Cardano (ADA) Soars! Here’s a Projection to $0.95 in September 2025

Jakarta, Pintu News – In recent trading, Cardano (ADA) showed strong signals of continuing its positive trend. After successfully breaking out of a descending wedge pattern, ADA is now sitting at $0.89, breaking through important resistance at $0.86. Technical indicators and a bullish market structure add to the confidence that ADA could reach its next price target of $0.95.

Encouraging Breakout Pattern

Cardano (ADA) recently confirmed a breakout from a descending wedge pattern, which often signals a change in momentum after a long period of consolidation. This rise was supported by an increase in Open Interest (OI) in the futures market, which reached $1.78 billion, indicating significant fresh capital flows.

The Directional Movement Index (DMI) shows the dominance of buyers with the +DI standing at 32, well above the -DI at 6. The strengthening of the trend is also reinforced by the ADX reading of 31, signaling that the trend formed is not weak or temporary.

With the support of strong market conviction, there is great potential for ADA to continue to maintain its upward momentum. If ADA continues to hold above $0.86, it signals that buyers are still in control of the market structure.

Also Read: Solana (SOL) Strengthens, Can the Trend Continue in September 2025?

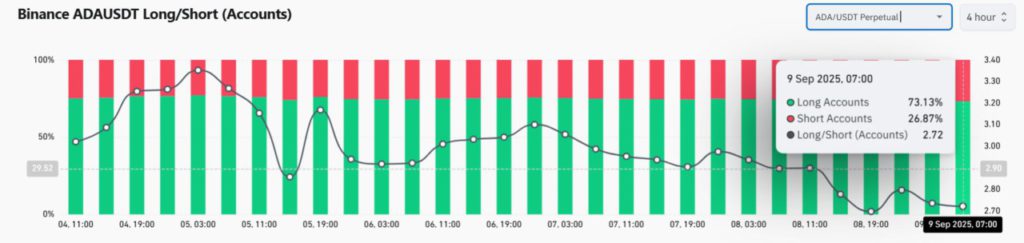

Optimism in the Futures Market

Aside from the bullish breakout, there was a surge in Open Interest (OI) of 6.51% to $1.78 billion. This surge shows that traders are increasingly confident in ADA’s ability to extend its gains. An increase in positions in derivatives indicates an increased risk appetite, which often precedes stronger market movements.

However, keep in mind that high OI can also increase volatility, creating sharper moves. In the next few days, ADA’s price action will determine whether this confidence can turn into sustained growth. Investors and traders should stay alert to the potential volatility that could arise from this increase in OI.

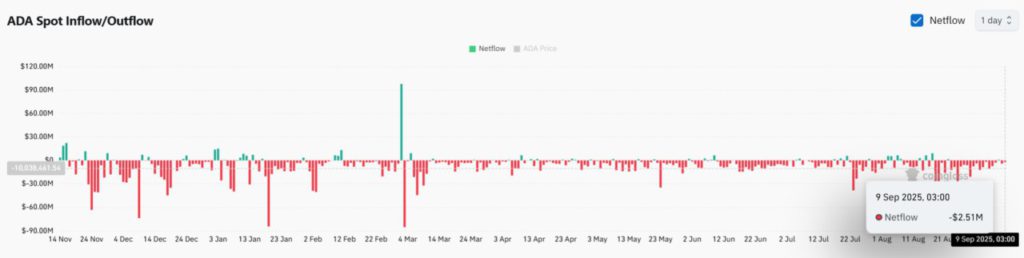

Spot Outflows Show Market Confidence

Net flows from spot exchanges showed a drawdown of $2.51 million, indicating that investors are likely to reduce their intention to sell. This pattern is usually a signal of an accumulation phase, where investors prefer to hold assets rather than sell them.

If this trend continues, it could provide critical support for ADA’s latest breakout. Constant monitoring of these net flows is important, as a change towards inflows could quickly change the short-term narrative. However, for now, this outflow trend adds evidence that ADA has market support to continue rising.

Conclusion

With various technical and market indicators in favor, Cardano (ADA) seems to have a solid foundation to continue moving up. While there are some risks to be aware of, such as potential volatility from high OI and long positions that may be too crowded, the overall current market structure favors a continuation of the bullish trend. Only time will tell if ADA can reach and pass the $0.95 target.

Also Read: ALtcoin Flock (FLOCK) Price Surges 219% After Listing on Coinbase & Upbit!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Cardano holds above key level, mapping ADA’s path to $0.95. Accessed on September 10, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.