Solana’s TVL Surges Past $13 Billion — Is a New All-Time High for SOL on the Horizon?

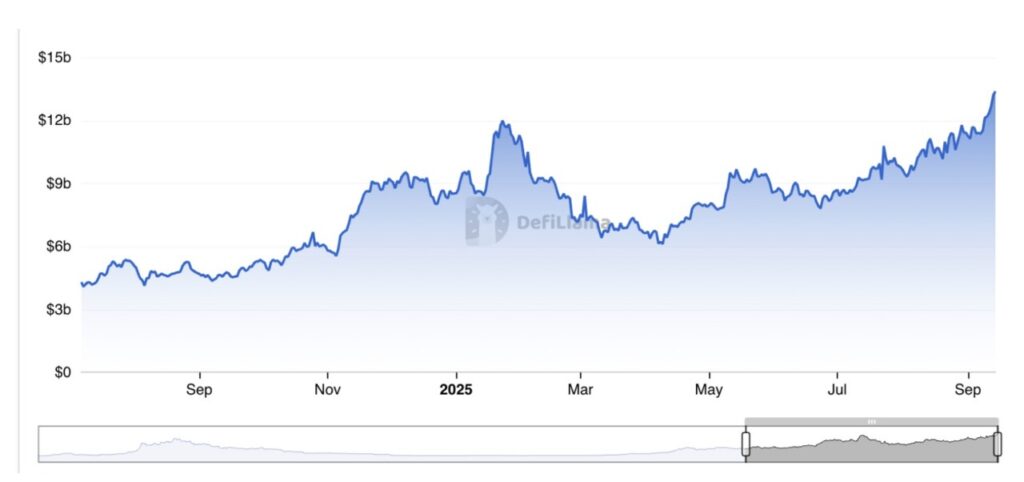

Jakarta, Pintu News – The Solana Network (SOL) experienced a surge in user demand and fund inflows, pushing the total value locked [TVL] in the decentralized finance [DeFi] sector to a record high of over $13 billion.

As buying activity has increased, the price of SOL has also jumped by almost 25% in the past week. Now the question is whether this wave of network growth is strong enough to push the altcoin back to its highest price levels.

Solana’s DeFi TVL Soars to Record Highs

Based on data from DeFiLlama, the total value locked [TVL] in the DeFi Solana sector is currently at a record high of $13.38 billion, jumping 18% in just the past week.

Read also: 3 Crucial Insights Into Pi Network’s Rally and Its Impact on the Market

This surge is a clear indicator of increased capital inflows to the DeFi protocol on the Solana network – a trend that can only happen if it is supported by growing user demand and on-chain activity.

More Users, More Transactions: Solana Network’s Momentum Continues to Strengthen

Data from Artemis reinforces this trend, showing that Solana has seen an increase in the number of daily active addresses and transactions. According to the on-chain data provider, in the past week, the number of daily active addresses that made at least one SOL transaction increased by 37%.

This increase in users had a direct impact on network activity, with the number of daily transactions also increasing by 17% over the same period. Such an increase in user demand signifies stronger trust in the Solana ecosystem and greater utility of its native assets.

With the Solana network performing solidly, attention now turns to how these achievements are reflected in the performance of the SOL market.

Read also: Solana Surges as Galaxy Digital Announces $1.2 Billion SOL Buyout

Can Solana Break $270 and Return to Record Highs?

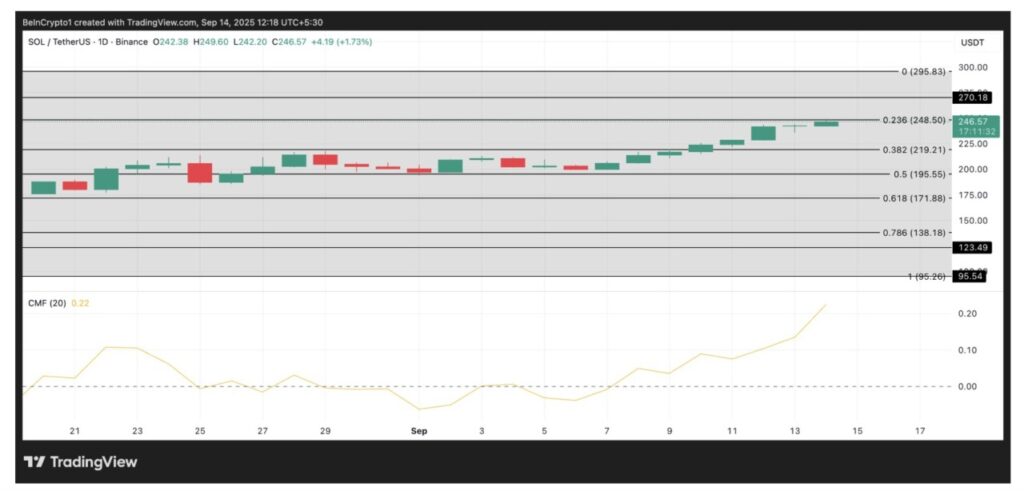

SOL prices rose 22% in the past week and are currently trading at $246.91. The Chaikin Money Flow (CMF) indicator is showing an upward trend, indicating strong demand is driving this rally. Currently, the momentum indicator stands at 0.23.

CMF measures the flow of funds in and out of an asset. A positive CMF number indicates that buying pressure is greater than selling pressure, reinforcing the prospect of rising prices (bullish).

With SOL’s CMF sitting at 0.22, it shows that capital flows remain supportive of the ongoing rally. If this momentum continues, SOL prices could potentially break down to $270.18. If it manages to surpass this level, then SOL has the opportunity to return to its record high of $295.83.

However, if demand starts to weaken and capital inflows slow down, the SOL risks a correction, with a potential drop towards $219.21.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. SOL Price Rally: Strong Inflows Hint at More Gains. Accessed on September 15, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.