5 Important Facts About the Movement of Bitcoin (BTC) and Gold in Early September 2025

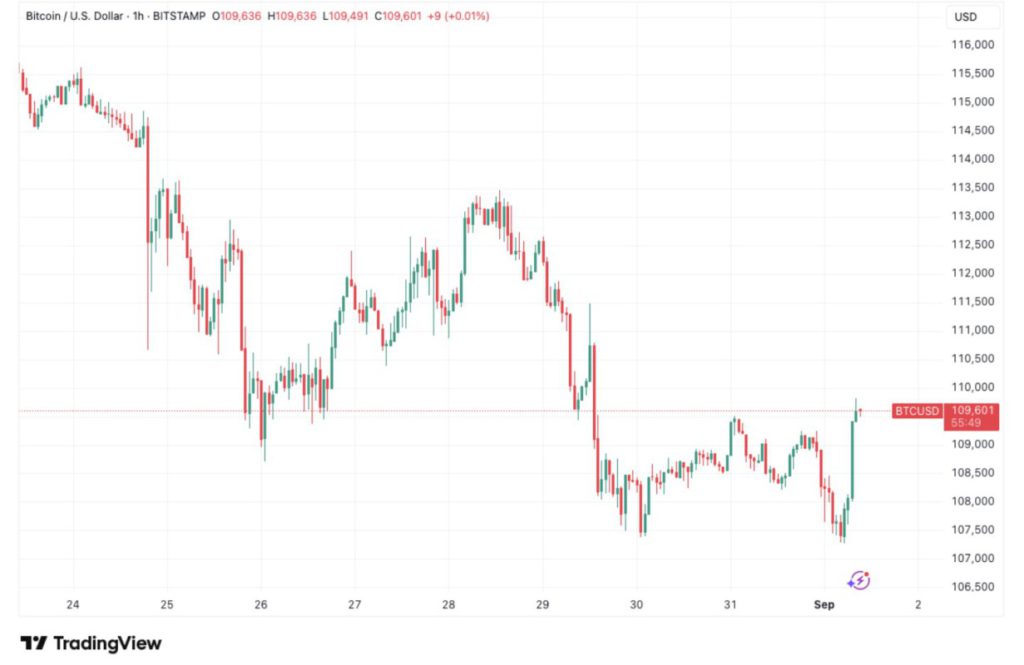

Jakarta, Pintu News – The crypto market entered September 2025 with a stressful start. Bitcoin (BTC) slipped to a local low of Rp1.76 billion ($107,270) before rebounding to around Rp1.82 billion ($111,000).

Gold, on the other hand, has performed impressively, approaching an all-time record price. This begs the big question: will September be the worst month for cryptocurrencies yet again?

Bitcoin Under Pressure in Early September

Bitcoin (BTC) started the week with a sharp decline, hitting a weekly low of Rp1.76 billion ($107,270). Despite rebounding to IDR1.82 billion ($111,000), selling pressure is still strong, especially amid low volatility due to the Labor Day holiday in the United States.

Some traders see the Rp1.64 billion ($100,000) area as an important psychological level that could potentially be retested. Some analysts even see the possibility of a deeper drop to IDR1.54 billion ($94,000) to close the CME gap in the lower area. However, there is also a view that this pressure is just a “deviation” before prices rally back towards IDR1.92 billion ($117,000).

Macro Uncertainty: Tariffs and Fed Rates

Global markets were also shaken by a court ruling regarding former President Donald Trump’s import tariff policy. This decision created new uncertainty in financial markets, including crypto. Trump himself emphasized that he would fight for the tariffs to remain in place to protect the US economy.

Also read: How much BTC does it take to become a trillionaire? The Complete Calculation!

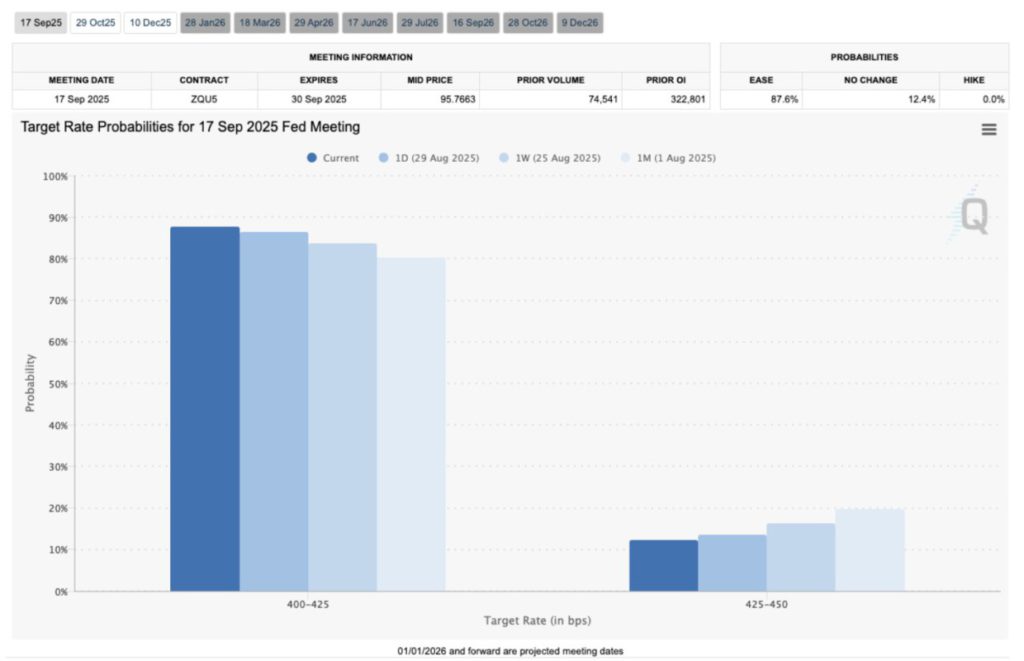

In addition, investors are now waiting for US employment data as a key consideration for the Fed in determining the direction of interest rates. The market estimates the chance of a 0.25% rate cut on September 17 at more than 90%. If it does happen, the cut could add liquidity and encourage capital inflows into riskier assets such as cryptocurrencies.

Gold nears record, Bitcoin weakens

While Bitcoin (BTC) and altcoins struggled, gold prices skyrocketed to IDR 57.3 million ($3,489) per ounce. This increase brings gold closer to the all-time record high recorded in April 2025.

According to Mosaic Asset analysts, gold’s rise this time was driven by higher-than-expected PCE inflation data, as well as the seasonal trend of September being a bullish month for gold. Peter Schiff, a Bitcoin critic, asserts that the current rally in gold and silver is a bearish signal for cryptocurrencies.

Institutional Investors Begin to Withdraw

Data from Farside Investors recorded an outflow of IDR2.08 trillion ($126.7 million) from the US spot Bitcoin ETF last Friday. Whereas earlier in the week it had shown positive signs with accumulation from large investors.

Also read: Bitcoin Will Drastically Drop to $10,000? Bloomberg Senior Warns!

More broadly, August was the month with the second-largest Bitcoin ETF outflows in history, reaching IDR 12.3 trillion ($750 million). Capriole Investments data also showed that institutional purchases of Bitcoin fell to the lowest level since April 2025. However, the combined institutional demand is still equivalent to 200% of the new supply miners generate every day.

September, the hardest month for Bitcoin?

Historically, September is known as the worst performing month for Bitcoin (BTC). BTC’s average monthly return in the last 12 years in this month is -3.5%. In fact, August 2025 was the first red month after the halving, adding to investors’ concerns.

However, there are analysts who think this time is different. Mark Harvey, an investor, mentioned that Bitcoin’s pattern no longer follows the traditional halving cycle, especially with increasing institutional adoption. This opens up the possibility that despite the pressure September brought, the crypto’s long-term trend is still positive.

Conclusion

The crypto market, particularly Bitcoin (BTC), faced a tough test in September 2025. Macro uncertainty, institutional outflows, as well as the gold rally are adding pressure to the price.

However, optimism remains that the new liquidity from the rate cut and the potential for large investor accumulation could be positive catalysts going forward. With high volatility, September once again proved to be a crucial month for cryptocurrencies.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. BTC vs. ‘very bearish’ gold breakout: 5 things to know in Bitcoin this week. Accessed September 5, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.