Could the Dogecoin ETF Launch Boost Pi Network’s Price? Here’s Why

Jakarta, Pintu News – The price of Pi Network has fallen by almost 15% over the past month. In the last 24 hours, it has edged up by about 1%, but overall, the momentum still appears weak.

With the token price hovering around $0.34, many traders fear a retest of the all-time low around $0.32. However, as reported by BeInCrypto, an unexpected signal could provide a short-term boost – possibly coming from the launch of the Dogecoin ETF (DOGE).

Correlation with Meme Coin could push prices up

One of the clearest signals comes from correlations. Pi Coin shows a one-month Pearson correlation of 0.79 with Bonk (BONK) and 0.62 with Shiba Inu (SHIB).

Read also: DOGE Surges 5% Amid Whale Accumulation — Could a 50% Jump Be Next?

The Pearson correlation method measures how closely two assets move, with a value of 1.0 indicating a perfect correlation. With 0.79, Pi Coin and BONK have a very strong price movement relationship.

This is important because Bonk is one of the leaders in the meme coin sector. If the launch of the Dogecoin ETF ($DOJE) sparks a rally among meme coins, then Pi Network (PI) could potentially go up due to its close association with them.

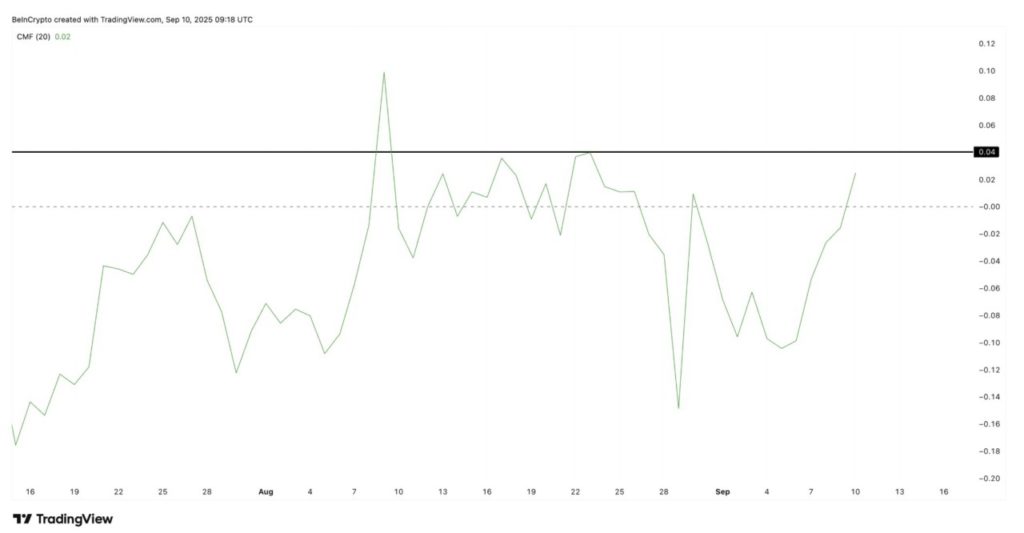

At the same time, fund flows have also started to show bullish signals. The Chaikin Money Flow (CMF) indicator, which tracks whether funds are flowing in or out of an asset, has now turned positive at +0.02.

The last time the CMF turned positive, which was on August 30, the price of Pi Coin experienced a rapid green spike. Now, with the CMF rising again alongside Pi Coin’s strengthening correlation with BONK, the timing doesn’t seem coincidental. These two signals suggest that buyers are starting to take positions in case the meme coin sector gets a boost from the launch of the $DOJE ETF.

For a stronger move, the CMF needs to rise towards +0.08, as it did in late August. This would confirm that large fund flows support the correlation narrative. But right now, Pi Coin traders would welcome even a small increase in CMF.

Bearish grip on Pi Coin price weakens, but not completely broken yet

Another indicator, the Bull-Bear Power (BBP), helps traders gauge the strength between buying and selling pressure. Since September 2, the BBP shows that the selling pressure has started to ease.

Read also: Pi Network Price Rises as User Base Hits 12 Million, but Pi Coin Still Struggles to Cross $1

Although the bears still control Pi Coin’s price chart, their lead is starting to shrink. In previous cases, this weakening of selling pressure was often followed by a short-term price spike. If sellers are losing steam, a small push from buyers could be enough to trigger a bounce.

The weakening of bear strength ahead of the launch of the meme coin ETF also further strengthens the odds. Technically, however, Pi Coin’s chart still shows bearish tendencies. The price is currently moving within a descending triangle pattern – a technical pattern that usually leads to further declines.

Price support is in the range of $0.33 to $0.32, and if this level is broken, PI prices could print a new low, meaning the bounce scenario will fail.

Unless the bulls are able to push Pi’s price past $0.36, the bearish pattern still dominates. Even if there is a bounce, it could be just one short green candle instead of a solid uptrend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Coin Price Could Be Looking at Dogecoin ETF Launch for a Relief Bounce – Here’s Why. Accessed on September 12, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.