana spot ETFs in the US, with issuers such as VanEck and Franklin Templeton updating their filings to include staking features.

Analysts now estimate the likelihood of approval to reach 95% by October 2025, potentially triggering significant institutional demand.

In other positive news, Solana validators have approved the Alpenglow update with 99% support. This update will cut transaction finalization time from 12.8 seconds to just 150 milliseconds, putting Solana’s speed on par with Google searches, while strengthening its position as a high-performance blockchain.

Is DeFi’s Increased Liquidity a New Strength for Solana?

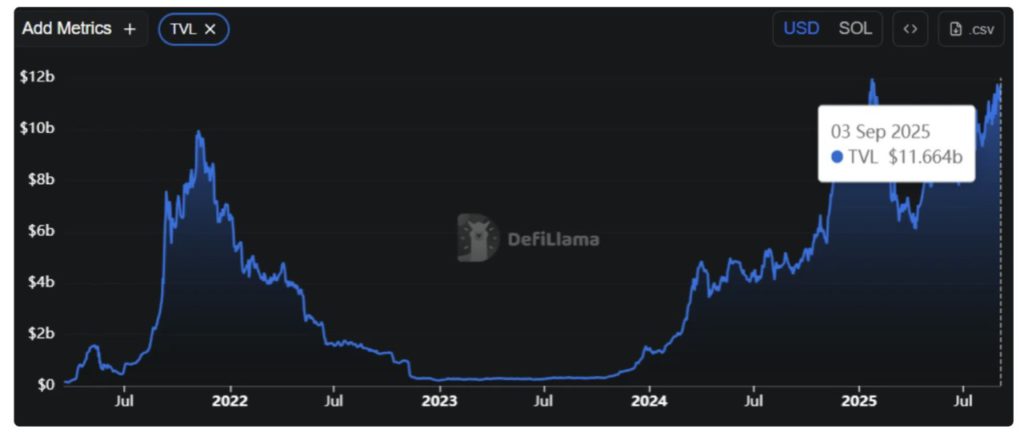

Solana’s on-chain activity continues to show strong growth, with TVL (Total Value Locked) reaching $11.66 billion on September 3, 2025, the highest level in more than two years.

Read more: As Solana’s Price Soars 100%, Falling Network Activity Raises Correction Concerns

This steady growth shows that more and more capital is entering the DeFi Solana ecosystem, including lending protocols, liquid staking, and decentralized exchanges.

This surge in TVL goes hand-in-hand with the price increase, confirming that Solana’s network fundamentals are improving in line with market sentiment.

As such, if the ETF approval is realized, institutional fund flows could further accelerate this growth, strengthening Solana’s position as a leading smart contract platform.

SOL Price Analysis

According to Coinpedia (3/8), SOL prices have successfully broken the 7-day SMA at $204.69 and the 30-day EMA at $192.23. The move above $210 triggered stop-loss orders and algorithmic buying, which pushed the price towards short-term resistance.

However, traders should note that the Fibonacci resistance at $204.52 could hold the bulls back temporarily.

Read also: Michael Saylor’s Strategy Firm Buys 4,048 Bitcoin for $449 Million!

On the upside, a close above $217.84 will pave the way for SOL to reach $233.19. Further, the next significant resistance is at $236, while the ATH (All-Time High) at $294.33 remains a long-term target, especially if the ETF approval attracts institutional fund flows similar to the Bitcoin ETF which has $142B AUM.

On the other hand, price support lies near the lower Bollinger band at $195 and $176.69, with deeper protection at $146.52 if the general market sentiment weakens.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Solana Price Breaks $209 – Can ETF Optimism Push SOL to $233? Accessed on September 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.