SharpLink Grows Its Ethereum Treasury to 837,230 ETH, Valued at Nearly $3.6 Billion!

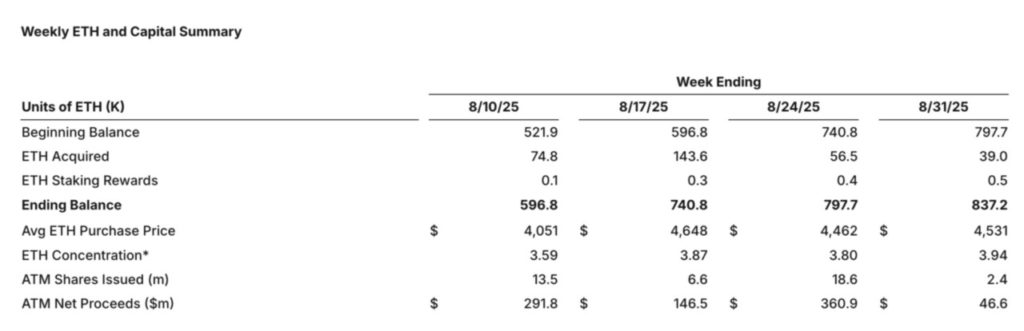

Jakarta, Pintu News – SharpLink Gaming (SBET) revealed that it had purchased over $176 million in Ethereum (ETH) in the last week of August. These purchases increased their total holdings to 837,230 ETH, which was valued at nearly $3.6 billion on August 31.

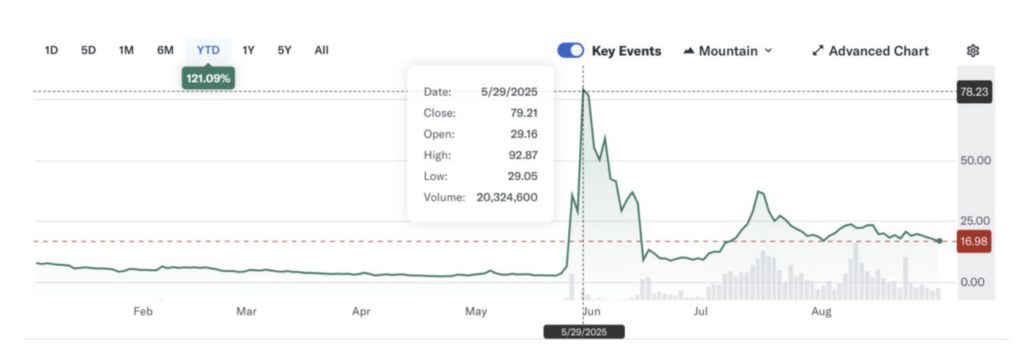

While their ETH strategy attracted attention, the company’s stock performance didn’t provide much excitement for investors, especially as September started with a reduced risk appetite for stocks and other volatile assets.

SharpLink’s $176 Million Ethereum Buyout

SharpLink, a Minnesota-based company, purchased 39,008 ETH between August 25 and August 31 at an average price of $4,531. These purchases were partially financed through an at-the-market (ATM) equity program that raised $46.6 million.

Read also: Jack Ma’s Yunfeng Financial Acquires $44 Million Worth of Ethereum Amid Web3 Push!

SharpLink reported that its ETH concentration ratio – which measures digital assets relative to cash – jumped to 3.94, almost doubling since early June. At this level, the company has nearly four dollars in ether for every dollar of cash held, assuming full deployment of the remaining $71.6 million in liquidity.

Cumulative staking rewards have reached 2,318 ETH since the company launched its treasury strategy using Ethereum on June 2.

Co-CEO Joseph Chalom said, “We continue to execute our treasury strategy with precision, increase our ETH holdings, and continue to earn staking rewards. We remain opportunistic in our fundraising initiatives and will monitor market conditions closely to maximize shareholder value.”

SharpLink’s transformation into an Ethereum treasury vehicle accelerated in May following a $425 million private investment round led by Consensys, Galaxy Digital, ParaFi Capital, Ondo, and Pantera Capital.

That same month, Consensys founder Joseph Lubin was appointed Chairman, solidifying the company’s shift in focus from gambling marketing technology to this direction.

Stock Fluctuations as Ethereum’s Treasury Rises

Despite aggressively buying ETH, SharpLink (SBET) shares continue to experience volatility. On Tuesday (2/9), SBET’s share price was trading at $16.98, down nearly 5% on the day, even though the stock has risen more than 400% since mid-May, when its share price was below $3.

Read also: Toyota and Avalanche Collaborate to Launch Blockchain-Based Robotaxis in Japan!

On the same day, BitMine Immersion Technologies (BMNR), which also implements an Ethereum-based treasury strategy, revealed that it has approximately 1.87 million ETH – the world’s largest corporate Ether treasury – and is trading at $42.49, down 2.59% compared to the previous day.

Meanwhile, the price of Ethereum was trading at $4,343, up 0.3% from the previous 24 hours, although it is down about 11.4% since its peak of $4,900 on August 24.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. SharpLink Expands Ethereum Treasury to 837,230 ETH. Accessed on September 4, 2025

- TronWeekly. SharpLink Adds $177 Million in Ethereum, Total ETH Stash Nears $3.6B. Accessed on September 4, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.