Ethereum Price Hits $4,500 – Gaining Momentum, Could ETH Be on Track to Break $7,000?

Jakarta, Pintu News – The price of Ethereum (ETH) is attracting attention again as increased accumulation from large institutions is quietly driving new demand in the market. ETH showed a steady recovery trend after successfully reclaiming key levels, signaling a possible continuation of the uptrend.

Large purchases by institutional treasury wallets appear to be an important underpinning for the next phase of the rally. Although market uncertainty remains, current fund flows and historical cyclical patterns put Ethereum on a potentially explosive path – opening up opportunities for significant price spikes in the near future.

Then, how is Ethereum’s current price movement?

Ethereum Price Rises 2.20% in 24 Hours

Read also: Bitcoin Soars to $115,000 on September 12 — Whale Investors Jump Back In!

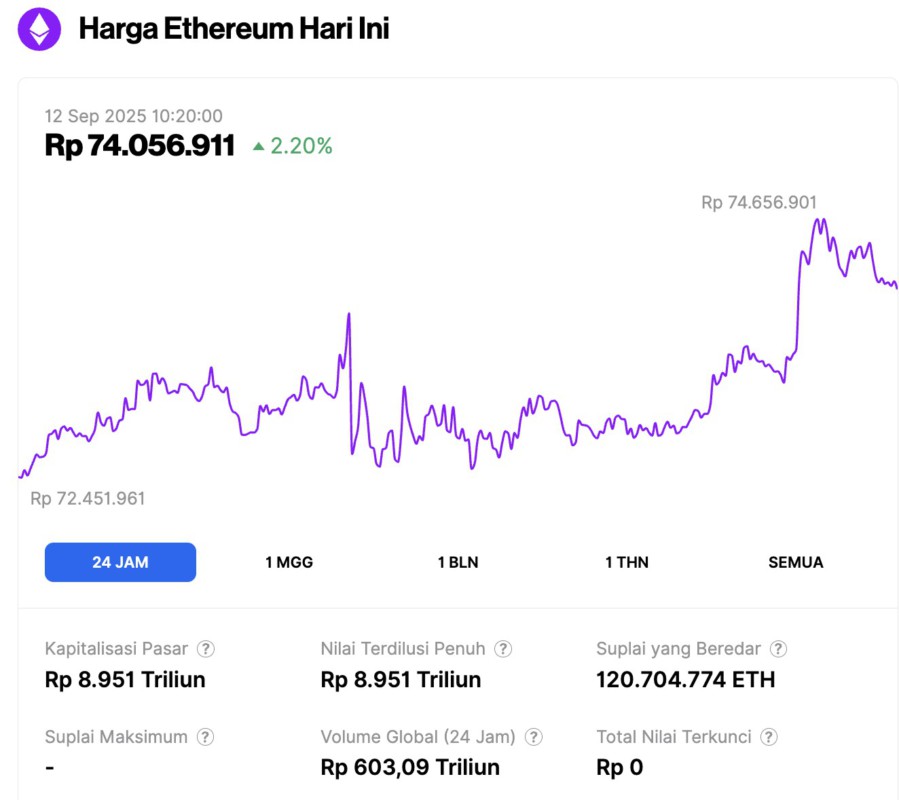

On September 12, 2025, Ethereum was trading at approximately $4,501, or around IDR 74,056,911 — marking a 2.20% increase over the past 24 hours. During this time, ETH reached a low of IDR 72,470,949 and a high of IDR 74,656,901.

As of this writing, Ethereum’s market capitalization stands at roughly IDR 8,951 trillion, while its daily trading volume has climbed 2% in the last 24 hours to IDR 603.09 trillion.

ETH Price Action Hints at Breakout Towards $7,000

Ethereum (ETH) is currently trading at $4,411, holding firm above the previous resistance zone – signaling strong uptrend resilience. ETH has successfully broken out of the multi-year consolidation zone, paving the way towards the next psychological challenge at the $5,000 mark.

Historically, breakouts after long accumulation phases are often followed by rapid price expansion, reinforcing the overall bullish narrative. However, the chart also shows that the $4,800 level is still an area of strong resistance, which was previously a point of rejection.

If ETH is able to hold above this level consistently, it will be a confirmation of renewed market confidence. Conversely, in the event of a correction, the $3,800 level will be short-term support to watch.

This movement reflects a cyclical pattern similar to 2017 and 2021, when euphoric rallies occurred after long periods of reset. Therefore, the current path suggests that Ethereum may be entering a similar vertical growth phase.

If history repeats itself, ETH prices could surge sharply once this breakout stabilizes – in line with long-term projections targeting ETH to reach $7,000.

Institutional Demand Increases: Bitmine & SharpLink Drive ETH Rally

Institutional demand for Ethereum is surging along with aggressive accumulation actions from big players like Bitmine Immersion and SharpLink Gaming.

In a recent report, Bitmine Immersion was found to have purchased 46,255 ETH worth over $200 million, bringing their total holdings to over 2.1 million ETH. This comes just days after another large purchase of 202,469 ETH, bringing their total weekly accumulation close to $881 million.

Around the same time, SharpLink Gaming moved 379 million USDC into Galaxy Digital, signaling a potential next wave of Ethereum buying. Strategic positioning like this from institutional treasuries is strengthening the current rally and easing supply pressure on crypto exchanges.

Furthermore, on-chain data shows that these large fund inflows coincided with the easing of inflation data in the US, which helped boost institutional investor confidence.

As a result, Ethereum’s price received a double boost – from the technical side showing a strong breakout, and from the fundamental side in the form of massive expansion by financial institutions.

Read also: Could the Dogecoin ETF Launch Boost Pi Network’s Price? Here’s Why

Historically, this kind of inflow of funds from whales and institutions has often been the trigger for long-term rallies capable of breaking previous highs. The combination of these factors creates a solid foundation for the ETH price target of $7,000 projected by analysts to be reached.

Will ETH Break $7,000?

Ethereum (ETH) price is now moving in a market landscape that is underpinned by a combination of breakout technical structure and massive institutional support. As long as ETH is able to hold above key resistance levels, the chances of setting a new price record will increase.

Significant accumulation by institutions such as Bitmine and SharpLink provided a solid foundation for this rally to continue. This support from big players not only strengthens demand, but also reduces selling pressure from the spot market.

With the current cyclical conditions showing similar patterns to previous major rallies, ETH price projections towards $7,000 are becoming increasingly realistic. If this momentum is maintained, Ethereum has the potential to enter an explosive growth phase in the near future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. ETH Price Prediction As Bitmine and SharpLink Continue ETH Buying Spree- Analyst Predicts $7K Next. Accessed on September 12, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.