5 Strong Crypto Predictions for Q4 2025, If Fed Lowers Interest Rates!

Jakarta, Pintu News – In the next few weeks, the crypto market is expected to enter an interesting period, especially if the Federal Reserve (Fed) decides to cut interest rates. This was stated by Crypto.com CEO, Kris Marszalek, who is optimistic about the performance of the crypto market in the fourth quarter (Q4) of 2025.

These predictions come after statements from Jerome Powell, the Fed Chair, who gave more dovish signals regarding monetary policy. Here are five key predictions for the crypto market at the end of 2025.

1. Fed Rate Cut Boosts Liquidity for Risky Assets

According to Crypto.com CEO, Kris Marszalek, if the Fed decides to lower interest rates at its September 2025 meeting, then the crypto market could see a significant surge in liquidity. Crypto and other risky assets are likely to benefit greatly from this rate cut. This will open up more room for institutional investors to enter the crypto market, which is expected to fuel the price rally of Bitcoin (BTC) and Ethereum (ETH).

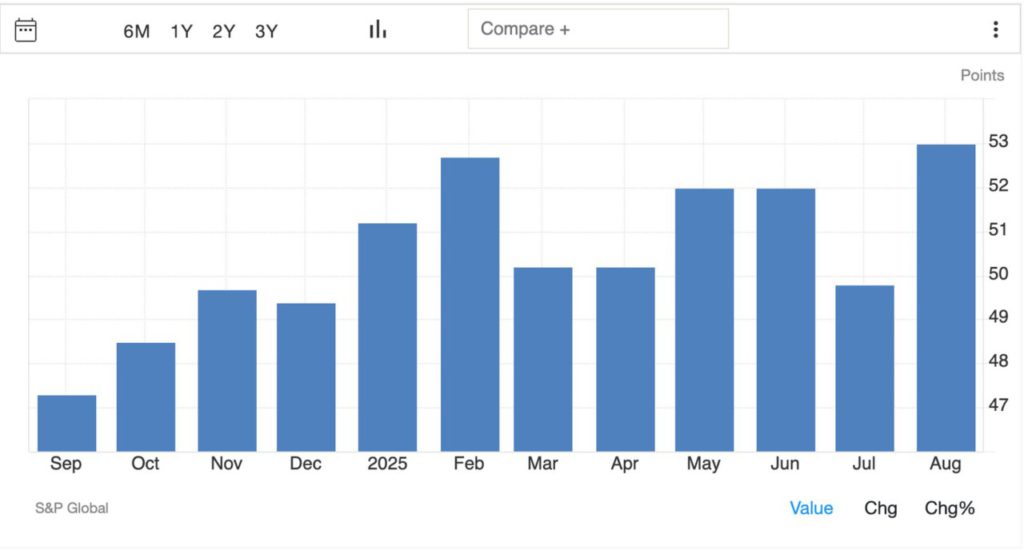

Through comments quoted from a Bloomberg interview, Marszalek mentioned that a rate cut could create a more favorable market for crypto, with more capital available to play in the sector. Based on data from CME Futures, the market estimates that there is a 90% chance that the Fed will reduce interest rates by 0.25% in the near future.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

2. Crypto Market Predictions: Bitcoin (BTC) and Ethereum (ETH) Head for New Peaks

By 2025, analysts believe that Bitcoin (BTC) could register a new higher price. Despite market volatility throughout the year, some analysts predict Bitcoin (BTC) will return to near all-time highs around the $100,000 mark. Ethereum (ETH) is also expected to see significant gains, with prices projected to surpass the $5,000 mark.

Some of the factors supporting this bullish prediction are growing institutional adoption, further development of Ethereum technology, as well as growing interest in DeFi (Decentralized Finance). However, it is important to remember that the crypto market remains volatile, and these price movements are highly dependent on global monetary policy and financial market conditions.

3. Cooperation with Trump Media Increases Crypto Legitimacy

One factor that could potentially influence the crypto market is the partnership between Crypto.com and Trump Media and Technology Group. In an announcement made in August 2025, Crypto.com revealed that they have entered into a partnership with Trump Media to develop a treasury strategy for their native token, Cronos (CRO). This could increase the use of crypto in various sectors and attract more investors.

The partnership will also include the development of crypto-based payment infrastructure and services, which is expected to expand the adoption of blockchain and crypto technology in the mainstream market. Although there are some concerns about potential conflicts of interest, as Trump’s assets are held in a blind trust, Crypto.com’s role as an independent company is expected to bring a positive impact to the sector.

4. Growing Demand for Blockchain-Based Assets

With the growing adoption of blockchain in various industry sectors, the demand for crypto and blockchain-based assets is expected to continue to rise. Many large corporations are starting to see crypto as an investment alternative, and the use of blockchain in terms of transactions and data verification is becoming more widespread.

For example, projects that integrate blockchain for transaction security and transparency will be in the spotlight by 2025. One of these is the tokenization of real-world assets (RWAs), which is growing in popularity and offers great potential to bridge the traditional and digital worlds. Investors see great opportunities in the tokenization of property and other financial products.

5. Anticipation for Popular Crypto and NFT Airdrops

As Q4 2025 approaches, many anticipate massive airdrops from new crypto and NFT (Non-Fungible Tokens) projects. Airdrops are an effective way for new projects to attract users and increase community participation. Many cryptos will launch airdrop programs in the fourth quarter, and this could provide an opportunity for traders to get free tokens.

Moreover, the NFT market is expected to continue growing, with more creative projects involving artists and collectors. NFTs are now not just limited to digital art, but also extend to sports collectibles, music, and various other industries. Users interested in the world of NFTs can take advantage of airdrops or purchase popular NFTs that are on the rise.

Conclusion

Looking at the predictions, 2025 looks to be a year full of potential for the crypto market. Interest rate cuts by the Fed could increase liquidity for risk assets, while crypto and blockchain are expected to continue to cement their position as an increasingly accepted alternative asset class. For investors or traders interested in the crypto market, following these developments wisely and always doing your research is crucial.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Anas Hassan. Crypto.com CEO Predicts Strong Q4 if Fed Cuts Rates at September Meeting. Accessed September 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.