Chances of 50 BPS Fed Rate Cut Increase Ahead of Inflation Data, Here’s the Data!

Jakarta, Pintu News – Markets are starting to factor in the possibility of a 50 basis points (bps) cut in the Federal Reserve (Fed) interest rate in the upcoming FOMC meeting. This comes ahead of the release of CPI and PPI inflation data next week, which could influence the Fed’s decision.

Increased Chance of Fed Rate Cut

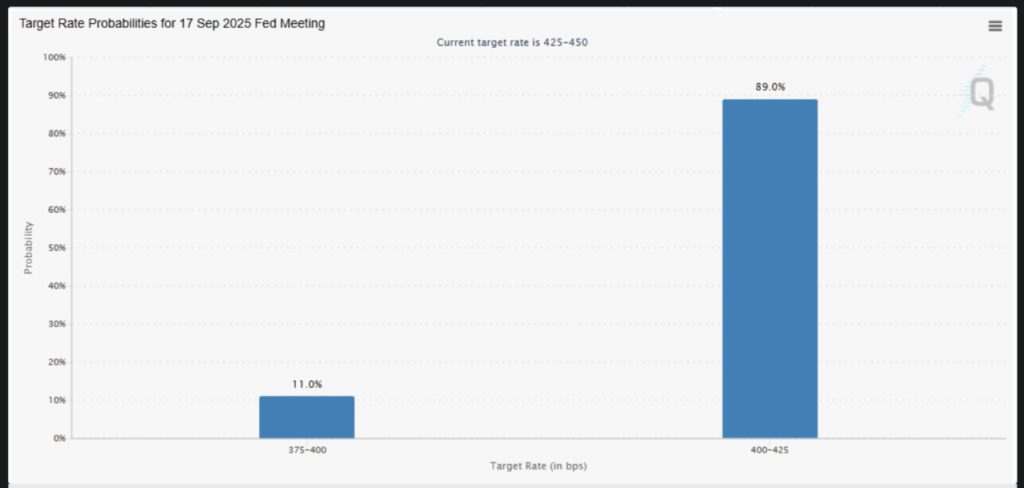

Data from CME FedWatch shows an 11% chance that the Fed will cut rates by 50 bps at the upcoming FOMC meeting. This comes ahead of the release of PPI and CPI inflation data by the Labor Department on September 10 and 11.

This opportunity began to be priced in by traders after the release of US jobs data that showed only 22,000 jobs added in August, well below expectations of 75,000. Meanwhile, the unemployment rate rose to 4.3%, close to a four-year high.

Also read: BTC vs. Gold: Where Are the Prices of the Two Assets Going?

Market Reaction to Labor Data

This latest labor data suggests that the labor market is starting to weaken and the Fed needs to adjust its monetary policy. Jerome Powell has signaled in the Jackson Hole conference that a Fed rate cut may be necessary with rising risks in the labor market.

However, the Fed also has a mandate to keep inflation stable, which is why the upcoming PPI and CPI data will be key in their decision on the rate cut at the September 17 meeting.

Also read: What Can You Do If You Own Crypto in 2025?

Waiting for Inflation Data Before Making Decisions

According to a Bloomberg report, Federal Reserve Bank of Chicago President Austan Goolsbee said that he has not yet decided on the course of action he will support during the upcoming FOMC meeting. He stated that he wants to get more information, referring to next week’s inflation data.

Meanwhile, Fed Governor Chris Waller has stated that they need to make a rate cut at the September 17 meeting. Waller is not worried about the inflation side and warned that they need to get ahead of the sharp slowdown in the labor market.

Conclusion

With disappointing jobs data and the chances of a rate cut increasing, financial markets may see a significant change in Fed policy. The decision to be made at the upcoming FOMC meeting will not only be influenced by the latest inflation data, but also by the changing labor market conditions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. September 50 BPS Fed Rate Cut Odds Climb Ahead of CPI, PPI Data. Accessed on September 8, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.