Inflation Data Determines the Fate of Financial Markets and Bitcoin? Here are the Details!

Jakarta, Pintu News – This week, all eyes are on the release of inflation data, which will determine the Federal Reserve’s monetary policy. Recent reports from crypto exchanges Bybit and FXStreet highlight the importance of this data to market dynamics. Read the details in this article!

Inflation Data as Fed Policy Catalyst

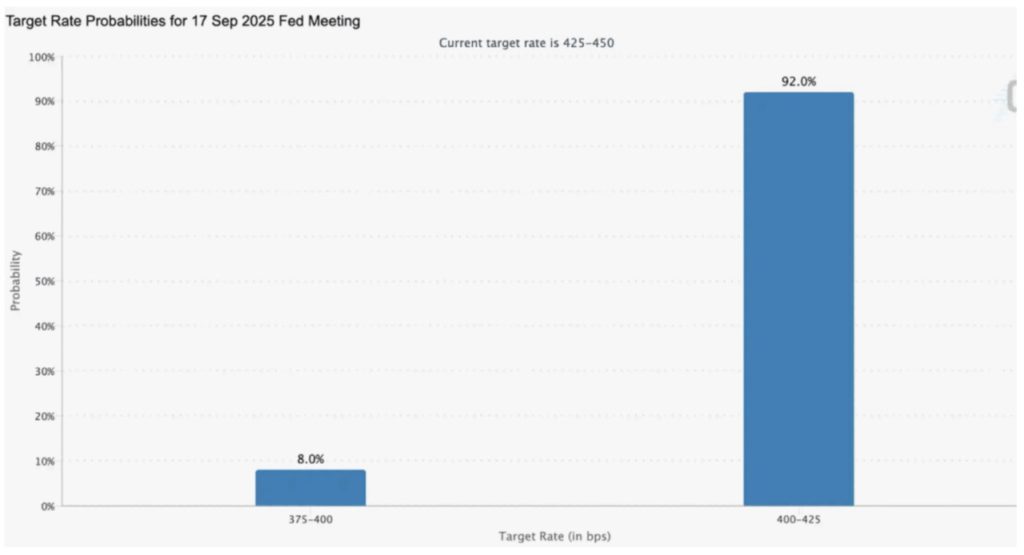

Producer Price Index (PPI) data is scheduled for release on September 11, followed by Consumer Price Index (CPI) data on September 12. According to the report, these figures will greatly influence market expectations of the Federal Reserve’s next move.

General predictions point to an annual increase in CPI from 2.7% to 2.9%. If the figure exceeds expectations, the likelihood of a rate cut will decrease, which could trigger a broad market correction.

Conversely, lower-than-expected inflation data will favor interest rate cuts, which generally benefits risky assets by increasing market liquidity. This shows how important inflation data is in determining the direction of monetary policy.

Read also: Worldcoin (WLD) Approaches $2 Level, DCA Strategy Yield Simulation Rp100,000 per Month

Bitcoin and S&P 500 on the Edge

Bitcoin (BTC) is on the verge of an important decision. If the CPI data shows lower than expected inflation, Bitcoin (BTC) could surge past the key resistance level of $117,300 and reach a new record high of $124,500.

However, if the data shows an increase in inflation, Bitcoin (BTC) could fall below the important support level of $107,200, which risks triggering a big drop. The S&P 500 is also not free from the influence of inflation data.

Currently, the index is holding above the pivot level of 6,500 points. The report suggests that the S&P 500 could reach 7,000 points if the inflation report shows a decline, which would extend the equity rally.

Also read: USDT vs. USDC: Who is the King of Stablecoins in Indonesia?

Investment Strategies in the Face of Inflation Data

Investors and traders need to prepare strategies to deal with possible price fluctuations brought about by the release of inflation data. If the Federal Reserve decides to lower interest rates, it could bring more money into the global financial system, which would trigger a rise in the prices of cryptocurrencies and stocks.

However, if inflation continues to rise, it could confirm that interest rates will remain high for a longer time, which will put pressure on the overall market. Therefore, it is important for investors to monitor inflation data and adjust their portfolios accordingly.

Conclusion

This week’s inflation data is more than just an economic update; it is a critical determinant for the Federal Reserve’s short-term monetary policy. With such profound consequences, a deep understanding of the impact of this data is key for investors and traders to make informed decisions in managing their assets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. Bybit CPI Data is Make or Break for Bitcoin’s P 500. Accessed on September 12, 2025

- Featured Image: Generated by Ai

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.