Ethereum Price Stays at $4,300 Today (Sept 4): With ETH Supply Shrinking, What’s Next?

Jakarta, Pintu News – Ethereum (ETH) is showing all the signs of a theoretical supply shock, with balances on exchanges at record lows, rapidly increasing staking demand, and growing institutional fund flows.

However, despite the increasingly limited supply, Ethereum prices have remained stable, leading analysts to debate whether retail selling is hiding one of the most bullish market conditions in recent years.

Then, how is Ethereum’s current price movement?

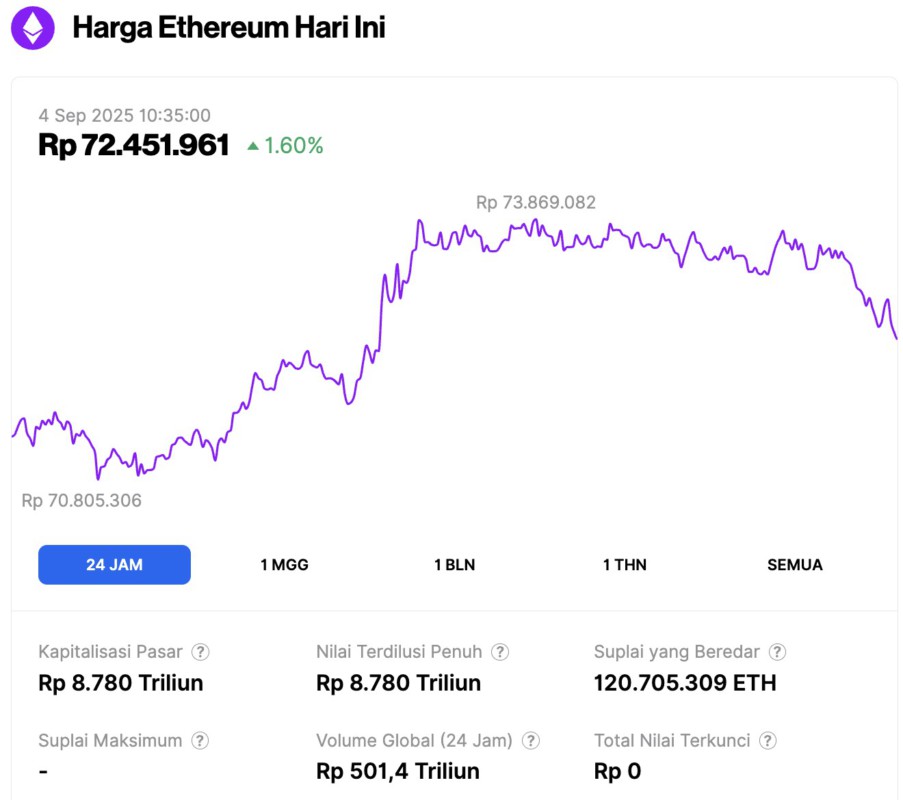

Ethereum Price Rises 1.60% in 24 Hours

On September 4, 2025, Ethereum’s price was recorded at approximately $4,398, or around IDR 72,451,961, marking a 1.60% increase in the last 24 hours. During this time, ETH reached a low of IDR 70,805,306 and a high of IDR 73,869,082.

As of now, Ethereum’s market capitalization stands at about IDR 8,780 trillion, with its daily trading volume dropping by 5% to IDR 501.4 trillion over the past 24 hours.

Read also: Solana Price Breaks $209 – Will ETF Optimism Push SOL to $233?

Ethereum Supply Declines While Bitcoin Increases

According to Crypto analyst Gucci, ETH reserves on centralized exchanges have dropped to a new low, while Bitcoin (BTC) balances on exchanges have surged to the highest level in recent months.

“Investors are hoarding ETH and selling BTC… an ETH supply shock is coming,” the analyst warned.

This divergence highlights the growing confidence in Ethereum’s long-term value proposition, even though its short-term price movements still lag behind.

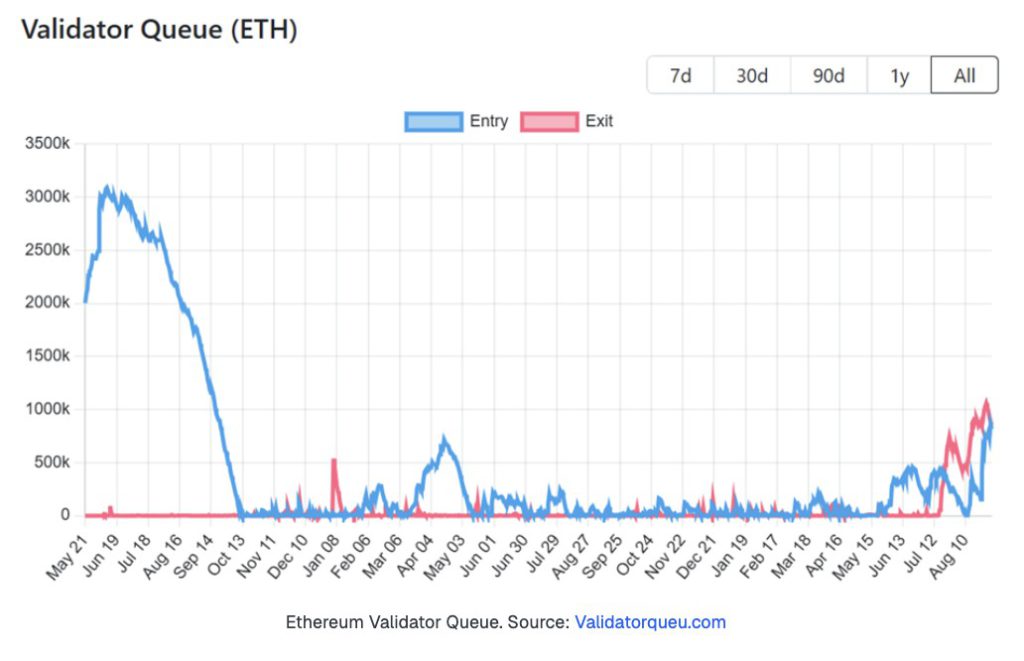

Meanwhile, on-chain data confirms that ETH is being locked in at historical levels. Specifically, the queue for Ethereum staking has surged to its highest level since 2023. Additionally, there are 860,369 ETH worth $3.7 billion currently waiting to be staked.

Everstake, a staking protocol, noted that this was the largest queue since the Shanghai update that allowed withdrawals two years ago.

“More people believe in the long-term value of Ethereum and want to participate in securing it,” the company said.

Everstake also points to institutional participation, favorable market conditions, and increased trust in the network.

Currently, more than 35.6 million ETH are already staked. This share, which accounts for 31% of the total supply, is worth about $162 billion.

Institutions and Cash Management Companies Buy Ethereum

Meanwhile, institutional interest is playing a very important role. Hasu analysts observed that nearly 10% of ETH supply is now owned by publicly traded vehicles, a milestone that reflects its widening adoption.

Tom Dunleavy, head of the venture division at Varys Capital, added that the cash management company has bought more than 3% of the total ETH supply in just two months. This shows a very fast pace of accumulation.

Read also: Whale Bitcoin OG Adds $1 Billion Ethereum Investment!

“It is striking that in less than 2 months, more than 3% of the total ETH supply has been purchased by cash management companies,” Dunleavy wrote.

The cash management company now holds 4.7 million ETH, valued at $20.4 billion, with most of it used for staking strategies.

This has helped push the validator queue to its highest level. At the same time, it has also reduced the risk of mass exodus, as the exit queue has decreased by 20% since August.

Retail Sales Meet Ethereum Whale Accumulation

Despite this positive flow, ETH was trading at $4,368 as of September 3. This price is down more than 12% from the all-time peak recorded on August 24, with analysts saying that retail sales are suppressing price momentum.

Defi Ignas noted that ETH holders in the 100-1,000 ETH range are selling, while whales with holdings of 10,000-100,000 ETH “are buying up quickly.”

This analyst mentions that this is the same pattern seen before every major ETH rally, where supply switches from weak hands to strong hands.

In the same way, Sigil Fund CIO Dady Fiskantes suggested that some investors may be rotating their spot ETH into Ethereum ETFs (exchange-traded funds) to reduce custody risk, similar to the flows seen in Bitcoin previously.

However, Ignas doubts the timing is right, which contradicts the view that ETH whales operate like large holders of Bitcoin. Some other analysts have a more bullish view.

“…liquidity coming out of retail is always a trigger fuel. Once they are fully out, ETH will surge. A flat price is a bullish signal,” Tradinator analysts said.

Analysts argue that the fundamentals are ripe for an explosive move. Ethereum’s price is caught between strong institutional accumulation and ongoing retail selling, with exchange reserves at record lows and staking queues reaching record highs.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Faces Supply Shock-So Why Is the Price Still Flat? Accessed on September 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.