Drastic Drop in NFT Sales, Yet CryptoPunks Still Survives?

Jakarta, Pintu News – The non-fungible token (NFT) market experienced another sharp decline with total sales volume dropping by 22.65% to $104.5 million. This decline occurred despite the general recovery of the crypto market. Although the number of NFT buyers and sellers increased, the transactions that took place decreased, signaling the complex dynamics within the current NFT market.

Check out the full information in this article!

Ethereum Leads the Market with $37.7 Million in Sales

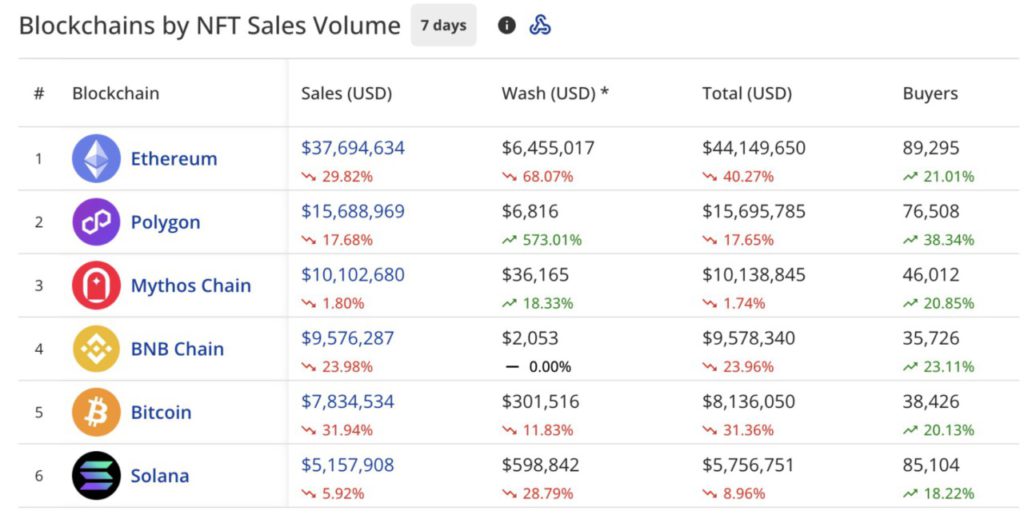

Ethereum (ETH) continued to lead the market with sales reaching $37.7 million, despite a 29.88% drop from the previous week. This decline coincided with a massive drop in wash trading on Ethereum, which fell by 68.03% to just $6.4 million.

Meanwhile, Polygon (POL) managed to hold on to second place with sales of $15.7 million, despite also experiencing a 17.43% drop. On the other hand, Mythos Chain managed to take third place with sales of $10.1 million, only down by 1.73%.

BNB Chain (BNB) and Bitcoin (BTC) took fourth and fifth place with sales of $9.5 million and $7.8 million respectively, showing a significant decline. Solana (SOL) came in sixth place with sales of $5.1 million, down 6.81%.

Also read: Michael Saylor: The Bitcoin Investment Strategy that Beat the S&P 500

CryptoPunks Sales Up 4.73%

CryptoPunks, one of NFT’s most iconic collections, managed to show positive growth with sales of $8 million, up 4.73%. This indicates that some NFT collections are still able to survive and even grow amidst the sluggish market.

DMarket and DKTNFT also showed mixed dynamics, with DMarket declining while DKTNFT grew. Panini America, a digital sports card collection, made it into the top five with sales of $3.1 million, a significant increase of 46.16%.

This shows that there is a growing interest in digital trading cards. Meanwhile, Guild of Guardians Heroes saw a sharp decline of 27.50%, indicating that not all of NFT’s game collection can survive in the current market conditions.

Read also: Investors Withdraw Large Funds from Ethereum ETFs, What’s the Impact?

Number of NFT Buyers Increases

Although the overall NFT market is on the decline, the number of buyers and sellers continues to increase. This shows that interest in NFTs has not completely dimmed, but the market may be undergoing a correction.

Buyer growth on Polygon reached 38.34%, followed by BNB Chain with 23.11% and Ethereum with 21%. Polygon’s Courtyard collection still leads the ranking with $14.6 million in sales, although it fell by 17.41%.

This collection experienced a huge growth in the number of sellers, rising by 333.68%, while the number of buyers actually fell by 18.39%. This shows that the dynamics of the NFT market are highly volatile and influenced by various factors.

Conclusion

With the ever-changing market conditions, it is important for NFT investors and enthusiasts to constantly monitor the latest developments. While some collections have shown growth, many have also seen declines. The success of CryptoPunks and some other collectibles shows that there is still room for optimism amidst market uncertainty.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. NFT Sales Nosedive $104.5M, CryptoPunks Sales in Green. Accessed on September 9, 2025

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.