Bitcoin Hits $111,000 Today (4/9/25): Will BTC Bounce Back to $115K?

Jakarta, Pintu News – Bitcoin (BTC) has experienced a significant decline since reaching its highest level this year. The cryptocurrency briefly dropped below $110,000, raising fears of continued bearish pressure.

However, recent data suggests that this movement is more of a short-term fluctuation rather than the beginning of a long downward trend, indicating a potential recovery.

Then, how is the current Bitcoin price movement?

Bitcoin Price Drops 0.25% in 24 Hours

On September 4, 2025, the price of Bitcoin was recorded at $111,208, which is equivalent to IDR 1,823,403,042, reflecting a 0.25% correction in the last 24 hours. During this period, BTC reached a low of IDR 1,819,874,399 and a high of IDR 1,849,706,526.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 36.422 trillion, with trading volume over the past 24 hours dropping by 21% to IDR 573.15 trillion.

Read also: Dogecoin Sees Modest Price Increase Today: DOGE Launches $175 Million Treasury!

Is Bitcoin Safe?

Signs of risk in the Bitcoin market are starting to subside. According to Bitcoin Vector, the Risk-Off Signal is retreating, moving towards low risk conditions. This change indicates that market conditions are starting to stabilize after several weeks of volatility.

At the same time, Bitcoin has managed to break out of the price compression that it has been in since reaching an all-time high of $124,500. The price recovery at $110,000 confirms the end of this compression zone.

With resistance weakening, BTC now has room to move higher, increasing the chances of a recovery in the next few weeks.

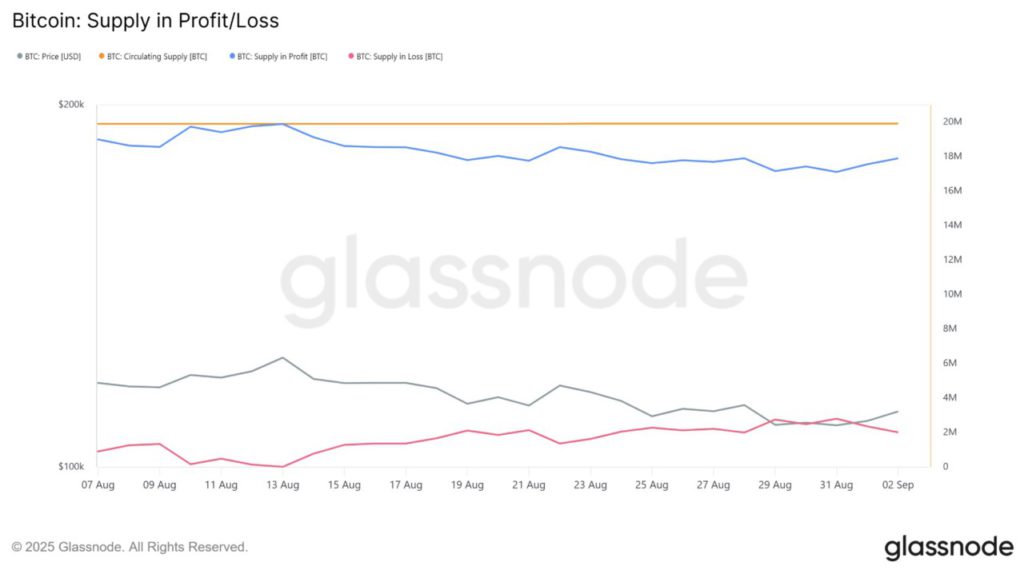

On-chain data supports this view. Of the 19.91 million BTC in circulation, only about 2.73 million coins are currently lost. This represents only 13.71% of the total supply, well below the threshold typically associated with bear markets, where losses typically exceed 50% of Bitcoin in circulation.

This shows that Bitcoin is still far from capitulation territory. Despite the recent price drop, the majority of holders still recorded profits, showing resilience.

The limited supply at a loss reflects investors’ strong conviction, indicating that BTC has a solid foundation to withstand selling pressure and maintain upward momentum in the near future.

Read also: Hashgraph Group Launches TransAct: A Crypto-Free Transaction Solution for Enterprises

BTC Price to Continue its Rise

On September 3, Bitcoin was trading at $111,600, slightly below the $112,500 resistance level. The asset managed to rebound from $108,000 earlier this week, showing renewed strength.

Holding above $110,000 provides stability, giving BTC the foundation it needs to attempt further recovery amidst existing market pressures.

If the current momentum holds, Bitcoin is likely to continue rising. A breakout above $112,500 could pave the way towards $115,000, reinforcing the bullish sentiment. This move would confirm an improvement in the market structure and indicate a new recovery attempt.

However, risks remain if selling pressure returns. If Bitcoin fails to maintain momentum, a drop back to $110,000 is possible.

In a deeper correction, the price could return to $108,000, raising concerns among investors regarding potential short-term weakness.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Correction, Not Capitulation: Bitcoin Price Recovery To $115,000 On The Cards. Accessed on September 4, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.