BTC Hits $113K Today, Hinting at a Possible Symmetrical Triangle Breakout

Jakarta, Pintu News – As reported by Coingape, the price of Bitcoin (BTC) is still moving in an ascending symmetrical triangle pattern, which hints at a potential breakout in the near future. Speculation is getting stronger along with the possibility of interest rate cuts by the Fed, so market attention remains focused on this crypto asset.

The combination of technical and macro factors are starting to align, creating expectations of the next big move.

Bitcoin Price Rises 1.98% in 24 Hours

On September 11, 2025, Bitcoin was trading at $113,855, equivalent to IDR 1,869,867,718, marking a 1.98% gain over the past 24 hours. Within that timeframe, BTC dipped to a low of IDR 1,831,519,407 and climbed as high as IDR 1,879,325,132.

At the time of writing, Bitcoin’s market capitalization is estimated at IDR 37,326 trillion, while its 24-hour trading volume has surged 19% to reach IDR 843.9 trillion.

Read also: Altcoin Season Index Reaches Level 55: 3 Altcoins to Watch

Bitcoin Price Action Leads to a Potential Symmetrical Triangle Breakout

As of September 10, Bitcoin price was trading around $112,236, still moving in an ascending symmetrical triangle pattern. The lower support trend line holds strong around $107,304, while resistance is at the $117,156 area, which coincides with the 0.618 Fibonacci level.

If the price is able to break the resistance, it could confirm the continuation of the bullish trend and push BTC towards the target of $123,731, as per the projected Fibonacci 1.0 extension.

Furthermore, the chart also shows the next important level at $133.882 at the 1.618 Fibonacci extension. However, consolidation remains likely, with a potential correction to the midpoint of the triangle as a form of “healthy reset” in the uptrend.

The RSI indicator is at 49.75, higher than the signal line at 43.98, which supports a bullish bias according to the chart structure.

If the momentum continues, expansion higher remains open, with the 2,618 Fibonacci level at $150,309 reinforcing the positive long-term outlook for Bitcoin price. The resolution of this triangle pattern will determine whether BTC is capable of setting new record highs towards the end of the year.

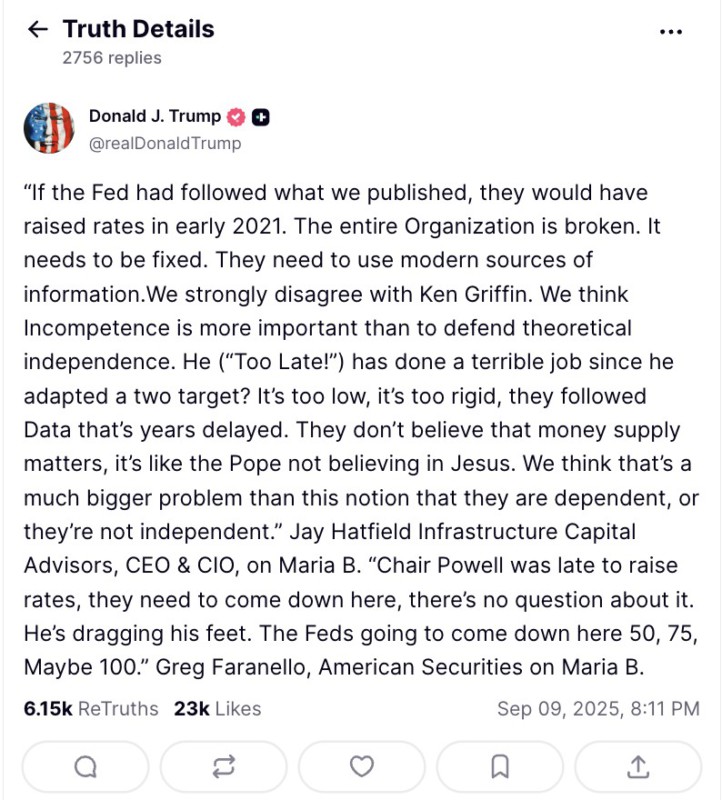

Trump’s Call for 100 BPS Rate Cut Shifts Market Focus

Donald Trump reignited the monetary policy debate by urging the Federal Reserve to cut interest rates by 100 basis points ahead of the FOMC meeting.

Read also: 5 Altcoins That Are Garnering Attention Right Now, Based on Binance Netflow Metrics

He criticized Jerome Powell for acting too late, in line with the views of Greg Faranello and Jay Hatfield who think the Fed is still relying on outdated indicators.

According to Trump, a rigid inflation target of 2% leaves little room for policy and exacerbates economic pressures. The weak August labor report-just 22,000 new jobs compared to a projected 75,000-and the 4.3% unemployment rate, a four-year high, further strengthened the argument for aggressive easing.

While the market still expects the Fed to only cut rates by 25 bps next week, Trump’s stance has heightened speculation. The call for repeated cuts in the coming months has also attracted attention, with some even suggesting the move could indirectly support Bitcoin prices.

The bullish sentiment was further strengthened after Metaplanet announced plans to use $1.4 billion from the capital increase to buy Bitcoin, thus expanding its digital asset reserves.

Amidst uncertainty, BTC price remains highly sensitive to macro factors and institutional movements. Currently, Bitcoin is preparing for a breakout from the ascending triangle pattern, with targets well above $130,000.

If the resistance breakout is confirmed, BTC has the potential to surge towards $150,000, supported by a combination of bullish technical analysis and macro narratives, including Trump’s aggressive push against the Fed.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Price Prediction Eyes $150K as Trump Calls for Aggressive 100 BPS Rate Cut. Accessed on September 11, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.